Finance and Economics Discussion Series

Federal Reserve Board, Washington, D.C.

ISSN 1936-2854 (Print)

ISSN 2767-3898 (Online)

FinTech and Banks: Strategic Partnerships That Circumvent

State Usury Laws

Gregory Elliehausen and Simona M. Hannon

2023-056

Please cite this paper as:

Elliehausen, Gregory, and Simona M. Hannon (2023). “FinTech and Banks: Strate-

gic Partnerships That Circumvent State Usury Laws,” Finance and Economics Discus-

sion Series 2023-056. Washington: Board of Governors of the Federal Reserve System,

https://doi.org/10.17016/FEDS.2023.056.

NOTE: Staff working papers in the Finance and Economics Discussion Series (FEDS) are preliminary

materials circulated to stimulate discussion and critical comment. The analysis and conclusions set forth

are those of the authors and do not indicate concurrence by other members of the research staff or the

Board of Governors. References in publications to the Finance and Economics Discussion Series (other than

acknowledgement) should be cleared with the author(s) to protect the tentative character of these papers.

FinTech and Banks: Strategic Partnerships That Circumvent

State Usury Laws

*

Gregory Elliehausen

‡

Retired

Simona M. Hannon

§

Federal Reserve Board

August 29, 2023

Abstract

Previous research has found evidence suggesting that financial technology (FinTech) lenders

seek out opportunities in markets that have been underserved by mainstream banks. The

research focuses primarily on the effect of bank market structure, limited income, and eco-

nomic hardship in attracting FinTech companies to underserved markets. This paper expands

the scope of FinTech research by investigating the role of interest rate regulation of consumer

credit and institutional risk segmentation in FinTech lenders’ efforts to solicit new customers

in the personal loan market. We find that strategic partnerships between FinTech companies

and specialist banks target marginal-risk, near-prime, and low-prime consumers for credit

card and other debt consolidation loans. These FinTech-bank partnerships especially tar-

get marginal consumers in states with low interest rate ceilings. Mainstream banks largely

avoid higher-risk consumers, and low rate ceilings inhibit consumer finance company lend-

ing, which historically has been the major source of personal loans for higher risk consumers

and may compete with banks at the margin. In partnering with the specialist banks, the Fin-

Tech lenders are able to take advantage of federal preemptions from state rate ceilings to lend

profitably to higher-risk consumers in states with low rate ceilings to compete in these markets.

Keywords: Consumer Credit, Access to Credit, Interest Rate Cap, Financial Regulation, Fin-

Tech.

JEL classification: G21, G23, G4

*

We thank Hannah Case, Jessica Flagg, and Lucas Nathe for superb research assistance, Molly Graebner and Anuj

Shahani for generous help with Mintel data, Robert Adams, Fabio Braggion, Tim Dore, John Driscoll, Harry P. Huizinga,

Thomas Lambert, Geng Li, Michael Palumbo, Damjan Pfajfar, and R. Burak Uras for helpful comments and suggestions,

and David Jenkins and Christopher Karlsten for outstanding editing. The views in this paper are those of the authors

and do not necessarily reflect those of the Board of Governors of the Federal Reserve System or its staff.

‡

The first draft of this paper was completed while Gregory Elliehausen was a Principal Economist at the Board of

Governors of the Federal Reserve System.

§

Corresponding author. Address: Board of Governors of the Federal Reserve System, 20th Street and Constitution

1. Introduction

Financial technology (FinTech) company partnerships with specialist banks commonly market

personal loans for credit card or other debt consolidation. These FinTech-bank partnerships use

online platforms to facilitate origination of loans through a partner bank and use proprietary un-

derwriting algorithms to supplement conventional underwriting criteria. Over the past decade,

the number of FinTech companies has increased alongside loan volume.

Evidence from previous research suggests that FinTech lenders seek opportunities in markets

that have been underserved by mainstream banks. These studies focus primarily on the effect

of bank market structure, low income, and economic adversity in attracting FinTech companies

to underserved markets. For example, Buchak et al. (2017) find that FinTech penetration in resi-

dential real estate lending is positively associated with larger minority populations, lower unem-

ployment, and higher market concentration. Havrylchyk et al. (2020) find that FinTech lenders

expanded in areas with lower-density branch networks. Jagtiani and Lemieux (2018) find that a

large FinTech firm’s (LendingClub) originations of personal loans for debt consolidation were as-

sociated with greater concentration in credit card lending, fewer bank branches per capita, and

weaker local economies. Cornaggia, Wolfe, and Yoo (2018) find that FinTech presence was associ-

ated with lower personal loan volume at banks in less competitive markets, while volume at banks

in more competitive markets appeared largely unaffected. Tang (2019) finds that consumers who

are considered marginal by banks and consumers seeking small amounts of credit are most likely

to benefit from credit expansion opportunities offered by FinTech firms. Examining data from a

large FinTech firm, Balyuk (2019) argues that FinTech firms reduce information imperfections in

consumer credit markets, leading to better consumer outcomes, including reduced bank rents, in-

creased speed and convenience in obtaining credit, and broadened financial inclusion. Di Maggio

and Yao (2020) find that FinTech borrowers seeking a personal loan tended to have lower credit

scores than bank borrowers but generally were not subprime. FinTech lenders sought out riskier

consumers than banks at first but later expanded their market share by extending credit to less

risky consumers.

1

The underserved market investigated by this study is the personal loan market for risky con-

sumers. Most previous studies focus on FinTech firms’ and banks’ provision of personal loans used

for debt consolidation and other purposes. They have not considered personal loans from con-

sumer finance companies, which have traditionally been the major source of personal loans for

higher-risk consumers (National Commission on Consumer Finance, 1972; Durkin et al., 2014).

Mainstream banks generally have avoided higher risk consumers. This segmentation is partly the

consequence of historical risk tolerance, but regulation has also played a role. In some states, con-

sumer finance companies commonly had higher interest rate ceilings and lower loan size limits

than banks. This difference meant that small personal loans to higher-risk consumers tended to

1

Similar results have been found for FinTech participation in the small business credit market. For example, see Erel

and Liebersohn (2020) or Balyuk et al. (2020).

1

be almost the exclusive province of finance companies, and banks made larger loans to lower-risk

consumers (Rogers, 1975; Durkin et al., 2014; Durkin, Elliehausen, and Hwang, 2016).

2

In other

states, where low rate ceilings made high-risk and small dollar loans unprofitable, risky consumers

experienced rationing. FinTech firms operate both alone as finance companies or in partnership

with a bank. Where they fit in the institutional structure of the personal loan market has not been

fully examined.

Despite the tendency to segment the market based on risk, the risk profiles of bank and fi-

nance company customers, to some extent, overlapped (Boczar, 1978; Durkin and Elliehausen,

2000), suggesting that these sources competed at the margin. Federal regulation permitting na-

tional banks and banks insured by the Federal Deposit Insurance Corporation (FDIC) to charge

interest rates allowed by their home states facilitated interinstitutional competition but did not

eliminate risk segmentation in the market for personal loans. Many banks continued to be reluc-

tant to lend to higher-risk consumers.

The federal regulations that allowed a bank to charge rates permitted in its home state provided

an opportunity for some banks located in high- or no-rate-ceiling states to partner with FinTech

companies. Partner banks could legally charge rates that reflect the risk of loans, which enabled

them to originate loans to riskier consumers in low-rate states. When partnered with a bank, Fin-

Tech companies are able to access low-rate ceiling markets that other finance companies find un-

profitable.

This paper investigates the influence of interest rate regulation on credit availability for marginal

consumers in personal loan markets. Using data on solicitations (an indicator of credit supply),

we find that FinTech-bank partnerships heavily targeted near- and low-prime consumers in states

with restrictive interest rate ceilings. The partnerships did not heavily solicit high-prime con-

sumers, regardless of rate-ceiling regulation. They also appeared to have little interest in sub-

prime consumers in high-rate states. However, FinTech-bank partnerships moderately solicited

subprime consumers in states with low rate ceilings, likely because they faced relatively little com-

petition in these states. As finance companies without bank partners cannot operate profitably in

low-rate states, our results show that finance companies heavily solicited subprime consumers in

high-rate states. In contrast, banks showed little interest in consumers in any part of the risk spec-

trum other than the high-prime part. Notably, our data also allow us to confirm payday lenders

little-known, but significant participation within the installment loan space.

The remainder of this paper proceeds as follows. Section 2 discusses how state interest rate

ceilings affect the structure of consumer credit markets. Section 3 provides details on our research

design and data used in this study. Section 4 discusses our empirical analysis and results. Section

5 concludes.

2

Smaller loans are also relatively more costly to produce than larger loans because much of the cost of producing a

loan is fixed. Costs are incurred largely because a loan is made and are not especially sensitive to the amount of the loan.

Consequently, breakeven interest rates are higher for smaller loans than for larger loans. This fact prevents banks from

making smaller loan sizes, which risky consumers are better able to afford than lower-risk bank borrowers. See Chen

and Elliehausen (2020).

2

2. Rate Ceilings, Credit Availability, and the Emergence of FinTech-Bank

Partnerships

Interest rate ceilings have existed long before the emergence of FinTech-bank partnerships.

3

When a rate ceiling is less than the market rate, credit is often rationed. Lenders may consolidate

offices or exit the market completely. The market for personal loans has been especially exposed

to risks of rate regulation (National Commission on Consumer Finance, 1972; Durkin et al., 2014).

The emergence of non-bank lender-bank partnerships is a market response to limitations result-

ing from regulatory restrictions. This model was used in the 1990s by payday lender-bank partner-

ships to circumvent restrictive state regulations (Stegman, 2007), and it continues today with the

FinTech-bank partnerships explored in this paper.

4

2.1. A Brief History of the State Regulation of Consumer Credit

Historically, consumer credit in the United States has been regulated by the states, whose pri-

mary concerns were the price of credit, nonprice terms, and creditor conduct.

5

States regulated

credit prices through interest rate ceilings. State credit price-ceiling laws generally included usury

laws and a variety of special laws allowing higher rates than those allowed under usury laws for

specific types of credit from certain classes of lenders. States also hoped to influence other signifi-

cant characteristics of credit offerings in the marketplace by restricting market entry to “legitimate”

lenders through licensing and other requirements. State laws further provided for limits on credi-

tors’ rights in the case of default (creditor remedies).

State regulation of interest rates—in particular, the establishment of ceilings for interest rates—

has unquestionably exerted a tremendous influence on the development of consumer credit insti-

tutions and markets in the United States. Restrictions on entry and creditors’ remedies were always

closely connected and justified in the same way as rate ceilings, as part of a regime of controlling

the price and character of credit service. The underlying rationale for the regulations included, first

and foremost, attempting to protect unsophisticated borrowers from unneeded credit, uninformed

use of credit, and harsh credit terms. They also were intended to redress unequal bargaining power

3

Changes in state rate ceilings are infrequent. Political measures and economic conditions have little or no effect on

ceiling rates (see Glaeser and Scheinkman, 1998).

4

Other known models of strategic partnerships include those between specialized finance companies and small

banks with the purpose of circumventing state laws (Bhattacharyya, 2021), those between tax preparation firms and

banks for the issuance of tax refund anticipation loans (the loans are repaid by a customer’s tax refund and are issued

through the tax preparation firm in partnership with a bank, with the consumer being required to file the tax returns

electronically (Duffy, 2004; Millerbernd, 2021)), those between crypto lenders and banks (Crosman, 2018), and those

between credit unions and either FinTech (Gargano, 2021) or buy now, pay later (BNPL) companies (Adams, 2021). Aside

from the "financial institution with financial institution" model, embedded finance evolved to address various market

needs. For example, Tab Bank in Utah was founded 23 years ago as an affiliate of a chain of truck stops with the purpose

of providing financial support to truckers on the road (Crosman, 2021).

5

Until passage of the federal Truth in Lending Act (TILA) in 1968, the states were the primary regulators of consumer

credit in the United States. TILA’s concern was mostly disclosure rather than regulation of credit prices or terms. With

the passage of the original Equal Credit Opportunity Act in 1974, the federal government sought to ensure fairness in

credit granting and promote credit availability, especially for historically underserved consumers.

3

arising from borrowers’ urgent need or lenders’ market power and to discourage prodigal spending

and excessive indebtedness.

Despite relaxation of many state interest rate ceilings for consumer credit in the 1970s and

1980s, many states still retained interest rate restrictions on consumer credit. Significant in re-

laxing the influence of interest rate ceilings on consumer credit during these years was the rise of

interstate competition and Supreme Court decisions on permissible rates for interstate banks.

In 1978, the U.S. Supreme Court in Marquette National Bank v. First Omaha Service Corpora-

tion ruled that national banks could charge interest rates permitted by the lending bank’s home

state regardless of the rate permitted by the borrower’s state of residence. Until recently, this sig-

nificant court ruling had its greatest effect on the credit card market, as it enabled credit card com-

panies to expand their offerings geographically to consumers located across states with various

interest rate ceilings. As a result of the Marquette ruling, credit card companies moved to states

with high or no credit card rate ceilings, and the credit operations of many large retail stores and

consumer finance companies were acquired by or otherwise became affiliated with national banks

and their subsidiaries. We observe a similar phenomenon with FinTech companies. In the cur-

rent environment, as the restrictive interest rate ceilings in some states limit their access, FinTech

companies strategically partner with banks in order to access those markets.

The effects of interest rate ceilings in personal loan markets have been largely discussed, and

a significant amount of evidence developed over many years suggests several conclusions about

them (Durkin et al., 2014):

• State interest rate ceilings restricted credit availability when set at levels that were lower than

equilibrium market rates for higher-risk borrowers. When rate ceilings were set at higher levels,

higher-risk borrowers were less likely to experience reductions in credit availability.

• Different rate ceilings for different institutional types of lenders tended to segment consumer

credit markets (Rogers, 1975), with lenders that had higher ceilings (until recently, finance com-

panies) lending to higher-risk borrowers more frequently than institutional types that had lower

ceilings (banks). Such restrictions tended to reinforce banks’ preference to specialize in the low-

risk segment of the market.

• Despite market segmentation, empirical risk distributions of bank and finance company bor-

rowers partly overlapped (Boczar, 1978). That many finance company borrowers had risk charac-

teristics similar to those of bank borrowers suggests that these finance company customers may

have been able to obtain loans from banks and that banks and finance companies may have com-

peted over (at least some part of) the risk distribution of consumers. As researchers did not have

all variables related to risk, this result is only suggestive.

• Observed interest rates were not generally at the state rate ceilings unless ceiling rates were

already low (National Commission on Consumer Finance, 1972). Average interest rates for un-

secured installment loans charged by banks in high-ceiling states were not much different from

average rates in low-ceiling states, and interest rates for considerable shares of finance company

personal installment loans were below rate ceilings.

4

2.2. The Special Cases of Arkansas and Iowa

Arkansas is a popular place to study effects of rate ceilings because of its very low rate ceiling.

Unlike most states, Arkansas’s usury limit is constitutional, not statutory, and is currently set at 17

percent.

In 1957, the Arkansas Supreme Court affirmed that all forms of credit in the state were subject

to the 10 percent usury ceiling in the state constitution, regardless of actions the legislature might

take (Sloan v. Sears, 228 Arkansas 464, 308 S.W., 2d 802 1957). More recently, Arkansas has revised

its state constitution and usury law, but the revised law remains restrictive compared with most

other states. Today, the ability of Arkansas residents to obtain revolving credit from out-of-state

credit card companies headquartered in states with a high rate ceiling or no ceiling vitiates in large

part the state’s restrictive usury law. However, higher-risk consumers may have difficulty access-

ing revolving credit. The rate-ceiling limits these consumers’ access to personal installment credit

from finance companies. Lukongo and Miller Jr. (2018) show that the number of consumer finance

company personal loans in Arkansas is lower than the number of such loans in the neighboring

states. As no consumer finance company offices are located in Arkansas, the prevalence of con-

sumer finance personal loans in border counties of Arkansas and a virtual absence of such loans

in interior counties suggest that Arkansas consumers in border counties travel out of state to get

the loans, and, as a result, there is a “credit desert” in the middle of the state. Still, the restrictive

effect is clearly evident. Recent work by Elliehausen, Hannon, and Miller Jr. (2021) using a different

data source, the Federal Reserve Bank of New York (FRBNY) Consumer Credit Panel (CCP)/Equifax

credit bureau data, supports the previously discussed findings on credit availability when rate ceil-

ings are low.

Iowa provides another useful comparison group for studying the geographical consequences

of the Marquette ruling. Iowa is the only U.S. state that opted out of the interest rate exportation

regime provided by the Marquette ruling, by invoking the exception to the federal preemption un-

der Section 525 of the Depository Institutions Deregulation and Monetary Control Act of 1980 (see

Brennan and Udell, 2018).

6

As Iowa is a low interest rate state located between three high interest

rate states (Wisconsin, Illinois, and Missouri) and three low interest rate states (Minnesota, South

Dakota, and Nebraska), Iowa provides a counterfactual for any developments enabled by the Mar-

quette ruling.

7

6

Puerto Rico also opted out of the coverage, and several states—Colorado, Maine, Massachusetts, Nebraska, North

Carolina, and Wisconsin—previously opted out of the coverage as well but have either rescinded their opt-out or let it ex-

pire. (See footnote 18 on page 44148 of the Office of the Federal Register, National Archives and Records Administration,

2020.)

7

Iowa law allows a maximum interest rate of 5 percent unless a different rate is agreed upon in writing. In that case,

the interest rate cannot exceed the state’s official usury rate set by the superintendent of banking in accordance with

the provisions of Iowa Code Section 535.2(3)(a), consisting of the monthly average of the 10-year Treasury rate plus a 2

percent premium.

5

2.3. Effects of FinTech Presence in Consumer Credit Markets

The emergence of the FinTech sector added another layer of complexity to the personal loan

market. As credit issued by traditional financial institutions such as banks, thrifts, credit unions,

and finance companies decelerated in the aftermath of the financial crisis, the FinTech sector

emerged to provide credit or refinance debts of borrowers who might otherwise be priced out of

the market. FinTech companies target low-prime and near-prime borrowers who are less attrac-

tive for banks and who may be able to obtain better loan terms from companies outside of the

finance company universe. Given the nascent nature of the field, research results on the effects of

FinTech presence in consumer credit markets are mixed. Adams (2018) finds that consumer loans

issued by FinTech lenders are primarily used for refinancing various types of consumer debt. Dore

and Mach (2019) show that at Prosper, borrowers’ credit scores initially increase after they take

out loans, and their credit card utilization rates fall relative to nonborrowers. In the longer run,

however, total debt levels for Prosper borrowers are higher than those of otherwise similar non-

borrowers, but delinquency rates are lower for borrowers. Danisewicz and Elard (2018) show that

restricting FinTech presence in a consumer credit market is associated with a significant increase

in personal bankruptcy. This result followed the Madden v. Midland Funding court verdict, which

ruled that above-usury loans issued by banks to residents of Connecticut and New York were null

and void if the loans were immediately sold to non-bank entities. Their findings suggest that re-

stricting marketplace lending delays filing for bankruptcy and consistently helps some households

avoid bankruptcy.

As interest rate ceilings limit non-partnered FinTech presence in some states, FinTech compa-

nies can circumvent the usury rate legislation and partner with specialist banks in order to avoid

these states’ low(er) interest rate ceilings. As a result of this arrangement, the FinTech sector is

segregated into (1) companies that function more like finance companies and end up being re-

stricted in low-rate states and (2) companies that place themselves in a position to take advantage

of weaker competition from finance companies and other FinTechs in such states.

2.4. FinTech-Bank Partnership Mechanism

The FinTech-bank partnership opportunity is born at the intersection of state usury rate ceiling

restrictions and the Marquette ruling. Powered by the Marquette ruling, banks are able to export

their home state interest rates to most states, irrespective of the state’s interest rate ceiling.

8

Lim-

ited by the state usury laws, FinTech companies operating alone find that doing business in states

with low interest rate ceilings is less profitable than in high- or no-rate ceiling states. However,

some FinTech companies have partnered with banks to circumvent the usury rate legislation by

offering joint personal loan offers. When these partnerships occur, the bank becomes the “true

8

Iowa is an exception discussed earlier.

6

lender” by making the loan on behalf of the FinTech company.

9

The bank holds onto the loan for

a number of days or even months and may retain a certain percentage of the loan production. For

example, LendingClub reveals in its 2019 third quarter 10-Q report that WebBank holds onto its

loans for two business days, after which the loans are purchased by the marketplace lender at par

plus accrued interest.

10

Cross River Bank retains 5 to 10 percent of the monthly loan production

and tends to hold onto the loans for six to nine months. Loans are then sold back to the FinTech

company, which in turn sells them in either the private or public securitization market (see Scully,

2015).

Importantly, in order for these partnerships to be profitable, the banks that are typically in-

volved in joint offerings, the specialist banks, need to be either exempt from rate ceilings or located

in states with high or no consumer finance rate ceilings. In the next section we note how WebBank,

one of the major specialist banks engaged in partnerships, has a Utah industrial loan bank charter,

that exempts it from state lender licensing laws, interest rate ceilings, and money service business

laws, and Cross River Bank, the other major specialist bank engaged in partnerships, is located in

New Jersey, a state that has no limits on loans made by banks.

These arrangements can be mutually beneficial. FinTech companies are able to access markets

previously considered insufficiently profitable and earn transaction fees for their role in processing

the loan applications. LendingClub discloses in its 2019 third-quarter 10-Q report that the amount

of fees charged is based on the terms of the loan, including grade, rate, term, and channel—and

that as of September 30, 2019, these fees ranged from 0 to 6 percent of the initial principal amount

of a loan.

11

In addition, FinTech lenders benefit from their partner banks having the regulatory,

compliance, and licensing frameworks in place in the respective states in which they choose to

operate.

Banks’ revenues in such a partnership mainly come from loan issuance fees. For example,

Cross River Bank charges a processing fee between 30 and 100 basis points per loan, conditional

on the volume of loans processed; on the loans it retains, the bank is generally open to a revenue-

share structure with the platform such that if the platform elects to work with another bank, it has

to pay a fee of 10 to 20 basis points per loan until the contract ends (see Scully, 2015). In addition,

banks may benefit from the technological novelty FinTech companies bring to these partnerships.

Both FinTech and bank partners are subject to approbation and regulatory scrutiny. Regulatory

scrutiny is especially likely for bank partners in FinTech-bank partnerships. Bank regulators used

supervisory guidance to discourage banks from partnerships offering payday loans and refund an-

ticipation loans—loans issued through tax preparation firms and repaid with tax refunds.

12

For

9

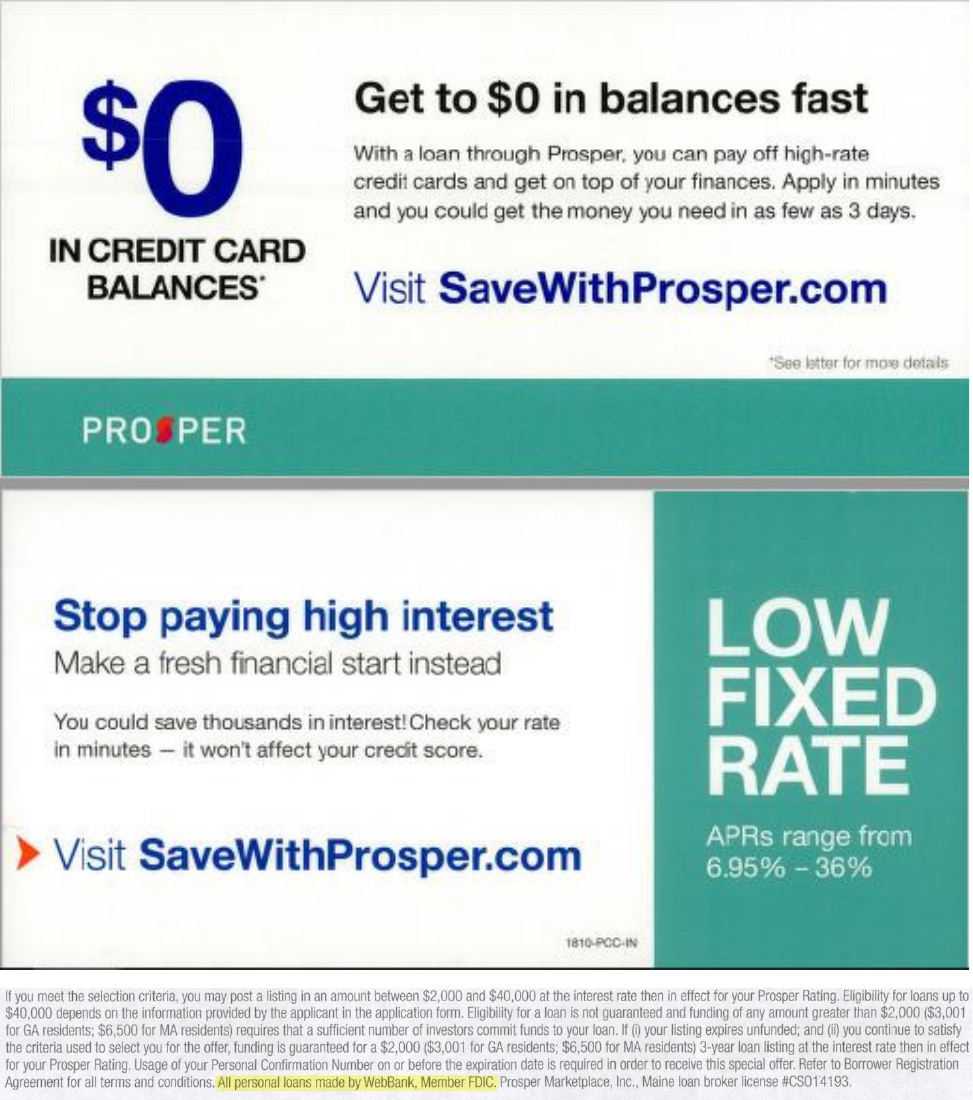

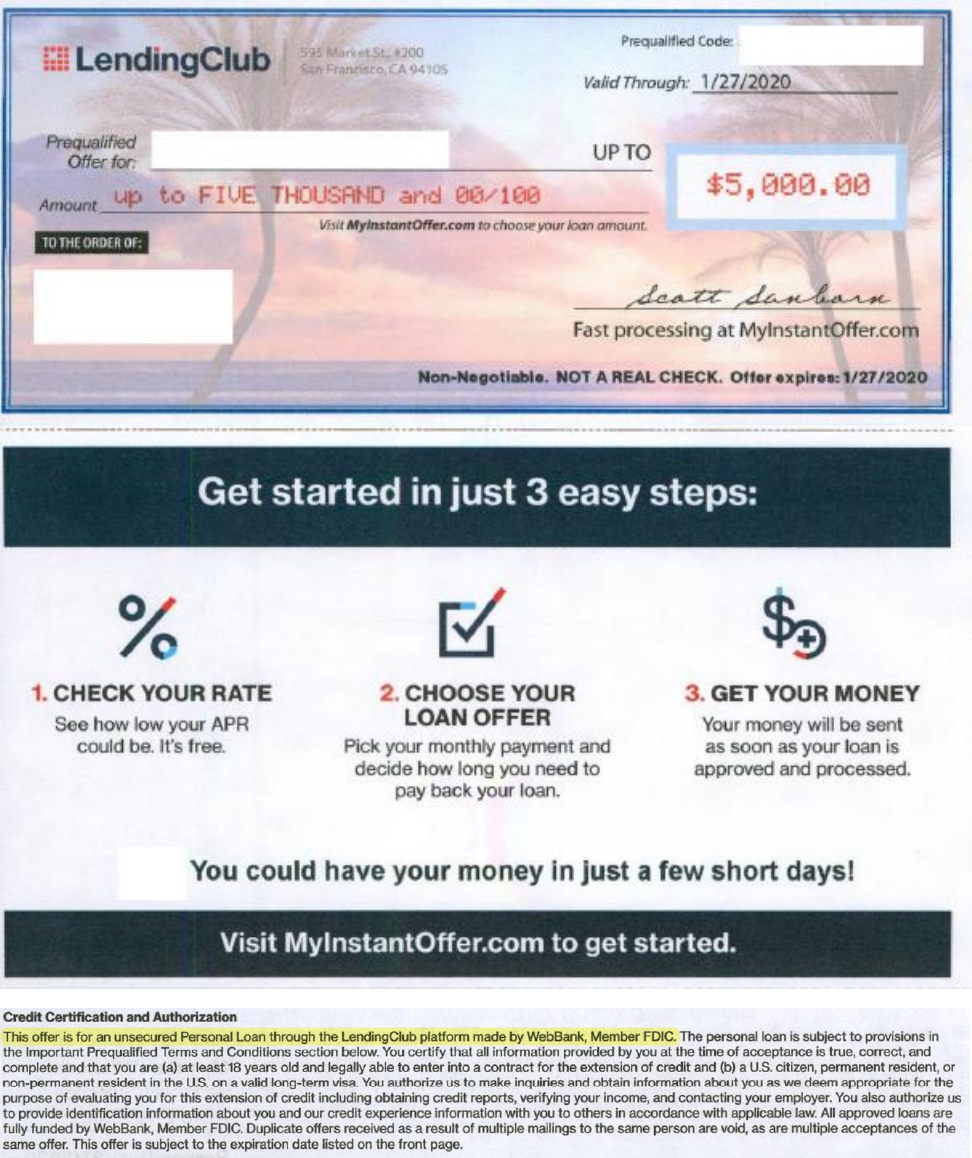

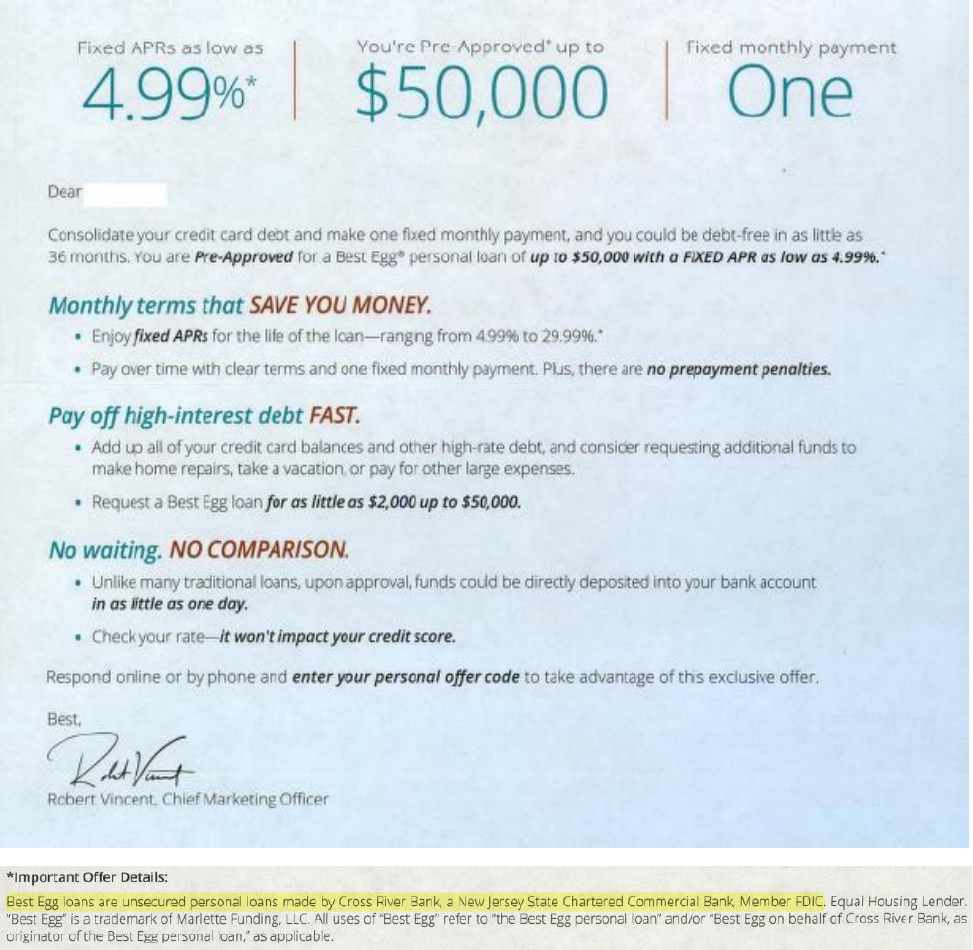

The offer details typically include information on the true lender. See figures A1 through A3 in Appendix A for

sample offers.

10

See page 49 of Form 10-Q for 2019:Q3.

11

See page 68 of Form 10-Q for 2019:Q3.

12

For example, bank regulators did so via Operation Choke Point, a Department of Justice initiative that investigated

banks and businesses if they engaged in dealings with companies considered to be at a high risk for fraud and money

laundering, which included payday lenders.

7

FinTech companies, loss of bank partnerships may jeopardize the viability of their business mod-

els.

2.5. Partner Banks

But what do we know about these banks that partner with FinTech companies? Although in

our data (discussed below) we observe a number of banks that partner with marketplace lenders,

we will focus the discussion around WebBank and Cross River Bank, the predominant banks in

FinTech-bank partnerships.

WebBank is a $961 million FDIC-insured state-chartered industrial bank located in Salt Lake

City, Utah, which was founded in 1997.

13

As of the end of 2019, personal loans represent close to

50 percent of its total assets. WebBank is owned by Steel Partners Holdings LP, a diversified inter-

national holding company. Steel Partners Holdings L. P. reveals in its Q3 10-Q report that WebBank

represents its financial services business:

14

“WebBank engages in a full range of banking activities including originating loans, is-

suing credit cards and taking deposits that are federally insured. WebBank originates

and funds consumer and small business loans through lending programs with unaffil-

iated companies that market and service the programs (“Marketing Partners”), where

the Marketing Partners subsequently purchase the loans (or interests in the loans) that

are originated by WebBank. WebBank retains a portion of the loans it originates for

its Marketing Partners. WebBank also has private-label financing programs that are

branded for a specific retailer, manufacturer, dealer channel, proprietary network or

bank card program. WebBank participates in syndicated commercial and industrial as

well as asset-based credit facilities and asset-based securitizations through relation-

ships with other financial institutions.”

According to the Utah Department of Financial Institutions, as a Utah industrial loan bank

charter, WebBank is subject to the same regulatory framework as commercial banks and is autho-

rized to make all kinds of consumer and commercial loans. The bank can accept federally insured

13

Industrial banks evolved from “Morris Plan” banks, named after Arthur J. Morris, who devised in 1910 a method

to provide small loans that did not violate usury laws. Their customers were primarily industrial workers. Under the

Morris Plan, lenders would offer a loan at the legal rate allowed under the usury law. Interest was quoted on a discount

basis, which collects interest in advance out of the loan principal. This practice reduced the lender’s outlay, thereby

increasing the revenue relative to other methods for quoting interest (see Mors, 1965). The Morris Plan also required a

simultaneous purchase on installments by the borrower of a non-interest-bearing certificate of deposit from the bank

in the same amount as the loan principal. When the certificate was fully paid for, it would be used to pay off the loan

(Michelman, 1966; Oeltjen, 1975). This arrangement increased the yield to the bank by bringing its funds back before

the actual maturity of the loan contract.

14

See page 35 of Form 10-Q for 2019:Q3.

8

deposits, but it cannot issue demand deposits if its assets are greater than $100 million.

15

How-

ever, banks that fall under the Utah industrial bank charter are not considered subject to the Bank

Holding Company Act. Industrial banks are exempt from state lender licensing laws, interest rate

ceilings, and money service business laws. Industrial banks have the advantage of reduced cost of

funding in part due to access to the Federal Reserve discount window. These types of banks are su-

pervised only by the Utah Department of Financial Institutions and the FDIC, thus circumventing

Fed oversight. Importantly, given that WebBank is chartered in Utah, it has no small-loan interest

rate cap because Utah has no state interest rate limits. As a Utah industrial bank, WebBank can

legally charge interest rates that exceed other states’ rate ceilings—a key feature for the FinTech

partnership. Other banks engaged in partnerships that are located in Utah are FinWise Bank and

First Electronic Bank.

Cross River Bank is a $2 billion FDIC-insured state-chartered bank located in New Jersey and

created in 2008 with the specific purpose of facilitating FinTech partnerships. As of the end of 2019,

nearly half of Cross River Bank’s total assets consist of personal loans. In March 2019, the bank was

awarded Grow New Jersey credits by the New Jersey Economic Development Authority, thus en-

abling it to expand within the state and encouraging it not to leave the state.

16

The bank is venture

funded, with investors such as venture companies Andreessen Horowitz, Battery Ventures, Ribbit

Capital, and KKR & Co. According to the state’s governor, “Innovative FinTech companies like Cross

River choose to locate in New Jersey because of our unrivaled pool of diverse, tech-savvy talent, and

the unique advantages of our location.” Cross River Bank is subject to regulation and supervision

by the state of New Jersey and the FDIC and is able to accept deposits. Although unlicensed lenders

and sales finance companies may charge an interest rate up to 16 percent on personal loans in New

Jersey, the state has no limits on loans made by banks, which enables Cross River Bank to partner

with FinTech lenders.

2.6. Legislative Challenges: Madden v. Midland Ruling

In 2015, FinTech lenders were affected by the Madden v. Midland Funding ruling, discussed at

length by Danisewicz and Elard (2018), when the U.S. Second Circuit Court of Appeals—presiding

over Connecticut, New York, and Vermont—overturned a lower court ruling that loans originated

to residents of those states with an interest rate exceeding the existing usury limits are null and

void if the loans are held by nonbank firms.

15

According to instructions in the Federal Reserve Board’s FR 2900, Report of Deposits and Vault Cash for banks, sav-

ings and loan associations, and savings banks instructions, demand deposits are deposits that are payable immediately

on demand, or that are issued with an original maturity or required notice period of less than seven days, or that repre-

sent funds for which the reporting institution does not reserve the right to require at least seven days’ written notice of

an intended withdrawal. Demand deposits are transaction accounts.

16

Grow New Jersey is a job-creation and incentive program created to strengthen New Jersey’s economic position.

According to the program’s website, businesses that are creating or retaining jobs in New Jersey may be eligible for tax

credits and bonus credits.

9

Saliha Madden, a New York resident, became delinquent on credit card debt. The credit card-

issuing bank deemed the debt to be uncollectable and sold it to Midland LLC, a debt collection

firm. Midland tried to collect the debt at a 27 percent rate, which exceeded New York’s 25 percent

rate ceiling. Madden sued, alleging that the loan was usurious because Midland was not a bank

and therefore was not entitled to preemption of the New York rate ceiling.

The penalty for violation of the usury ceiling in New York and Connecticut is forfeiture of in-

terest and principal. The penalty in Vermont is forfeiture of only the interest above the ceiling.

Although not directly related to FinTech lending, this ruling affected the specialist bank-FinTech

partnership model described in section 2.4 that allows the bank to issue the loans and subsequently

sell the loans to a nonbank partner. The Second Circuit ruling held that the exemption from state

rate ceilings no longer applies once loans are sold to nonbank firms.

The Madden ruling applies only to loans originated to residents of Connecticut, New York, and

Vermont, but it may more broadly raise concerns about risk in loan sales and solicitations.

3. Research Design and Data

We use a quasi-experimental design. Our dependent variable is the solicitation mail volume

sent to households by different types of lenders: FinTech company-bank partnerships (hereafter,

FinTech-bank partnerships), finance companies without a bank partner (hereafter, finance com-

panies), payday lenders, banks without a FinTech company partnership (hereafter, mainstream

banks), FinTech lenders without the participation of banks (hereafter, FinTech), and banks that are

typically involved in partnerships making independent offers (hereafter, specialist banks).

Our treatment groups consist of consumers in different credit risk classes residing in states

with low or high rate ceilings for personal loans (subprime/low rate, subprime/high rate, near

prime/low rate, near prime/high rate, low prime/low rate, low prime/high rate, high prime/low

rate, and high prime/high rate). Our comparison group consists of high-prime consumers residing

in states with high rate ceilings or no ceiling for personal loans. High-prime consumers in high-

rate states would be least constrained by their credit risk or lenders’ ability to offer small personal

loans profitably. The substantive restrictions imposed on nonbank lenders who operate in states

with low interest rate ceilings stimulate some of them to partner with banks in order to circumvent

the legislation that makes lending to riskier consumers unprofitable and expand their geographi-

cal presence within their target markets. Since some of these lenders successfully circumvent the

restrictive state rate ceilings, they end up being able to charge interest rates higher than maximum

rates specified in the state legislation (see Table 1). States with high or no interest rate ceilings—

South Carolina, Georgia, Texas, Oklahoma, Louisiana, Tennessee, Missouri, Illinois, New Mexico,

Kentucky, Alabama, Wisconsin, Indiana, Mississippi, and Idaho—are states in which high-rate con-

sumer finance companies operate.

In addition, to illustrate the effects of the Madden v. Midland ruling on credit supply for all

lender categories observed, in line with other studies examining the supply of FinTech loans, we

10

use a differences-in-differences estimation, but we expand the treatment group to include Ver-

mont, in addition to New York and Connecticut. The comparison group consists of personal loan

offer solicitations sent to consumers located in all other states.

We use data from three sources. Our primary data source is Mintel Comperemedia (hereafter,

Mintel), a data set consisting of monthly unsecured personal loan acquisition, cash advance prod-

uct, and vehicle title loan offers (solicitations). As the solicitations are credit offers, they are often

used as a measure of credit supply.

17

The data represent monthly campaign-level mail volume sent

to consumers over a period of ten years, starting with 2010. Mintel randomly selects roughly 4,000

consumers from a pool of 1 million consumers that Mintel purchased from a large survey service

provider. The Mintel panel is balanced on four major demographic characteristics: region, age,

income, and household size. Each month, about 2,500 consumers participate in the Mintel sur-

vey by mailing back to Mintel offers from across the sectors monitored by the company.

18

Mintel

motivates participation with raffles offering prizes, such as gift cards. The company records all the

offer details in its databases, thus providing insights into the rich landscape of supply offers. Every

month, post-collection, the data are sent to TransUnion alongside the name and address of the

panelist. TransUnion then appends the VantageScore credit score for every panelist and deperson-

alizes the information before sending it back to the Federal Reserve Board.

19

Mintel conducts an

additional survey of participating consumers to collect household-level demographic and socioe-

conomic information. This additional information is merged with the mail offer information.

20

Finally, Mintel applies weights to the approximately 2,500 consumers participating in the survey to

represent the entire U.S. adult population.

Crucially for our analysis, the data enable us to observe clearly, by name, the company sending

the offer and its exact brand partner companies, if applicable. (We include in Appendix A several

examples of various types of offers made to consumers.) Knowledge of the name of each com-

pany in the data set also enables us to categorize the offers by lender type. Mintel data show that

in 2019, there were approximately 1.8 billion acquisition offers for unsecured personal loans.

21

The personal loans category is relatively broad. It includes non-vehicle loans for any personal or

household-related expenditure or for consolidating any type of debt. The majority of the observa-

tions in the data set include detailed mailing location information.

22

More than one-third of these

offers are issued by FinTech lenders in partnership with specialist banks (33 percent), with another

one-third issued by finance companies (29 percent). The remainder of offers are issued by banks

other than those involved in partnerships (15 percent), banks that are typically involved in partner-

17

Dettling and Hsu (2021) and Han, Keys, and Li (2018) discuss the use of solicitations as a measure of supply.

18

If the consumers choose to respond to the respective offer, they send Mintel only the remainder of the offer materi-

als, exclusive of the response portion.

19

Personally identifiable information (PII) is not included in the data set available to researchers.

20

The demographic and socioeconomic information collected by Mintel applies to the household head and is repre-

sentative at the household level, while the VantageScore credit score is that of the panelist.

21

According to Mintel, solicitations for personal loans represent the largest mail volume category, superseding that

for mortgage loans or credit cards.

22

We drop the observations with insufficient geographical information to avoid errors.

11

ships making independent offers (10 percent), FinTech lenders without the participation of banks

(6 percent), payday lenders making installment loan offers (4 percent), other financial institutions

(3 percent), and credit unions (less than 1 percent).

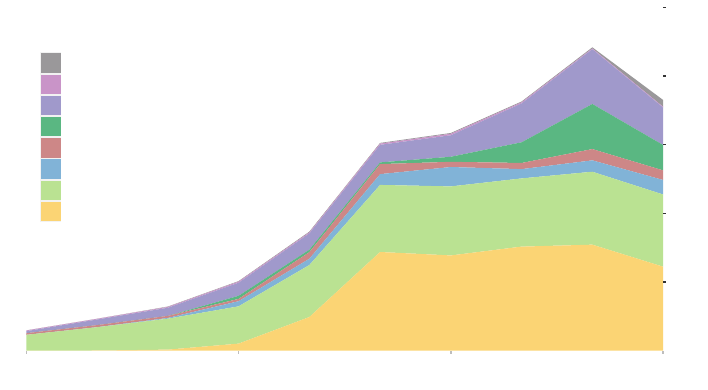

2324

Figure 1 shows the annual unsecured per-

sonal loan offer mail volume by lender type.

Mintel data allow us to identify the partner banks. We observe the notable participation of the

market leaders: WebBank and Cross River Bank, alongside other participants such as First Bank

of Delaware, First Electronic Bank, Farmers Merchant Bank, Mid America Bank & Trust Company,

County Bank of Rehoboth Beach, Republic Bank, The Brand Banking Company, FinWise Bank,

Goldman Sachs Bank USA, First Bank & Trust, and Capital Community Bank. When examining

the partnership structure, we note the dominance of WebBank (61 percent of offerings) and Cross

River Bank (35 percent of offerings). The FinTech company presence in partnership structures is

less concentrated than that of partner banks. LendingClub has the largest share of offerings (41

percent), followed by Best Egg (24 percent). Prosper, Upgrade, and Upstart have much smaller

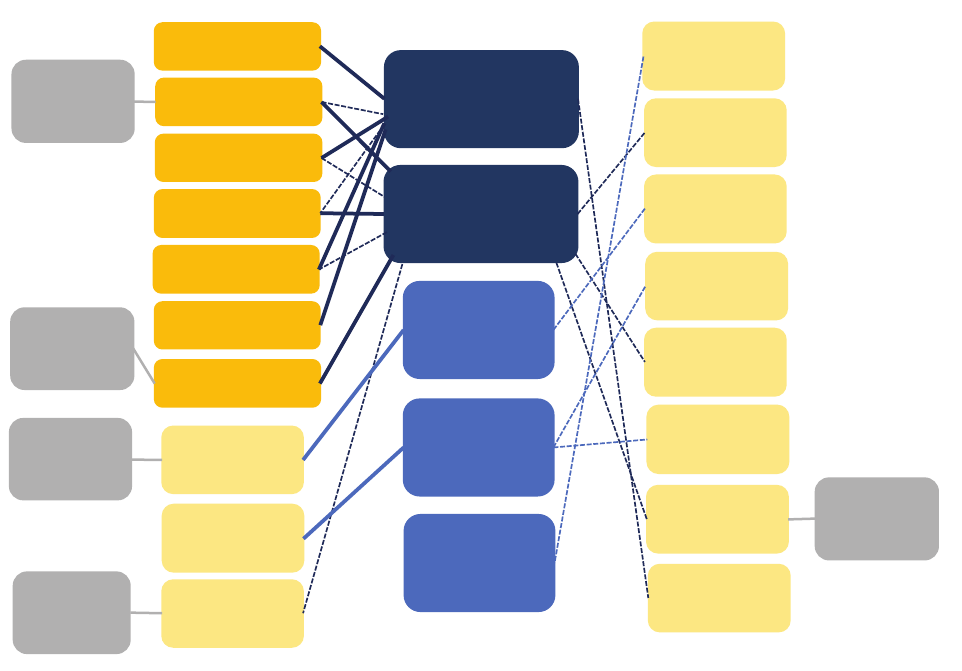

shares of offerings (11 percent, 10 percent, and 6 percent, respectively). Figure 2 shows a diagram

of FinTech-bank partnership relationships.

We complement the supply-side information we derive from Mintel data with loan-level infor-

mation from the two main FinTech lenders: Prosper and LendingClub.

25

Prosper data are available

at a monthly level starting with 2014, while LendingClub data are available only between January

2014 and December 2017. Both lender data sets allow us to observe the geographic location of

the borrower, the loan amount taken, the loan interest rate (Prosper data also include the loan an-

nual percentage rate, or APR), and the borrower’s risk score both generated by a traditional credit

bureau and supplied by an internal proprietary model used by this type of lender, among other nu-

merous details. In 2017, the most recent year for which we have available data, LendingClub made

443,549 new loans, amounting to nearly $6.6 billion. That same year, Prosper made 201,906 loans,

amounting to $2.7 billion.

26

Examining data for Arkansas, the state with the lowest interest rate

ceiling, between 2014 and 2017 for both lenders, we reveal that 36 percent of Prosper’s loans and

19 percent of LendingClub’s loans issued over the period have interest rates exceeding the state’s

ceiling rate (Table 1). This information serves as an additional motivating factor for our study.

Finally, in order to compare the mail volume of solicitations to aggregates of individuals with

credit scores, we use the FRBNY’s quarterly CCP, a database on consumers’ credit use and payment

performance drawn from Equifax credit bureau records. The anonymized random sample is repre-

23

Percentages may not add to 100 because of rounding. Vehicle title lenders make a small number of offers that

appear to be installment loan offers, but the data do not allow the differentiation between traditional installment loan

offers and vehicle title loans that are required to be repaid in installments.

24

Although payday lenders are known to make primarily cash advance or lump sum offers, our data allow us to ob-

serve installment loan offers made by these lenders, which are a newer type of product for them (see Miller Jr., 2019).

25

LendingClub’s LoanStats data was available to researchers via https://www.lendingclub.com/ until December

2017.

26

In 2019, Prosper made 156,671 loans, amounting to $2.2 billion. The loan characteristics for the two lenders are

similar, with both reporting loan amounts of $1,000 or $2,000 to $40,000—LendingClub with a median of $12,900 and a

mean of $14,926 and Prosper with a median of $12,000 and a mean of $13,713. A stable share of these loans—about 70

percent for both lenders—is used for debt refinancing.

12

sentative of the population of credit users in each quarter.

27

The database contains individual-level

data on virtually every debt owed by each consumer and, importantly for our analysis, the credit

bureau score, which we use to create aggregates for each credit risk group of borrowers.

28

We use a

1 percent sample from the total available 5 percent sample, covering the period between 2010:Q1

and 2019:Q4. At the end of the fourth quarter of 2019, the CCP totaled about 252 million individu-

als.

4. Empirical Analysis and Results

To identify the role of interest rate regulation of consumer credit and institutional segmentation

in FinTech lenders’ efforts to solicit new customers in the personal loan market, we first compare

the state-level share of mail volume in total mail volume over the period for each lender type. Then,

we compare the cumulative mail volume solicitations sent by FinTech-bank partnerships for each

credit score category (subprime, near prime, low prime, and high prime) and level of the state

consumer finance rate ceiling (with high and low). We also examine the differences in the aggregate

mail volume issued by FinTech-bank partnerships before and after the Madden ruling in the states

representing our treatment group versus all other states. In addition, we use regression analysis to

estimate differences in lenders’ unsecured personal loan mail offers.

4.1. Personal Loan Solicitations by Type of Lender, Interest Rate Ceiling Category, and

Credit Risk Group

We examine the aggregate number of personal loan solicitations over the analyzed period (2010–

19). Solicitations are an indicator of credit supply, but it is important to note that they do not

directly and uniformly translate into loans. The take-up rate of mail offers is relatively low—for

example, using the data available to us, we estimate it to be approximately 9.63 loans per 100 Lend-

ingClub solicitations and 12.76 loans per 100 Prosper solicitations. That said, these estimates are

likely biased as borrowers can obtain loans by contacting each lender directly, without being so-

licited via mail. The take-up rate is likely influenced by the local demand and supply characteristics

which are not uniform across states, within a state, or among borrower risk profiles. For exam-

ple, as FinTech lenders in partnership with banks and also acting independently typically compete

with finance companies, the take-up rate for FinTech-issued loans could be higher in states with

low consumer finance interest rate ceilings, where finance companies cannot operate profitably.

29

27

The sampling procedure ensures that the same individuals remain in the sample in each quarter and allows for

entry into and exit from the sample, so that the sample is representative of the target population in each quarter. See

Lee and der Klaauw (2010) for a description of the design and content of the CCP. See also https://www.newyorkfed.

org/medialibrary/interactives/householdcredit/data/pdf/data_dictionary_HHDC.pdf.

28

The variables include type of credit, type of lender, origination date, account balance, scheduled monthly pay-

ments, delinquency, and adverse events associated with credit accounts. Variables also include year of birth.

29

Both LendingClub and Prosper show higher take-up rates (20.1 and 25.63 loans per 100 solicitations, respectively)

in Arkansas, for example, the state with the lowest consumer finance rate ceiling where no finance companies are oper-

ating. These estimates however are biased, as previously noted.

13

Moreover, as Lukongo and Miller Jr. (2022) and Elliehausen et al. (2021) show that in Arkansas, for

example, there is a credit desert in the middle of the state and that there is a higher concentra-

tion of consumer loans in the counties bordering the neighboring states, the take-up rate for mail

volume solicitations from various lenders could be different in the interior counties versus the ex-

terior counties of the state. Finally, the take-up rate could also differ among borrower credit risk

groups, with certain credit constrained groups being more likely to pursue an offer received in the

mail than others.

4.1.1. State-Level Lender Share in Total Mail Volume

We first examine the cumulative mail volume distribution at the geographic level looking at

a state-level share for each category of lender identified earlier. Our share is constructed as the

ratio of all mail volume from each lender type to total mail volume sent between 2010 and 2019 to

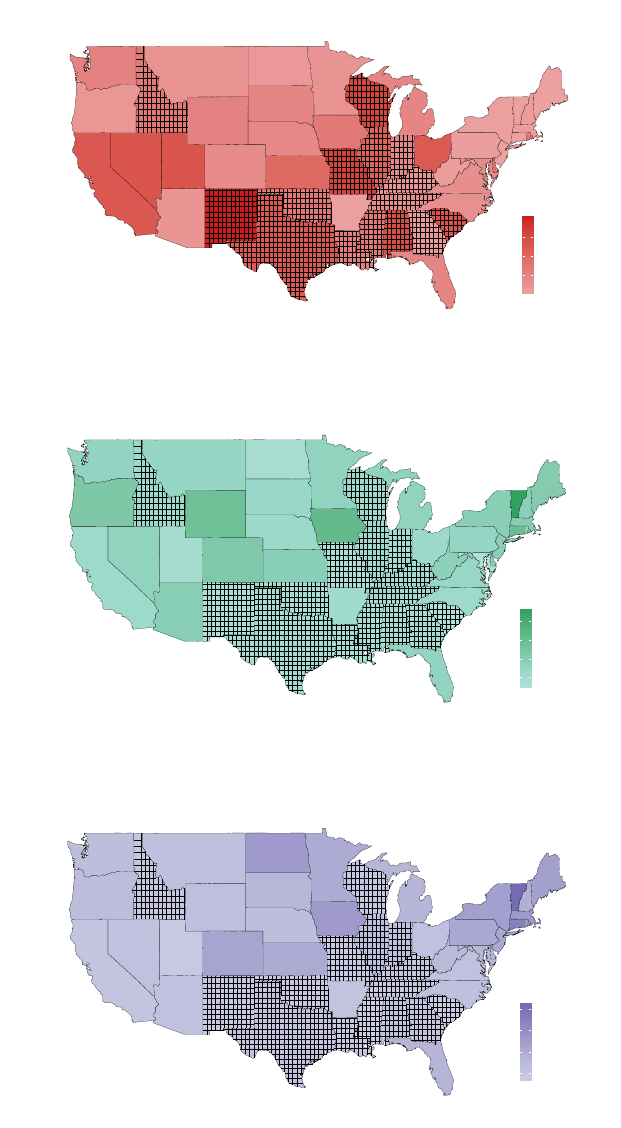

borrowers in each state. Figure 3 shows the share.

Focusing on the share for the mail volume sent by FinTech-bank partnerships (Figure 3a),

we note that states with lower interest rate ceilings (not hatched) appear to have higher levels of

FinTech-bank partnership mail volume than states with high interest rates (hatched). Notably,

Arkansas, the state with the most restrictive legislation, has by far the highest FinTech-bank mail

volume presence of all states for the observed period. As the most prominent of the low interest

rate states, Arkansas has a very low, constitutional interest rate ceiling that does not allow con-

sumer finance companies to operate profitably in the state. It is likely that, of the states with low

interest rate ceilings, Arkansas is attractive to FinTech lenders because of the lack of local finance

company competitors in the higher-risk market segment. In contrast, a notable exception to the

rule is Iowa. We believe this exception is due to Iowa’s opting out of the interest rate exportation

regime discussed previously. Another exception is West Virginia, which is likely due to legislation

prohibiting Prosper and LendingClub from doing business in the state.

30

In contrast, mail offers sent by finance companies (Figure 3b) are concentrated in states with

high interest rate ceilings, as the ability of finance companies to lend profitably in low-rate states

is limited by the low interest rate ceilings.

FinTech lenders sending out independent mail offers without bank partners (Figure 3c) and

payday lenders making installment loan offers (Figure 3d) appear mostly indifferent to the interest

rate ceiling regime, but, notably, they avoid Arkansas.

31

Banks of both types, mainstream and specialist, also appear to be indifferent to state interest

rate ceiling regimes (Figures 3e and 3f).

30

For example, Prosper explicitly notes on page 55 of its 2021:Q1 Form 10-Q that "no loans have been originated

through the Prosper platform to West Virginians since June 2016." This limitation is referenced as the "West Virginia

Matter" and is attributed to an unresolved discussion between the state’s attorney general and the lender in reference to

the potential violation of West Virginia’s Consumer Credit and Protection Act.

31

Although payday lenders are prohibited in Arkansas, the state’s consumers receive installment loan offers from

online payday lenders.

14

4.1.2. Aggregate Number of FinTech-Bank Partnership Offers by Risk Category for Individuals

with Credit Scores

Next, we examine the number of FinTech-bank partnership offers received over the period of

analysis by borrowers for each of the four risk categories we considered based on Mintel data: sub-

prime (VantageScore credit score lower than or equal to 660), near prime (VantageScore credit

score greater than 660 and lower than or equal to 719), low prime (VantageScore credit score greater

than 719 and lower than or equal to 792), high prime (VantageScore credit score higher than 792).

In order to do so, we obtained the credit score distribution as of 2019:Q4 from the FRBNY CCP/

Equifax data. Although Mintel data and the FRBNY CCP use different credit scores—Mintel uses

VantageScore credit scores and FRBNY CCP uses Equifax Risk Scores—their credit score distribu-

tions can be considered comparable. As such, we sum the mail offer information over the period

across the four credit risk categories and divide offers by the number of borrowers in each credit

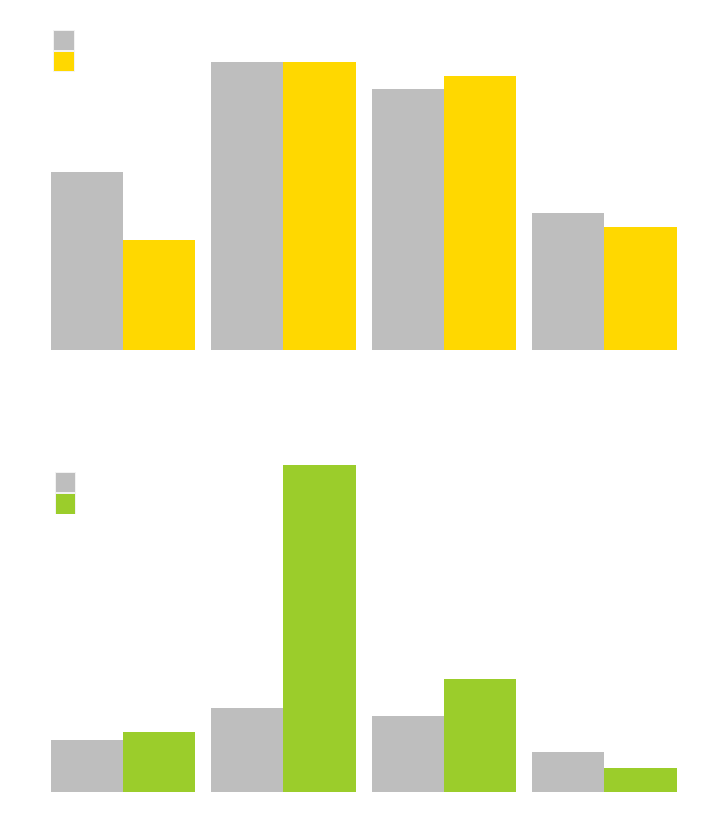

score group in the FRBNY CCP data. Figure 4 shows the results.

FinTech-bank partnerships targeted borrowers with near-prime and low-prime credit scores

more than their subprime or high-prime peers, irrespective of their state of residence (Figure 4a).

For low-risk borrowers, the state of residence makes little difference, as they receive about the same

number of personal loan mail offers—an average of 10 in low-rate states and 9 in high-rate states,

respectively, over the observed period. In contrast, the state of residence makes a notable differ-

ence for subprime borrowers, as those residing in low-rate states received about 5 more offers than

their peers residing in high-rate states, who received an average of 8 offers over the observed pe-

riod.

In Arkansas, FinTech-bank partnerships heavily targeted near-prime borrowers residing in the

state. Near-prime Arkansas consumers received nearly four times as many offers than near-prime

consumers residing in other low-rate states—81 offers relative to the 21 received by their peers

(Figure 4b). We also note that low-prime borrowers are also much more targeted by the FinTech-

bank partnerships than their counterparts in low-rate states, as near-prime borrowers residing in

Arkansas received 9 more mail offers than those residing in other low-rate states. The state of resi-

dence, makes little difference for subprime borrowers and higher-risk-score prime borrowers.

Particularly interesting about Arkansas is the focus on near-prime borrowers. In low-rate states

(excluding Arkansas), the FinTech-bank partnerships target similar proportions of near-prime and

low-prime borrowers. In Arkansas, FinTech-bank partnerships focus more heavily on near-prime

borrowers.

4.1.3. Aggregate Number of FinTech-Bank Partnership Offers in Light of the Madden v. Mid-

land Ruling

In this subsection, we examine the changes in the aggregate number of FinTech-bank part-

nership offers following the Madden v. Midland ruling. Although Horn and Hall (2017) highlight

several far-reaching effects of the Madden v. Midland ruling, our data enable us to complement

15

their key finding that the ruling led to a decrease in marketing and lending programs in the states

affected, and we show that the Madden v. Midland ruling caused uncertainty that had a ripple

effect on the supply of personal loans across other geographic areas as well.

32

In Figure 5, we con-

trast the supply trends in New York, Connecticut, and Vermont with those observed across the

unaffected states. Before Madden, New York, Connecticut, and Vermont solicitations were follow-

ing an ascending trend, similar to those in other states. However, solicitations in those three states

fell sharply following the ruling, while solicitations in other states remained flat. Although solic-

itations later increased to about pre-Madden levels, more recently, subsequent declines for New

York, Connecticut, and Vermont were steeper than declines in other states. Uncertainty following

the Madden decision likely reduced solicitation volume in the affected states, but the uncertainty

appears to have had spill over effects across other geographic areas as well.

4.2. Regression Analysis and Results

On average, lenders sent 202 monthly unsecured personal loan solicitations per campaign per

10,000 individuals with credit scores. The number of personal loan solicitations varied widely

among lender types. FinTech-bank partnerships had the largest average number of solicitations, 72

per 10,000 individuals with credit scores (Table 2), followed closely by finance companies, with 68.7

per 10,000 individuals. Mainstream banks had an average of 30.1 solicitations per 10,000, about

half the personal loan solicitations as the previous two categories. Specialist banks soliciting on

their own without a FinTech partner made, on average, 14.9 solicitations. FinTech firms offering

personal loans without a partner bank showed an average of 9.21 solicitations per 10,000 individu-

als, while payday lenders made 7.17 per 10,000. Credit unions and the other lender category made

few solicitations and therefore will not be considered in the subsequent discussion.

4.2.1. Personal Loan Solicitations by Type of Lender and Interest Rate Ceiling Category

We look first at the effect of rate ceilings on the volume of solicitations for personal loans of

different lender types. The dependent variable is the number of solicitations per 10,000 individuals

with credit scores in the respective state of residence for the receiver of the offer in total and for each

of the six categories of lenders. Our regression model is

Y

i j t

= β

0

+ b

1

· Rat e

j

+ Σ

r it

β

j

· X

r it

+ ε

i j t

, (1)

where Y

i j t

represent solicitations by lender category i in state j and month and year t. Rate

j

is an

indicator variable that equals 1 if the state has a high rate ceiling for loans from licensed lenders and

32

The other effects include the capping of interest rates according to the usury limits; the exclusion of loans to New

York, Connecticut, and Vermont residents from securitization pools or, vice versa, having these loans specifically ac-

quired by special purpose vehicles; and the restructuring of the relationship with the bank partner so that the bank

retains an interest on all the loans.

16

0 otherwise. The X

r j t

are r variables accounting for economic, credit risk, and life-cycle character-

istics that lenders might target for solicitations and time fixed effects to account for seasonality and

macroeconomic conditions. With the exception of the state GDP information, which comes from

the Bureau of Economic Analysis and we include as a proxy for consumer wealth and employment

opportunities in the state, all of the X

r j t

variables are from Mintel data, including the risk score.

33

ε

i j t

is the error term. Standard errors are clustered at the state level.

Table 3 presents estimation results in panel A. The coefficient of particular interest is the high-

rate-ceiling indicator variable. This coefficient is the mean difference in the number of solicitations

in high-rate states (the treatment group) relative to low-rate states (the reference group). FinTech-

bank partnerships (column II) and banks (columns VI and VII) solicited less in high-rate states

than low-rate states (partnerships, 44.4 per 10,000 fewer solicitations; mainstream and specialized

banks, 24 and 12.1 fewer, respectively). Finance companies (column III) solicited more in high-rate

states than low-rate states (9.46 solicitations per 10,000, ceteris paribus). In soliciting in high-rate

states, finance companies would be more likely to be able to charge rates that enabled them to

cover the costs of relatively small dollar and risky loans. That mainstream banks solicited less in

high-rate states is consistent with banks seeking to make larger loans and to less risky customers

and avoiding small-sized loans and risky borrowers. Specialist banks soliciting loans on their own

also showed less interest in soliciting loans in high-rate states than in low-rate states.

Significance of borrower characteristics (included in the controls) in this and subsequent esti-

mations suggests that solicitations target areas in which take-up rates and payment performance

are favorable. The size and significance of these variables often vary by type of lender, reflecting

differences in business practices of different lender types. Using consumers aged 40 to 54—who

still may be financing acquisition of durables with debt, have accumulated substantial debts, and

benefit from refinancing—as the reference age group, we find that households headed by younger

consumers (aged under 25 and aged 25 to 39) and older consumers (55 and older) are less likely

than the reference group to be solicited by finance companies, FinTech lenders acting indepen-

dently, and payday installment lenders.

34

Differences in solicitations by income are consistent with

institutional risk segmentation. Finance companies solicit most consumers with incomes less than

$25,000. As lower-income consumers tend to have little discretionary income above their normal

living expenses, they pose greater delinquency and default risk than higher-income consumers. In

contrast, FinTech-bank partnerships solicit least consumers in the lowest income bracket. Finance

companies specialize in lending to higher-risk consumers, while FinTech-bank partnerships do

not seek out higher-risk consumers for solicitations.

33

In the regressions, we use household heads’ VantageScore credit score information from TransUnion included in

Mintel data in a depersonalized fashion. We use the population with credit scores in the respective solicitation receiver’s

state of residence from Equifax to scale our results, as our dependent variables represent solicitations per 10,000 indi-

viduals with credit scores for each lender category.

34

Recall that in Mintel data, the demographic and socioeconomic information applies to the household head, while

the VantageScore credit score is that of the panelist.

17

The VantageScore credit score points to risk segmentation. Higher VantageScore credit scores

are associated with greater solicitations from banks. In addition, higher VantageScore credit scores

are associated with fewer solicitations from finance companies, FinTech firms operating without a

bank partner, and payday installment lenders. In general, renters are solicited more heavily than

owners across lender types. Higher state-level GDP is associated with fewer solicitations by all

lenders irrespective of type. Variables for the children, housing type, race, and education are gen-

erally not statistically significant.

As previously mentioned, banks historically have avoided high-risk consumers, and finance

companies provided credit to high-risk consumers, when the rate ceiling allowed them to do so

profitably. Institutional differences in solicitations by the height of the small-loan rate ceiling may

reflect continuing differences in risk tolerances of established lenders. Institutional differences

may also reveal risk-related perceptions of lending opportunities for relatively recent FinTech en-

trants. To explore this possibility further, we examine solicitations by rate-ceiling and consumer

risk categories, as described in the previous section. As before, the dependent variable is the num-

ber of solicitations per 10,000 consumers with credit scores. The regression model is

Y

i j t

= β

0

+ d1 · SL

i t

+ d2 · SH

i t

+ d3 · NL

i t

+ d4 · N H

i t

+ d5 · LL

i t

+ d6 · LH

i t

+ d7 · HL

i t

+ Σ

r j t

β

j

· X

r j t

+ ε

i j t

, (2)

Variables indicating the rate ceiling category (L, low; and H, high) and the consumer risk cat-

egory (S, subprime; N, near prime; L, low prime; and H, high prime) replace the high-rate indica-

tor variable from the previous regression. The high-prime, high-rate state (H H

i t

) is the reference

group.

Estimation results presented in Table 3 in panel B suggest that historical risk tolerances of fi-

nance companies and banks persist and that rate ceilings, when binding, influence the supply of

personal loans. Finance companies (column III) solicited quite heavily higher-risk consumers es-

pecially in high-rate states, consistent with risk segmentation of the personal loan market by insti-

tutional class. Subprime consumers in high-rate states received 58.6 solicitations per 10,000 more

than high-prime consumers in high-rate states, while subprime consumers in low-rate states re-

ceived 48 per 10,000 more solicitations from finance companies. Finance companies also solicited

near-prime consumers in high-rate states more than high-prime consumers in high-rate states. As

a whole, these findings suggest that finance companies specialize in the high-risk segment of the

market and that they especially focus their attention on high-rate states in which high-risk lending

is profitable.

Mainstream bank solicitations (column VII) targeted high-prime consumers. Subprime, near-

prime, and low-prime consumers received far fewer solicitations from banks than high-prime con-

18

sumers, regardless of rate ceiling.

35

High-prime consumers in low-rate states received substantially

more solicitations than high-prime consumers in high-rate states. Fewer solicitations of all but

high-prime consumers point to continued risk aversion by banks.

FinTech-specialist bank partnerships (column II) heavily solicited near-prime and low-prime

consumers, which appear not to interest banks and finance companies very strongly. Near-prime

consumers in low-rate states received 79.1 per 10,000 more solicitations from FinTech-bank part-

nerships than high-prime consumers in high-rate states, while low-prime consumers in low-rate

states received 72.3 per 10,000 more than the reference group. FinTech-bank partnership solicita-

tions of near-prime and low-prime consumers in high-rate states were also notable (35.2 and 38.2

per 10,000, respectively). Notable also are solicitations of subprime consumers in low-rate states

(47.8 per 10,000). The latter group (subprime consumers in low-rate states) likely are not profitable

for finance companies, because they are subject to local state rate ceilings. FinTech-bank partner-

ships can use the bank preemption of state rate ceilings to lend to this group.

Specialist banks (column VI) originating loans on their own solicited fewer subprime con-

sumers and near-prime consumers in high-rate states than high-prime consumers in high-rate

states. These banks solicited low-prime and high-prime consumers in low-rate states at a some-

what higher rate than the reference group, perhaps because their experience in FinTech partner-

ships made them comfortable using their preemption from state rate ceilings to lend in low-rate

states. In avoiding higher-risk consumers, specialist banks operating on their own acted much like

their mainstream bank brethren.

FinTech firms operating on their own (column IV) targeted riskier consumers. Subprime and

near-prime consumers in low- and high-rate states were solicited at notably higher rates (6.97, 13.7,

and 7.95 per 10,000 consumers, respectively) than the reference group. When operating on their

own, FinTech firms’ risk acceptance more closely resembled that of finance companies than banks.

Payday lenders (column V) focused on the riskiest customers, soliciting subprime consumers

more than any other credit risk category. Subprime consumers located in low-rate states received

10.5 solicitations per 10,000, while subprime consumers located in high-rate states received the

highest number of solicitations—18.9 per 10,000. Similar to finance companies, when making per-

sonal loans, payday lenders focus on high-rate states in which high-risk lending is profitable.

In Table B1 in Appendix B, we show that our results remain robust even after the elimination of

outlier states—Arkansas and Iowa.

4.2.2. Mail Volume after the Madden v. Midland Decision

To examine the implications of the Madden v. Midland ruling on the supply of personal loans,

we use a similar design employed by other studies (see Danisewicz and Elard, 2018), but we expand

the treatment group to include Vermont. As a result, our treatment group consists of all three

35

In some states, rate ceilings for banks may differ from rate ceilings in small-loan laws. Banks may charge rates

allowed in their home state, regardless of where the borrower is located.

19

states in which the U.S. Second Court of Appeals has jurisdiction — New York, Connecticut, and

Vermont.

36

Other states make up our comparison group. Our regression model is

Y

i j t

= β

0

+ d

1

· N Y CTV T

i

+ d

2

· Post Madden

t

+ d

3

· N Y CTV T · Post Madden

i t

+ Σ

r j t

β

j

· X

r j t

+ ε

i j t

, (3)

where Y

i j t

represent solicitations by lender category i in state j and month and year t in aggre-

gate and by credit risk group. N Y CT V T

i

represents an indicator variable that equals 1 if the

state is New York, Connecticut, or Vermont, and 0 otherwise. It carries the coefficient d

1

, which

shows the mean difference in the number of solicitations in treatment states (New York, Connecti-

cut, and Vermont) relative to control states (all others). Post Madden

t

represents an indicator

variable that equals 1 for the period after the Madden ruling and 0 otherwise. The coefficient d

2

captures the change in the number of solicitations after the ruling, relative to the previous pe-

riod. N Y CTV T · Post Madden

i t

is the interaction term underpinning the coefficient of interest,

d

3

, which represents the change in the number of solicitations in treatment states relative to the

change in the number of solicitations in control states. This coefficient is expected to be negative

and statistically significant for bank-FinTech partnerships. X

r j t

are r variables accounting for eco-

nomic, credit risk, and life-cycle characteristics that lenders might target for solicitations. ε

i j t

is

the error term. Standard errors are clustered at the state level.

After controlling for consumer characteristics, consumers in New York, Connecticut, and Ver-

mont received more solicitations from FinTech-bank partnerships (Table 4, panel B, column II)

and banks (panels F and G) than consumers in the comparison group states. Finance companies

(panel C) made fewer solicitations in treatment states. New York, Connecticut, and Vermont are

subject to relatively low rate ceilings. These results are consistent with low rate ceilings restricting

nonbank lending. Low rate ceilings make risky loans and small-sized loans unprofitable, so they

are not offered in the market. Banks generally are not so constrained. Banks and FinTech-bank

partnerships may take advantage of regulations that allow banks to charge rates that are legal in

their home state regardless of the state in which a consumer resides.

Overall, FinTech-bank partnerships (panel B, column II) and specialist banks (panel F, column

II) made more solicitations, while nearly all other lender types made fewer solicitations, in the

period after the Madden decision than in the period before the decision. After controlling for con-

sumer characteristics, the net effect of the Madden decision in treatment states was 15.9 fewer

solicitations per 10,000 individuals (41.2 per 10,000 post-Madden plus negative 56.1 per 10,000

post-Madden in New York, Connecticut, and Vermont). Finance companies made notably more

36

Although we are aware of the heterogeneity issue within our group, as Vermont differs in its treatment of usurious

loans, given that we examine the supply effects of the ruling, we include all three states in our treatment group. Our

results are consistent when excluding Vermont from our estimation. (See Honigsberg, Jackson Jr., and Squire, 2017; and

Danisewicz and Elard, 2018.)

20

(47.4 per 10,000) solicitations in treatment states after the Madden decision than they made in the

period before the decision.

37

Danisewicz and Elard (2018) found a decline in FinTech lending following the Madden deci-

sion, especially among low-income households. Low income is not the same as high risk, but

low income does tend to make consumers vulnerable to financial difficulties that adversely af-

fect their credit scores. Post-Madden, we find reductions in FinTech-bank partnership offers in all

risk groups relative to consumers in comparison states (Table 4, panel B), with the most significant

reductions in solicitations occurring for near-prime (76.2 per 10,000), low-prime (50.7 per 10,000),

and high-prime (37.4 per 10,000) consumers in treatment states. With the exception of finance

companies, solicitations from the other lender types were little changed in treatment states rela-

tive to consumers in comparison states in the post-Madden period. The most notable increases

shown by finance companies are for near-, low-, and high-prime consumers (60.8, 48.4, and 56.5,

respectively).