California Employer Health Benefits: Prices Up, Coverage Down

M A R C H 2 0 1 7

2

© 2017 CALI FORNI A HEALT H CARE F O U N D AT ION

California Employer Health Benefits

C O N T E N T S

Overview………………………..3

Coverage Availability………….4

Cost of Health Insurance……..9

Benefits and Cost Sharing…..18

Plan Choice and Enrollment..31

Employer Views and

Practices……………………….35

Methodology………………….41

Introduction

Since 2000, the percentage of employers offering health benefits has declined in California and

nationwide, although coverage rates among offering firms have remained stable. Only 55% of firms

reported offering health insurance to employees in 2016, down from 69% in 2000. Nineteen percent

of California firms reported that they increased cost sharing in the past year, and 27% of firms

reported that they were very or somewhat likely to increase employees’ premium contribution in the

next year. The prevalence of plans with large deductibles also continues to increase.

California Employer Health Benefits: Prices Up, Coverage Down presents data compiled from the

2016 California Employer Health Benefits Survey.

KEY FINDINGS INCLUDE:

• Health insurance premiums for family coverage grew by 5.6%. Family coverage premiums have

seen a cumulative 234% increase since 2002, compared to a 40% increase in the overall

inflation rate.

• The average monthly health insurance premium, including the employer contribution, was $597

for single coverage and $1,634 for family coverage in California, and was significantly higher

than the national average.

• Forty-one percent of workers in small firms faced an annual deductible of at least $1,000 for

single coverage, compared to 17% of workers in larger firms. The prevalence of these higher

deductibles in small firms has increased substantially in the past five years.

• Only one in four firms with many low-wage workers (those earning $23,000 or less) offered

health coverage to employees in 2016.

• In the past year, 24% of large firms extended eligibility for health benefits to workers not

previously eligible.

8%

9%

16%

18%

14%

14%

14%

12%

49%

46%

US

California

Workers

3

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

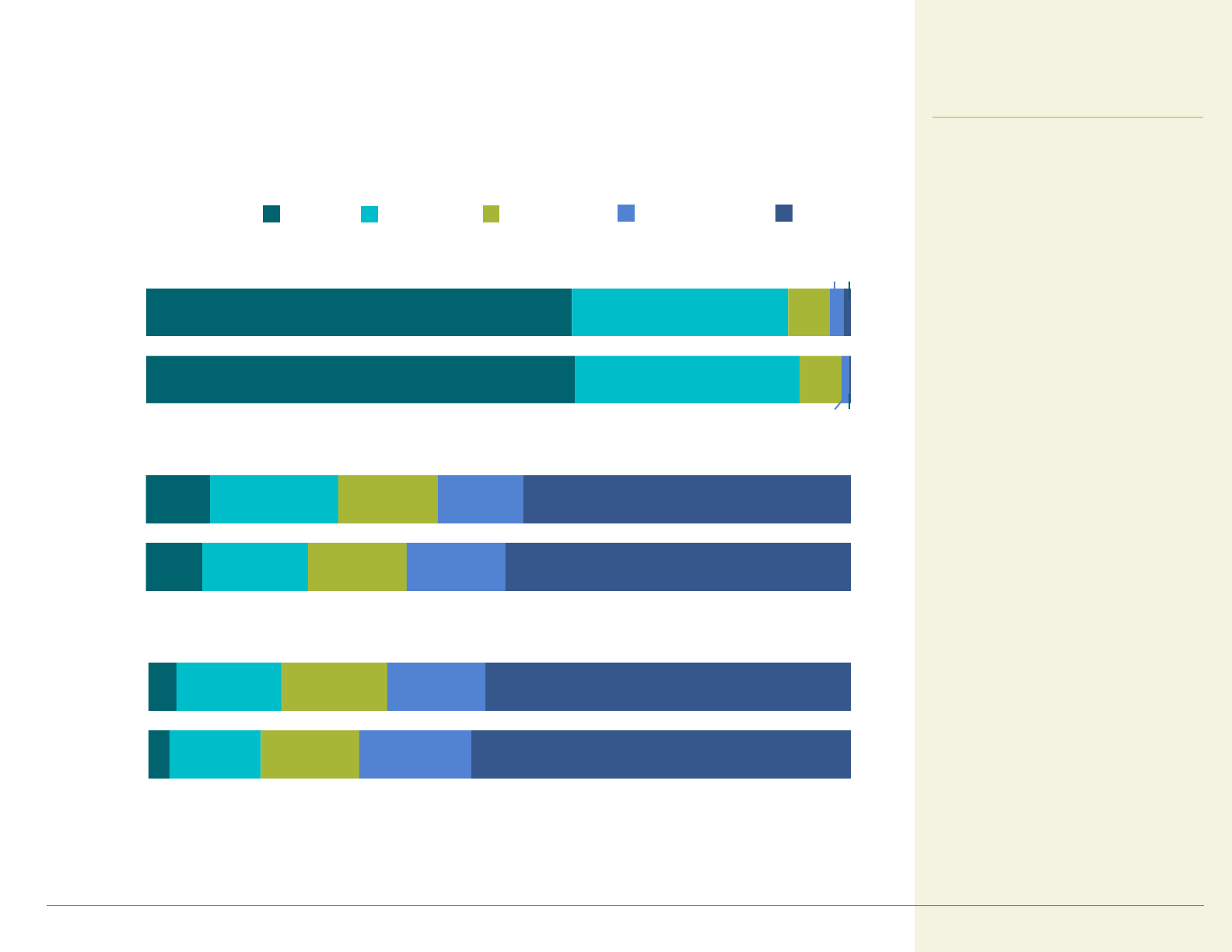

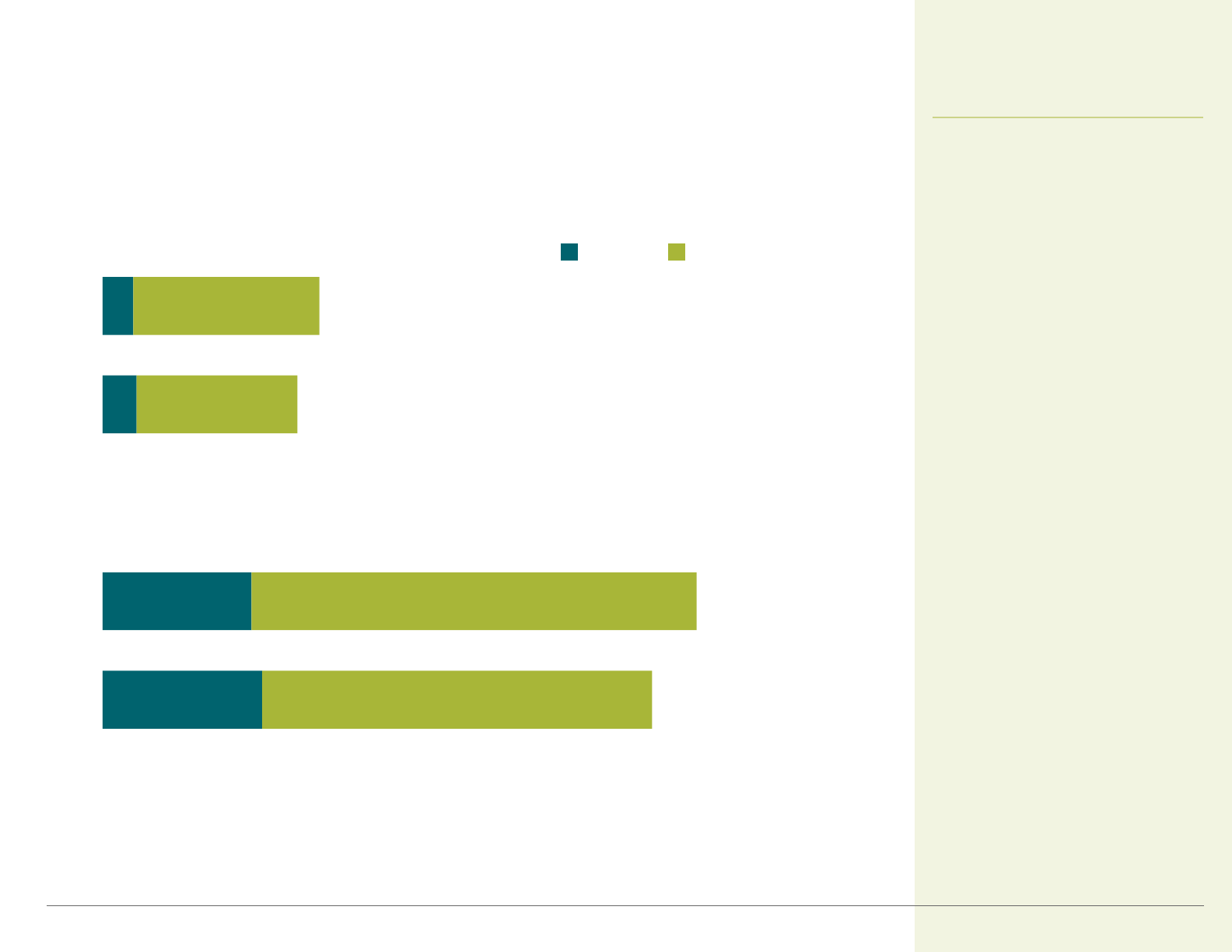

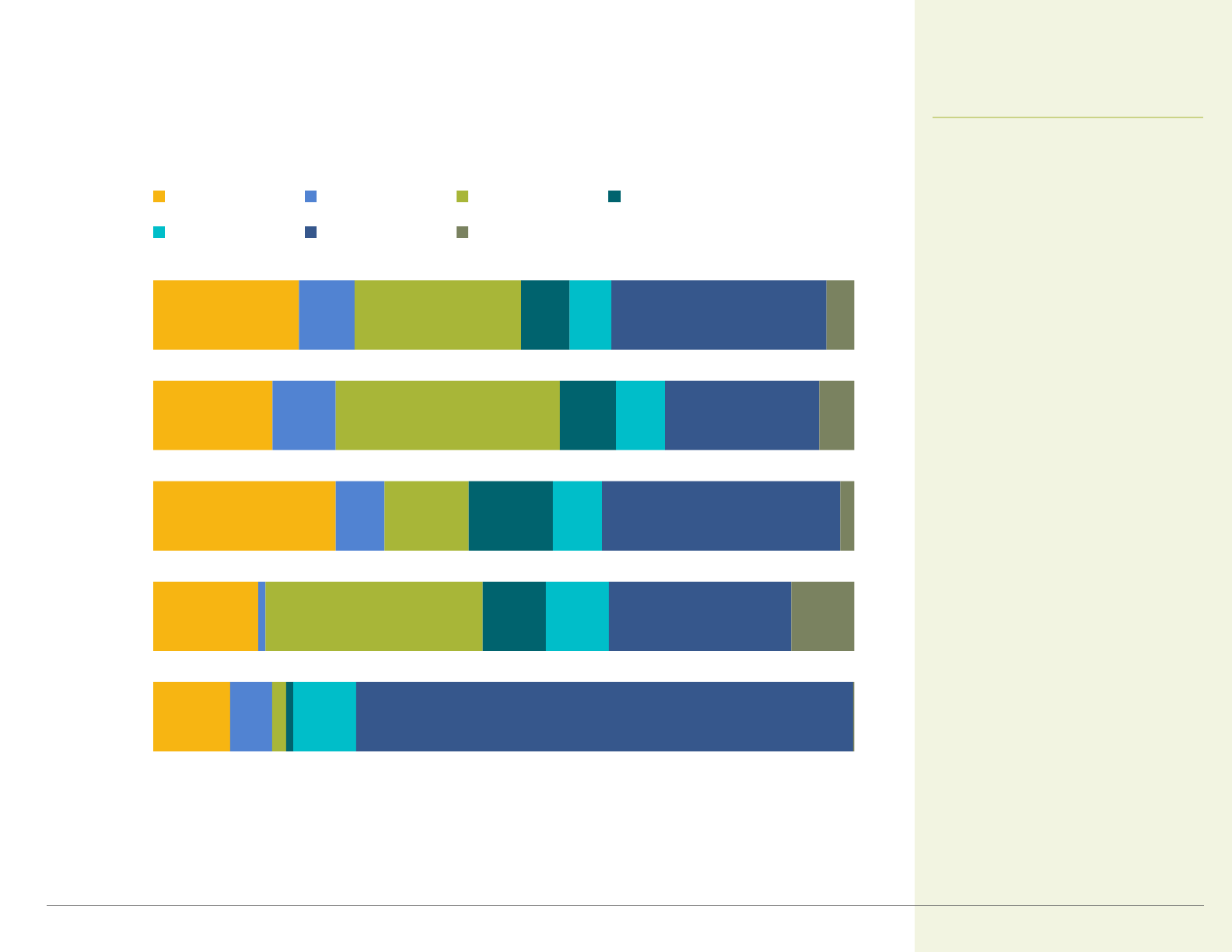

NUMBER OF WORKERS

*Estimates are statistically different betw een California and US.

Note: Segments m ay not add to 100% due to roundin g .

Sources: California Employer Health Benefits Survey : 2016, CHCF/NORC; author analysis of Survey of Employer-Sponsored Health Benefits publ i c use file: 2016, Kaiser/HRET.

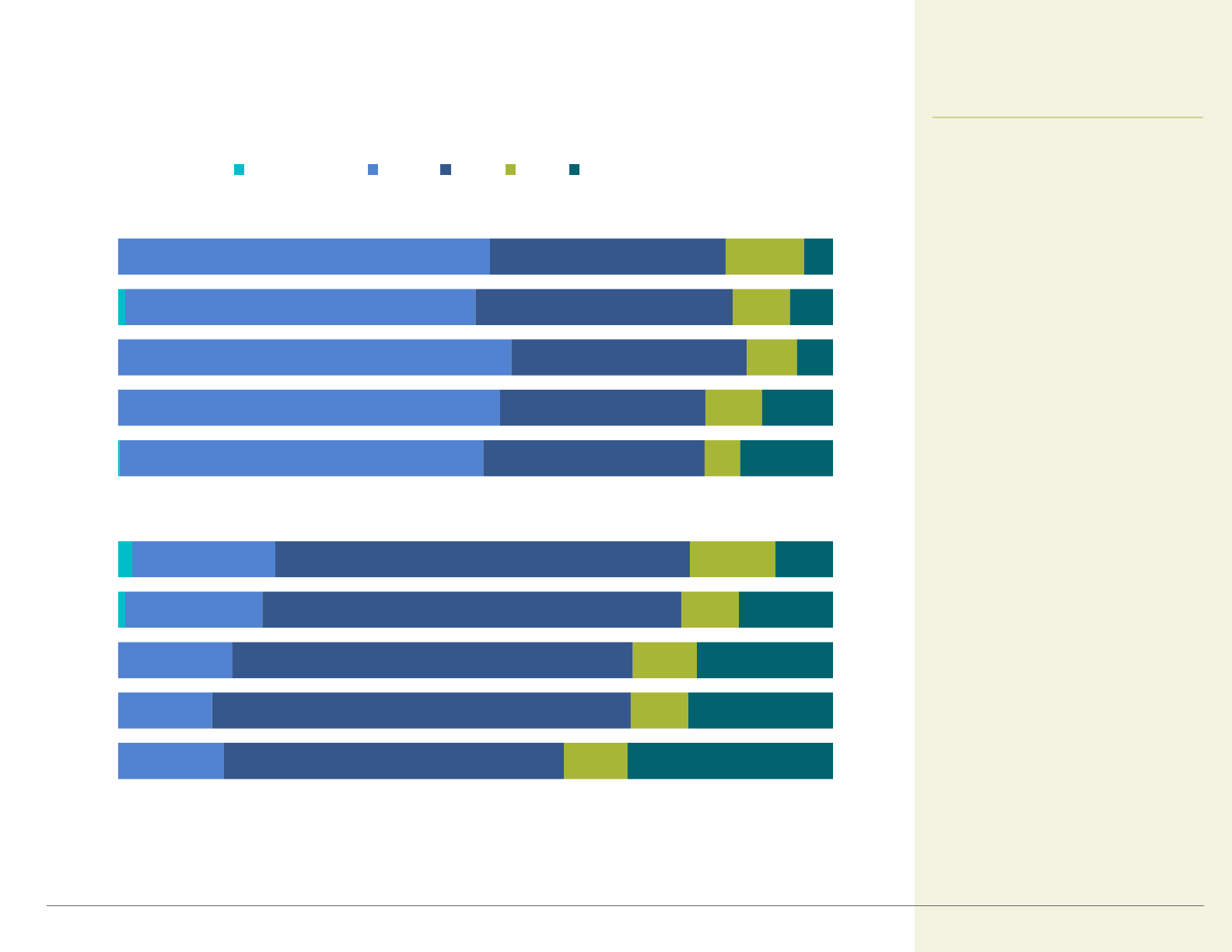

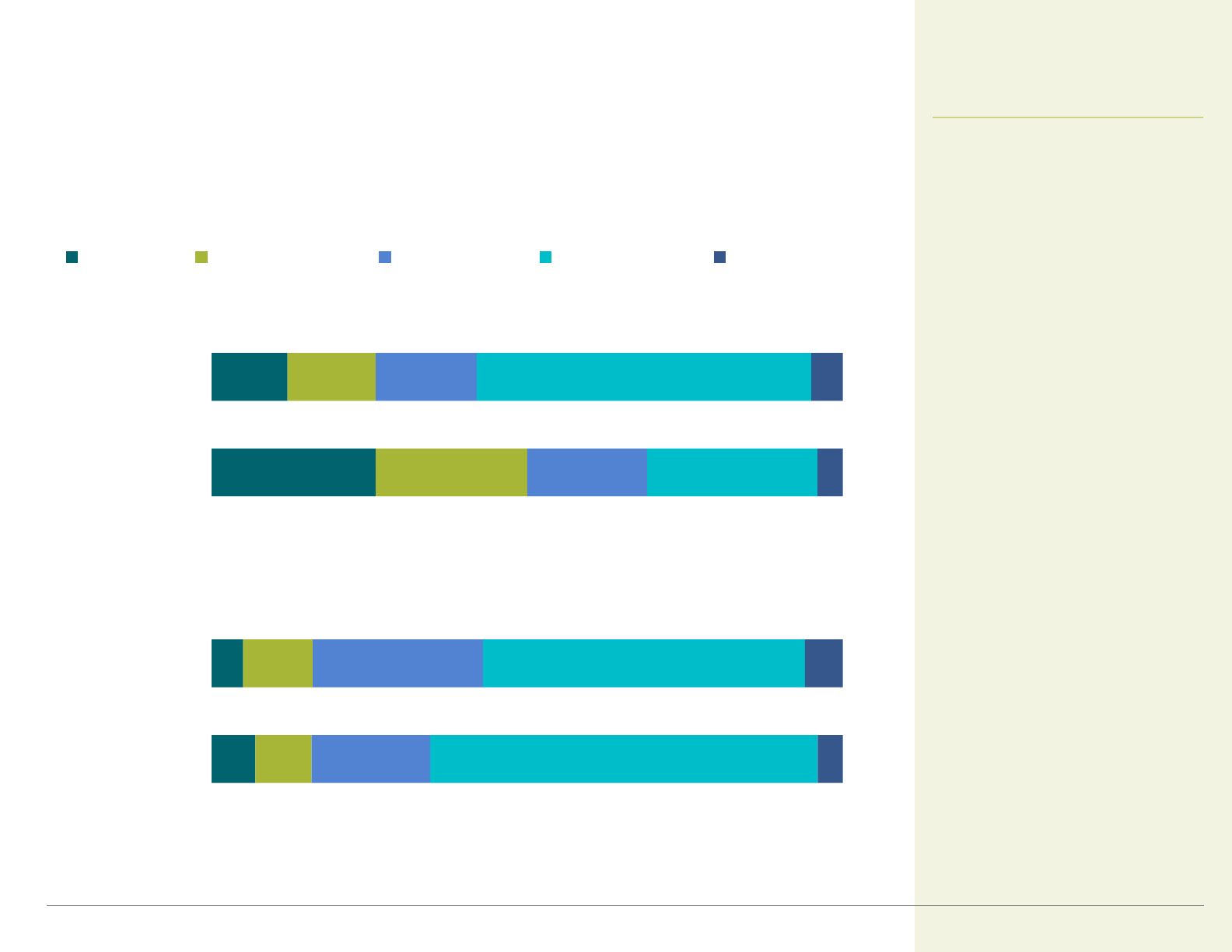

Employers, Workers, and Covered Workers,

by Firm Size

In 2016, California firms with 3

to 49 workers accounted for

92% of all employers, but just

27% of all workers, and 19% of

workers with health coverage,

a dynamic similar to national

firms.

61%

61%

32%

31%

6%

6%

1%

2%

<1%

1%

US

California

Employers*

3%

4%

13%

15%

14%

15%

16%

14%

54%

52%

US

California

Covered Workers

1,000+

200-999

10-49

3-9

California vs. United States, 2016

Overview

50-199

California Employer Health Benefits

Survey: 2004, CHCF/HRET; California Employer Health Benefits Survey: 2000-2003, Kaiser/HRET; Survey of Employer-Sponsored Health Benefits: 2000-2016, Kaiser/HRET.

4

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

*Estimates are statistically different from the previous year shown.

Sources: California Employer Health Benefits Survey: 2007-2016, CHCF/NORC; California Employer Health Benefits Survey: 2005-2006, CHCF/HSC; California Employer Health Benefits

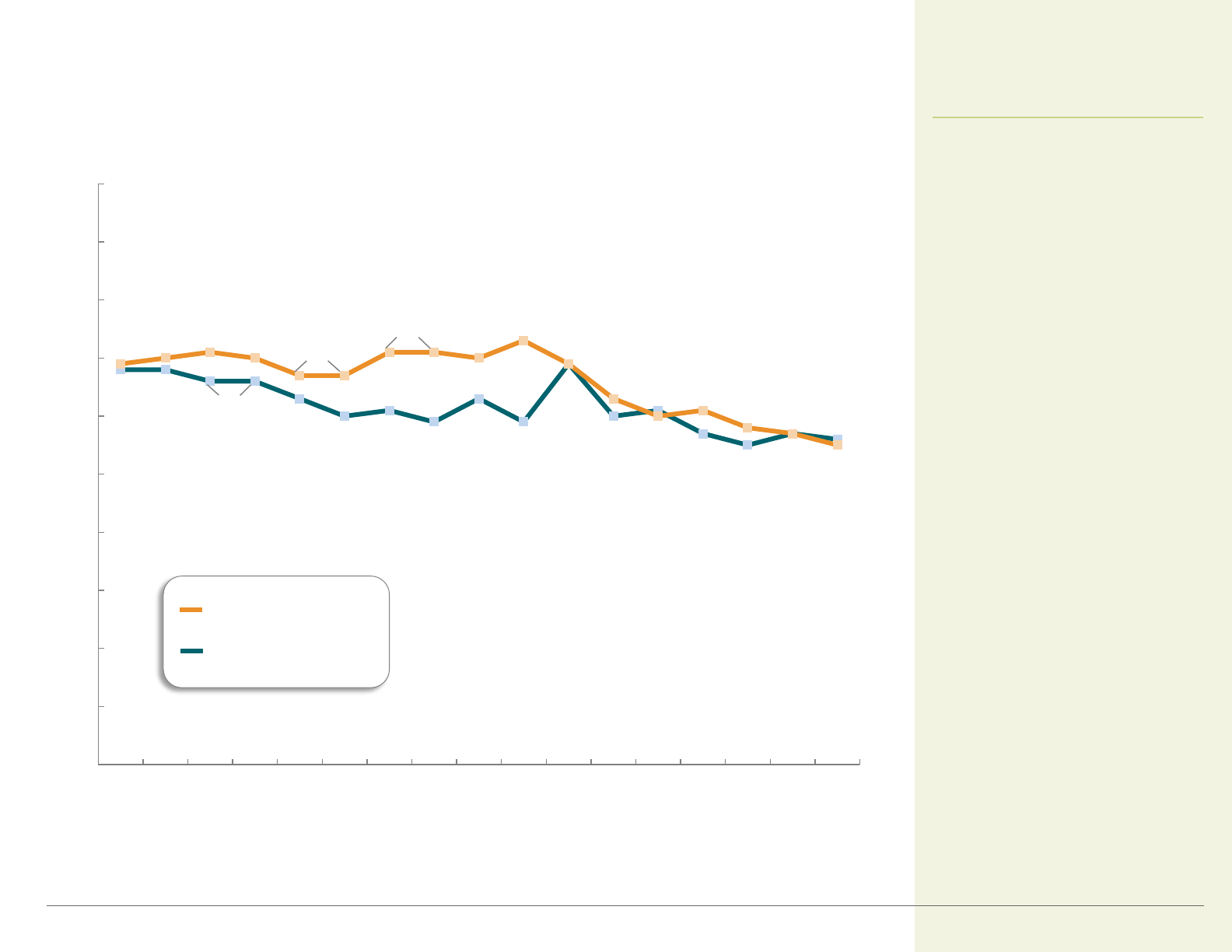

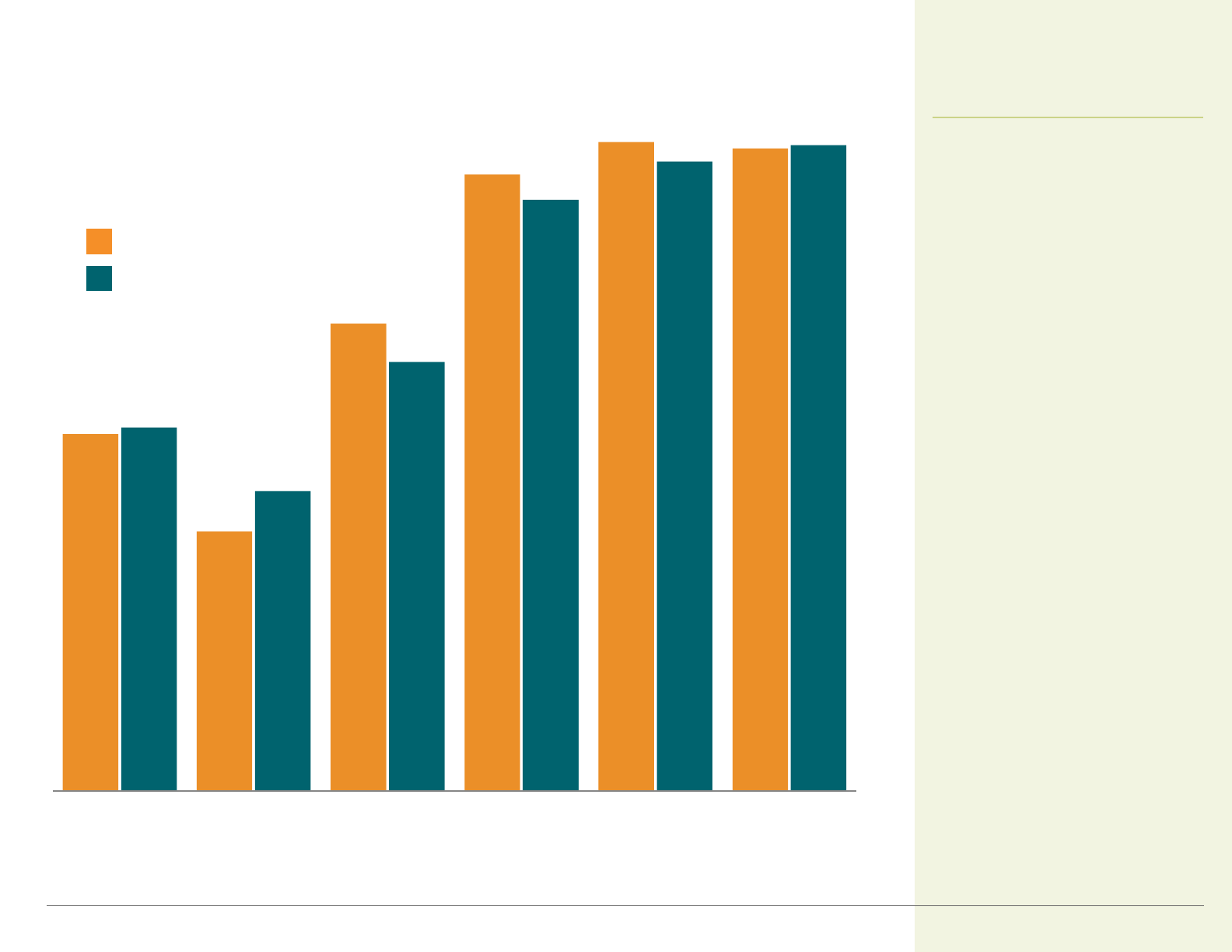

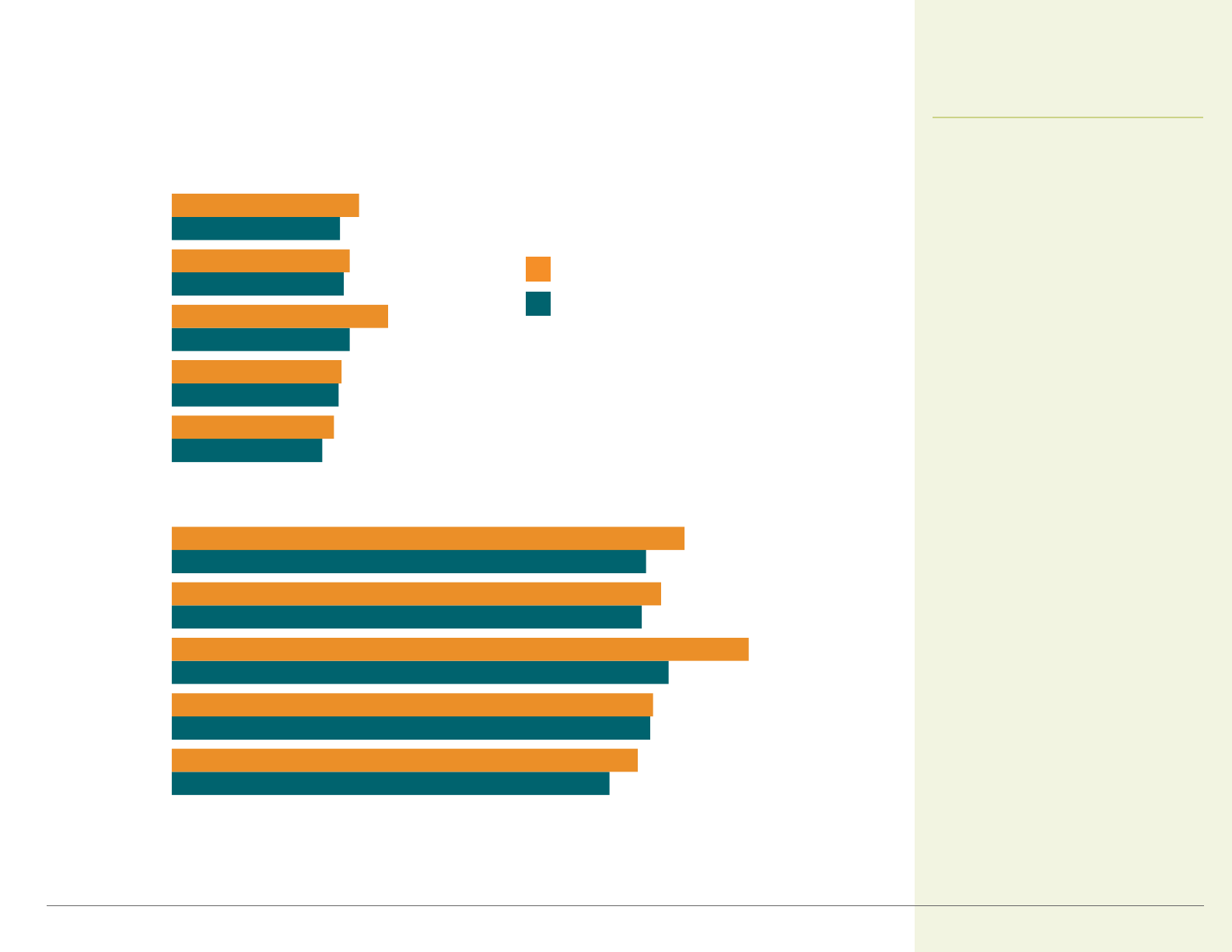

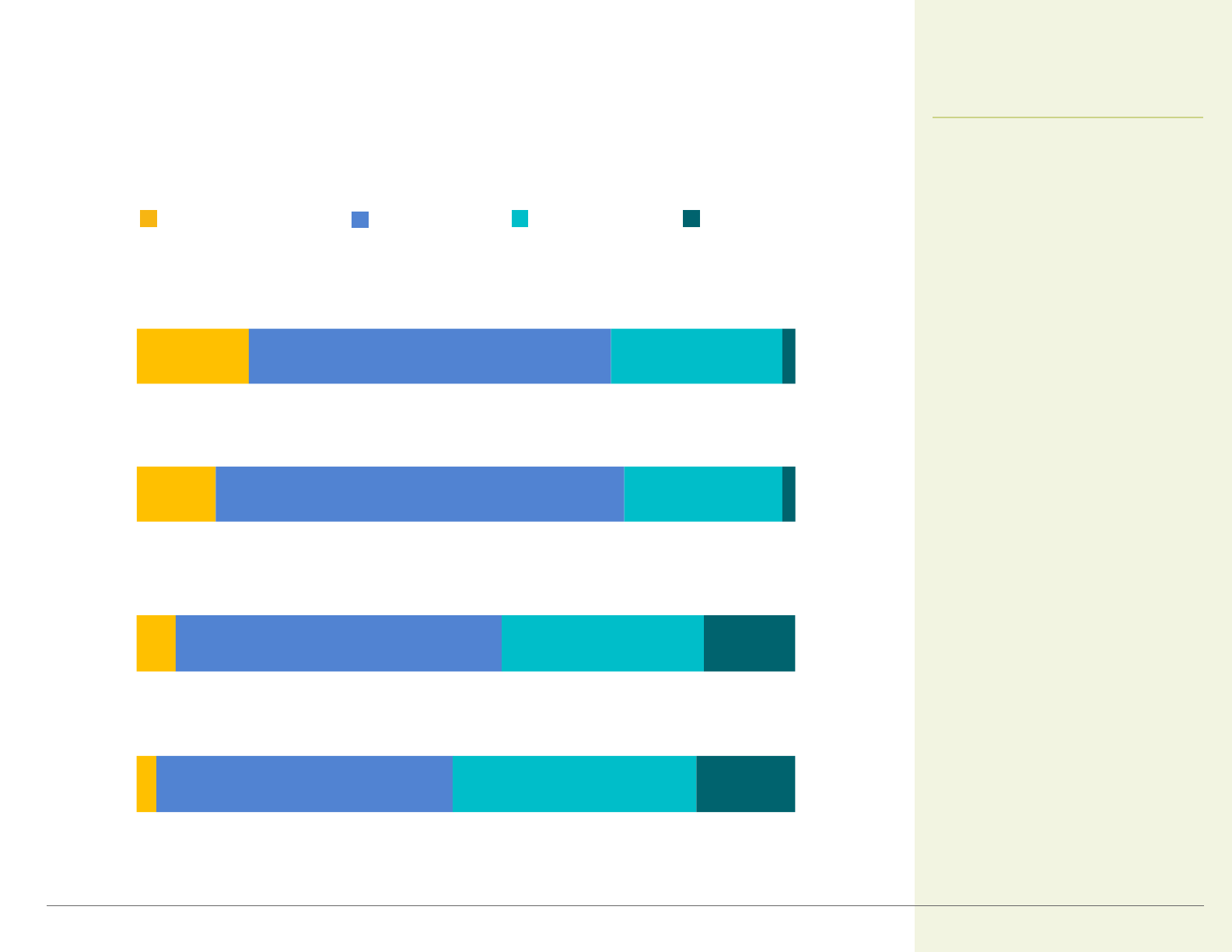

Employers Offering Coverage

The percentage of California

employers offering health

insurance in 2016 (55%) was

similar to the overall US rate of

56%. The recent decline in

California's offer rate was

largely due to fewer small firms

offering coverage.

68% 68%

66%

63%

60%

61%

59%

63%

59%

69%

60%

61%

57%

55%

57%

56%

69%

70%

71%

70%

67%

71%

70%

73%

69%*

63%*

60%

61%

58%

57%

55%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

California

United States

Coverage Availability

California vs. United States, 2000 to 2016

California Employer Health Benefits

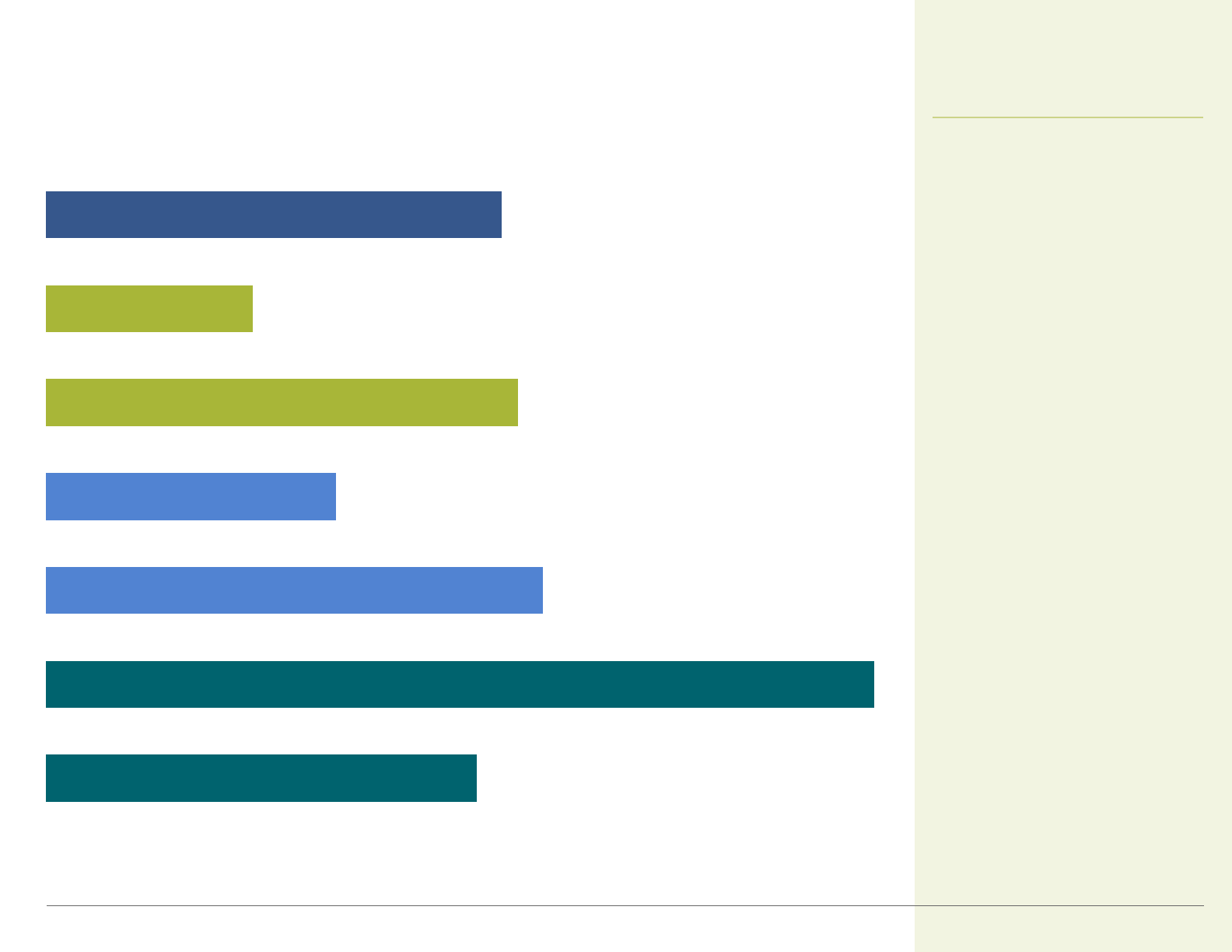

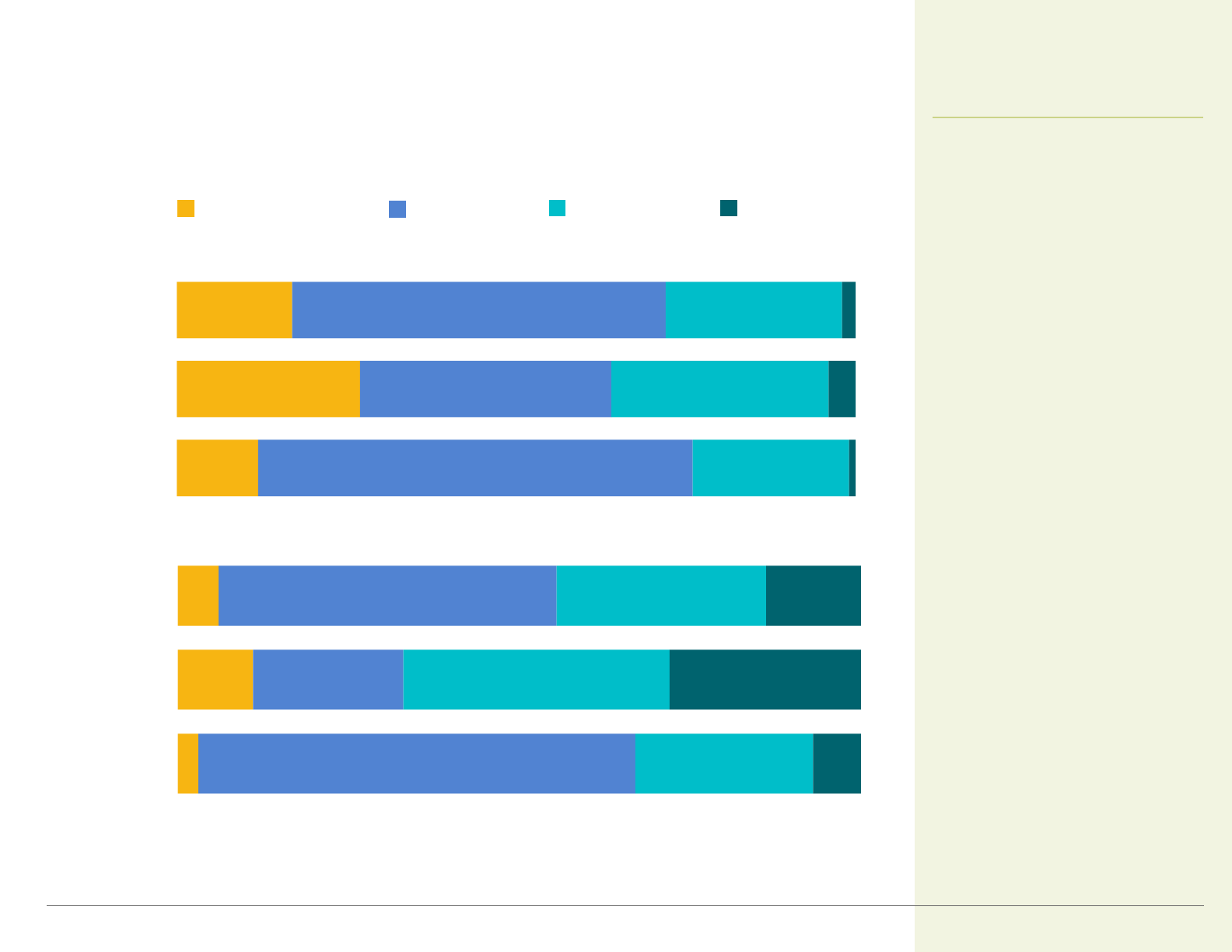

52%*

100%*

60%

35%

57%*

25%*

55%

No Union Workers*

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

5

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

At Least Some Union Workers*

Fewer Part-Time Workers

Many Part-Time Workers

Fewer Lower-Wage Workers*

Many Lower-Wage Workers*

All Firms

*Estimate is statistically different from all other firm s.

Notes: Firms with many lower-wage workers are defined as firms with 35% or more of w orkers earning $23,000 or less per year. Firms with fewer lower-w age workers are those with less

than 35% of w orkers earning that amount. Many part-time workers is defined as 35% or more of the w orkforce w orking part-time. Fewer part-time workers is the inverse.

Employers Offering Coverage, by Firm Characteristics

Whether a company offers

coverage varies widely by

firm characteristics. Firms

that employ many lower-

wage workers were less

likely to offer health

insurance than those that

employ fewer lower-wage

workers. All companies with

union workers (100%)

offered coverage, versus

only 52% of those with no

union workers.

California, 2016

California Employer Health Benefits

Coverage Availability

*Estimates are statistically different betw een California and US.

Sources: California Employer Health Benefits Survey: 2016, CHCF/NORC; author analysis of Survey of Employer-Sponsored Health Benefits public use file: 2016, Kaiser/HRET.

6

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

California’s smallest employers

(three to nine workers) were

much less likely to offer coverage

than larger firms. Less than half

(40%) of California's smallest

firms offered coverage in 2016,

compared to 53% in 2011 (not

shown). Offer rates for California

were similar to those nationwide.

Employers Offering Coverage, by Firm Size

California

United States

California vs. United States, 2016

55%

40%

72%

95%

100%

99%

56%

46%

66%

91%

97%

100%

All Firm Sizes 3-9 10-49 50-199 200-999* 1,000+

California Employer Health Benefits

Coverage Availability

California

United States

Eligible Workers Who…

Take Up Coverage

80%

Note: Tests found no statistically different estimates betw een California and US.

Sources: California Employer Health Benefits Survey: 2016, CHCF/NORC; Survey of Employer-Sponsored Health Benefits: 2016, Kaiser/HRET.

7

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Not all employees are eligible

for health insurance offered by

their firm, and not all who are

eligible elect to participate.

Seventy-seven percent of

people working in California

firms offering coverage were

eligible for health benefits. Of

those eligible, 81% elected to

enroll, resulting in a 62%

coverage rate.

Employee Eligibility, Take-Up Rates, and Coverage

79%

81%

California vs. United States, 2016

77%

62%

79%

62%

Eligible Workers Covered Workers

California Employer Health Benefits

Coverage Availability

62%

64%

66%

64%

65%

All Firms

Note: Tests found no statistically different estimates from previous year shown within firm size.

Source: California Employer Health Benefits Survey: 2008-2016, CHCF/NORC.

8

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

65%

Worker Coverage Rates Among Firms Offering Health

Benefits

Insurance coverage rates

among California employers

offering health benefits have

been fairly stable since

2008, with year-to-year

changes not statistically

significant. Large and small

firms had comparable

coverage rates.

2008

2010

2012

2014

2016

63%

62%

63%

67%

69%

Small Firms (3-199 workers)

62%

65%

68%

62%

63%

Large Firms (200+ workers)

by Firm Size, 2008 to 2016, Selected Years

California Employer Health Benefits

Coverage Availability

Sources: California Employer Health Benefits Survey: 2016, CHCF/NORC; Survey of Employer-Sponsored Health Benefits: 2016, Kaiser/HRET.

9

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

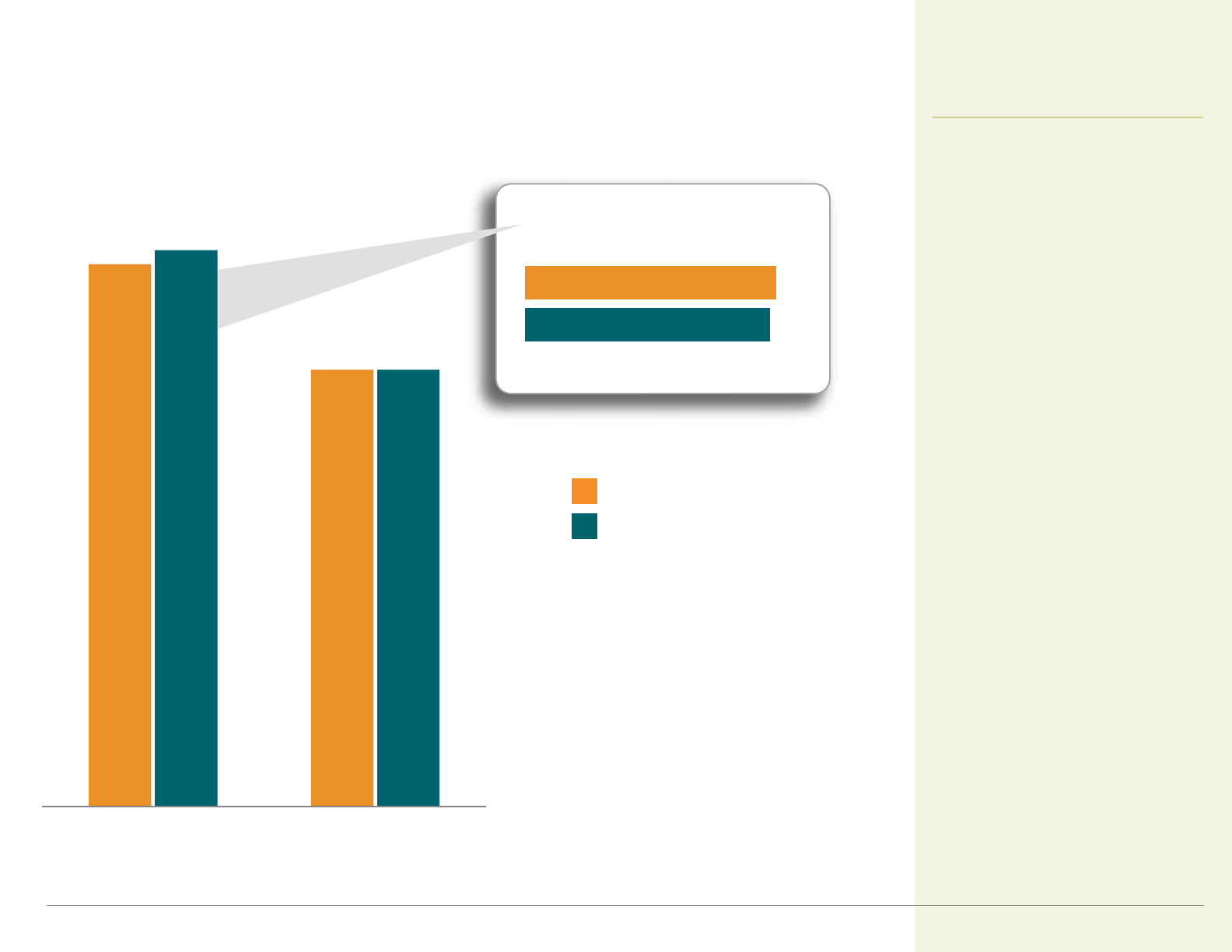

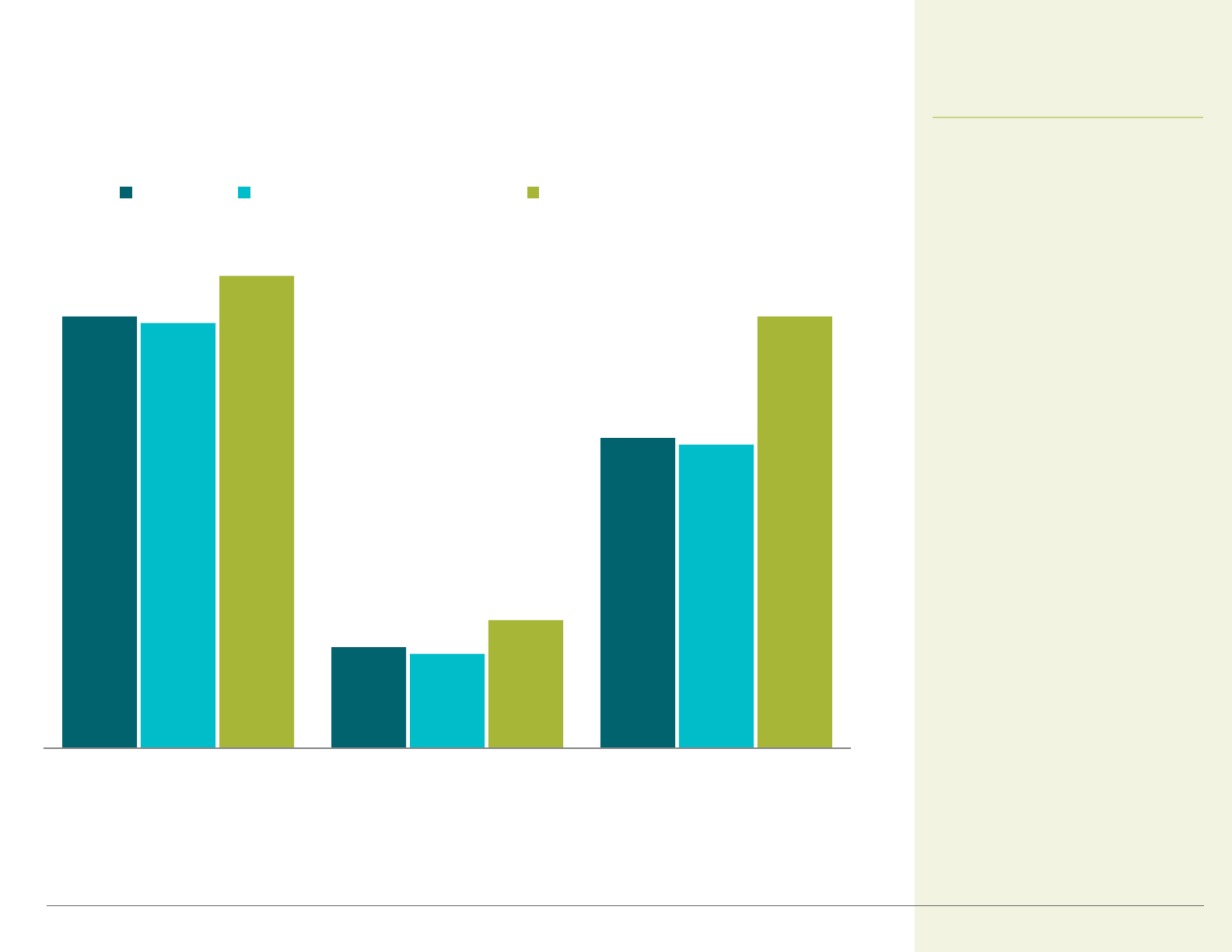

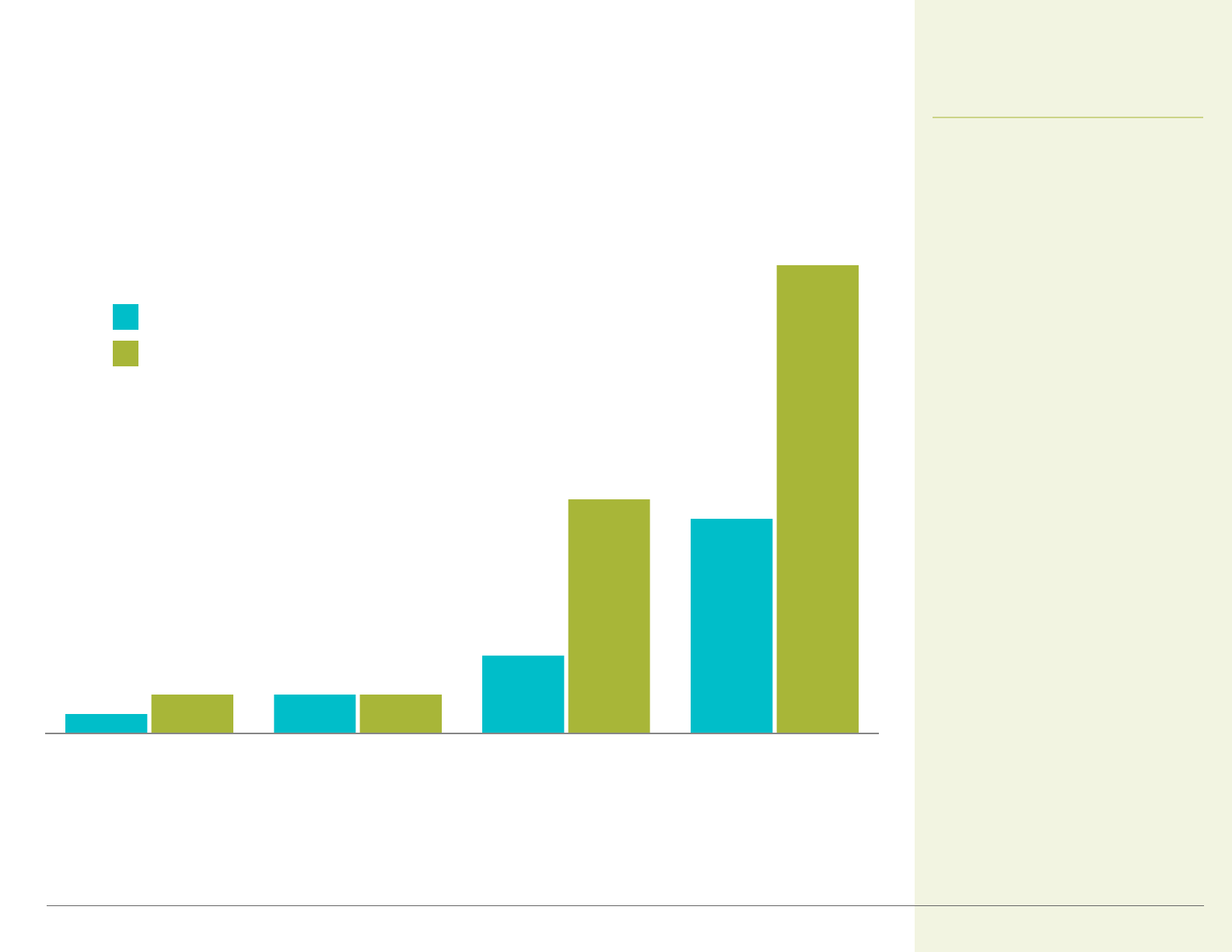

Average Increases in Premiums, Family Coverage

Among California firms that

offered the same health plan

or plans in 2015 and 2016

(fixed enrollment), the

average premium increase

for family coverage was

5.6%. For those firms that

changed plans or had

workers who switched plans

(variable enrollment), the

average family premium

increase was 5.2%.

Fixed vs. Variable Enrollment, California vs. United States, 2016

5.6%

5.2%

3.0%

California

(fixed enrollment)

California

(variable enrollment)

United States

(variable enrollment)

Cost of Health Insurance

California Employer Health Benefits

4.8%

6.7%

10.0%*

13.4%*

15.8%*

11.4%*

8.2%*

8.7%

8.3%

7.5%

8.1%

6.4%*

5.7%

6.0%

4.5%*

5.6%

3.5%

2.8%

4.3%

2.7%

1.7%

3.9%

4.2%

3.4%

3.0%

-0.6%

1.8%

3.1%

1.7%

1.4%

1.9%

1.1%

2.2%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

Premiums

Overall Inflation

Sources: California Employer Health Benefits Survey: 2007-2016, CHCF/NORC; California Employer Health Benefits Survey: 2005-2006, CHCF/HSC; California Employer Health Benefits

Survey: 2004, CHCF/HRET; California Employer Health Benefits Survey : 1999-2003, Kaiser/HRET; California Average of Annual Inflation (April to April): 1999-2016, California Division of

Labor Statistics and Research.

10

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

*Estimates are statistically different from the previous year shown.

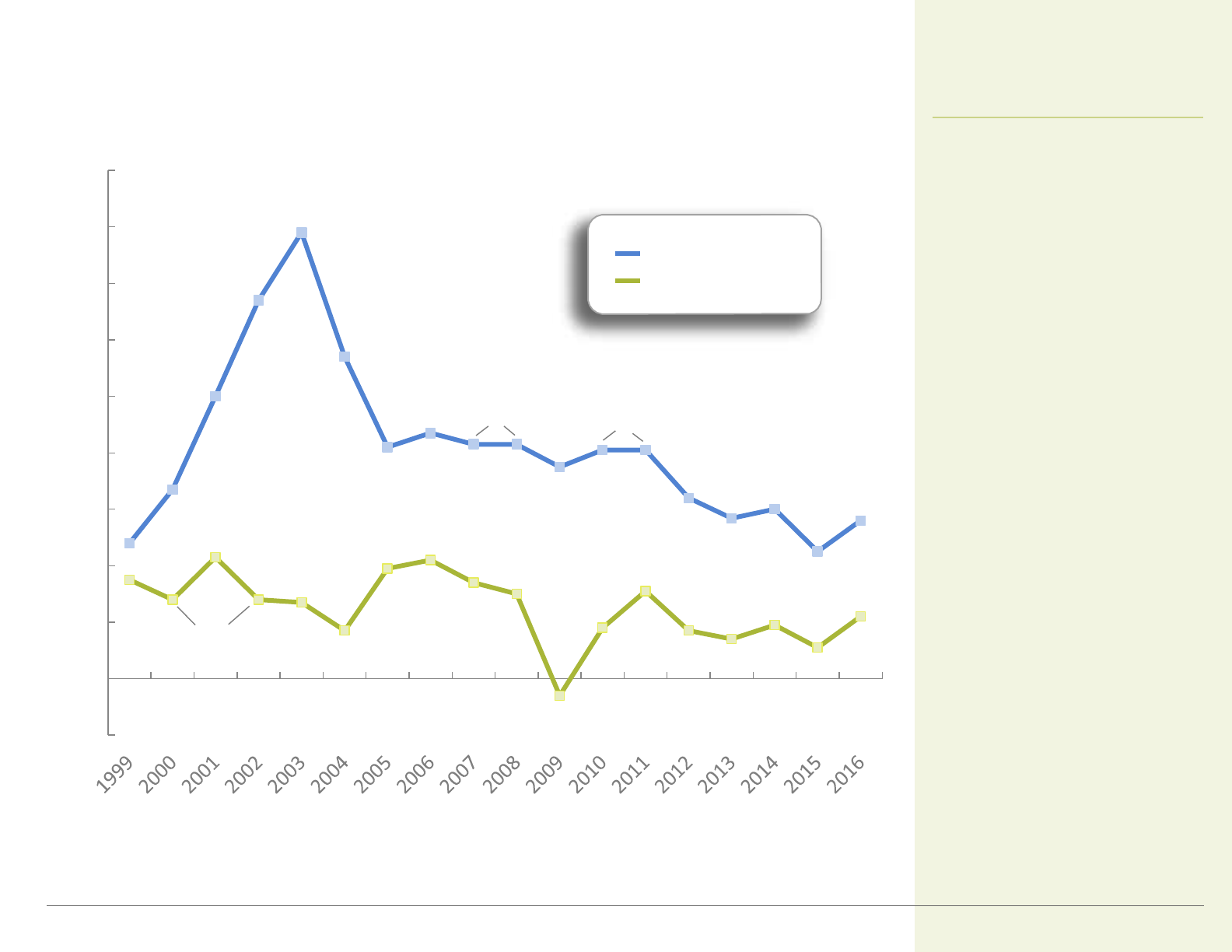

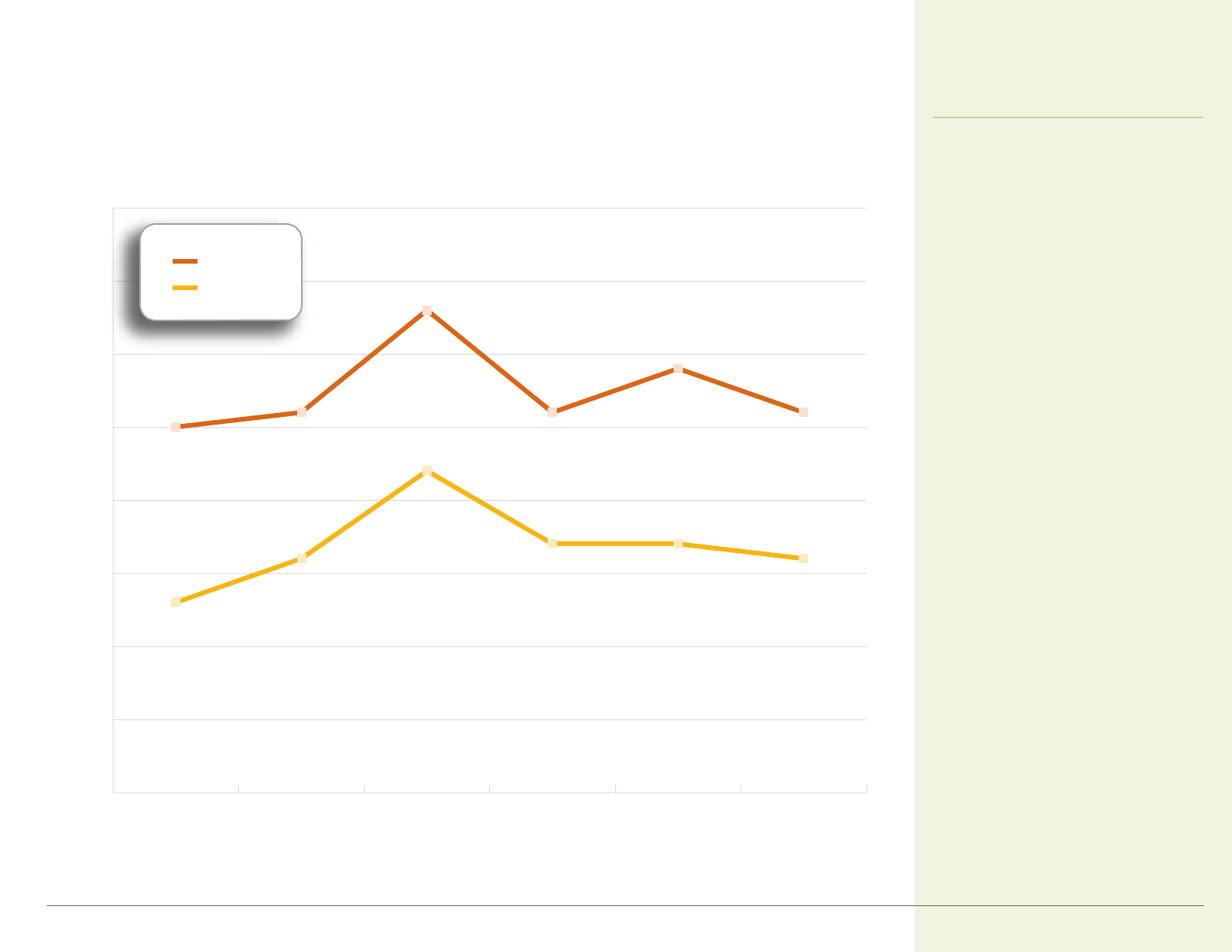

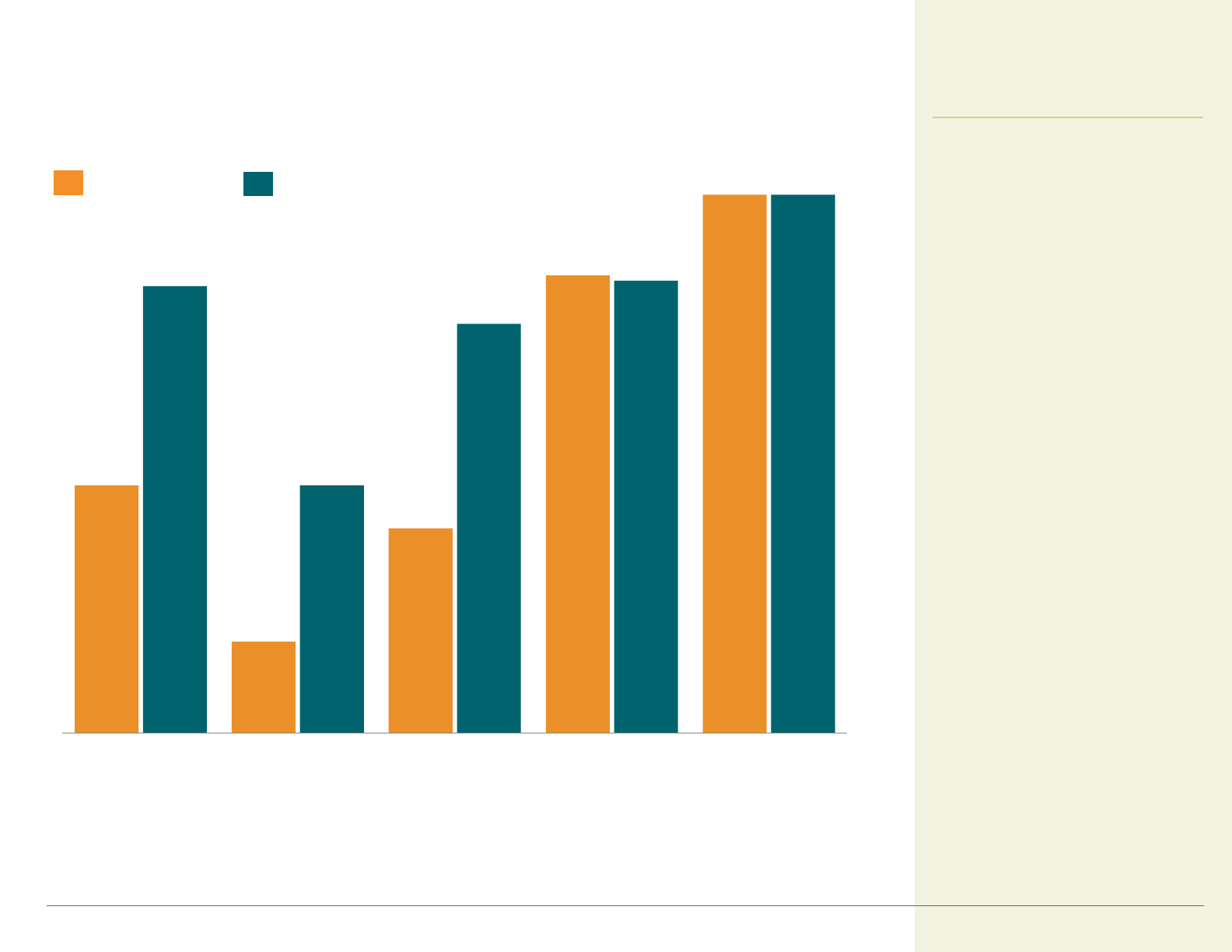

Annual Premium Growth Compared to Inflation

Health insurance premiums

for family coverage in

California grew by 5.6% in

2016. While modest by

historic standards,

premiums continued to rise

faster than the California

rate of inflation.

Family Coverage, 1999 to 2016

Cost of Health Insurance

California Employer Health Benefits

Premiums

Overall Inflation

Sources: California Employer Health Benefits Survey: 2007-2016, CHCF/NORC; California Employer Health Benefits Survey: 2005-2006, CHCF/HSC; California Employer Health Benefits

Survey: 2004, CHCF/HRET; California Employer Health Benefits Survey : 1999-2003, Kaiser/HRET; California Average of Annual Inflation (April to April): 2002-2016, California Division of

Labor Statistics and Research.

11

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

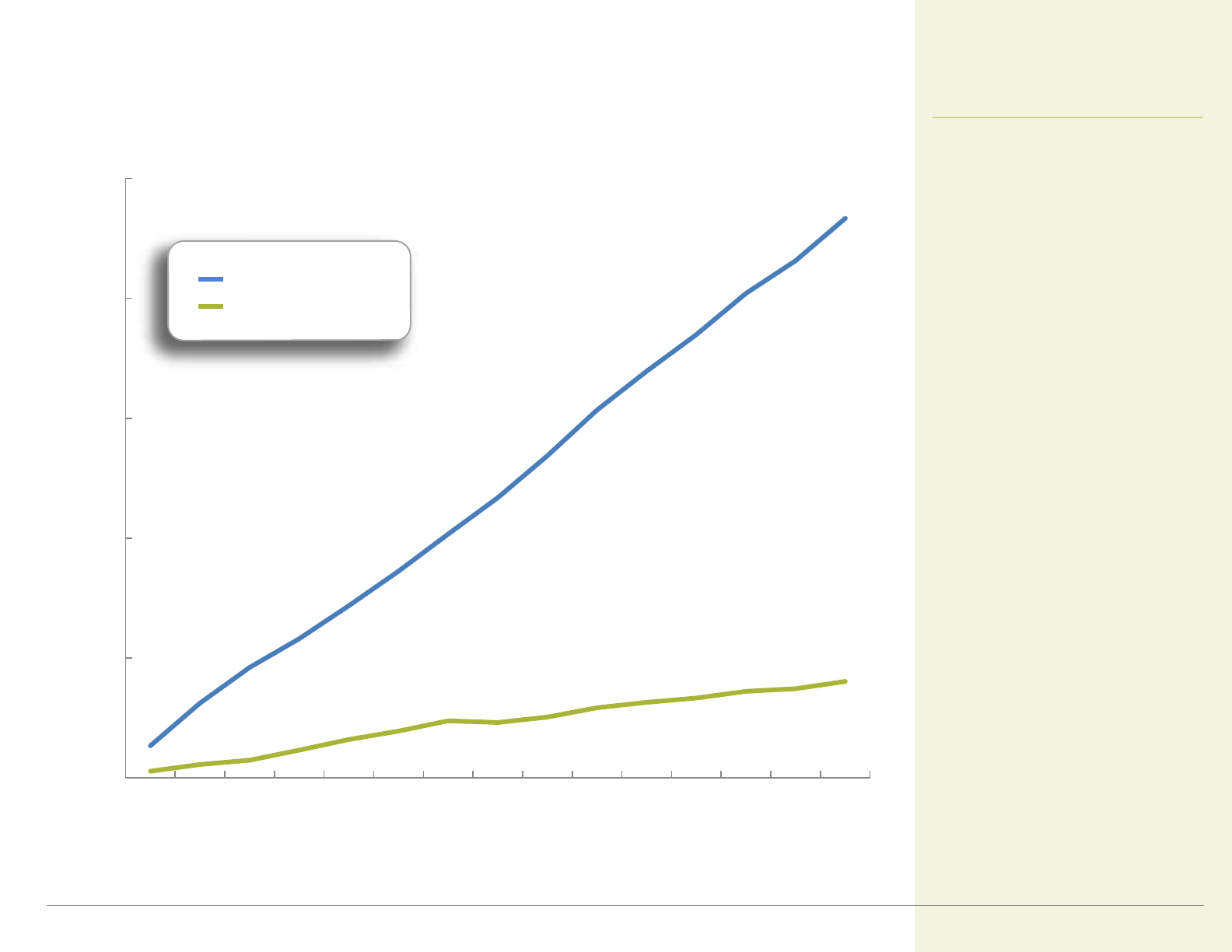

Cumulative Premium Growth Compared to Inflation

Since 2002, health

insurance premiums in

California have increased by

234%, nearly six times the

increase in the state’s

overall inflation rate.

13.4%

233.5%

2.8%

40.2%

0%

50%

100%

150%

200%

250%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Family Coverage, California, 2002 to 2016

Cost of Health Insurance

California Employer Health Benefits

Notes: POS means poi nt-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage and at least

$2,000 for family coverage.

Sources: California Employer Health Benefits Survey: 2016, CHCF/NORC; Employer Health Benefits Survey: 2016, Kaiser/HRET.

12

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

*Estimates are statistically different betw een California and US.

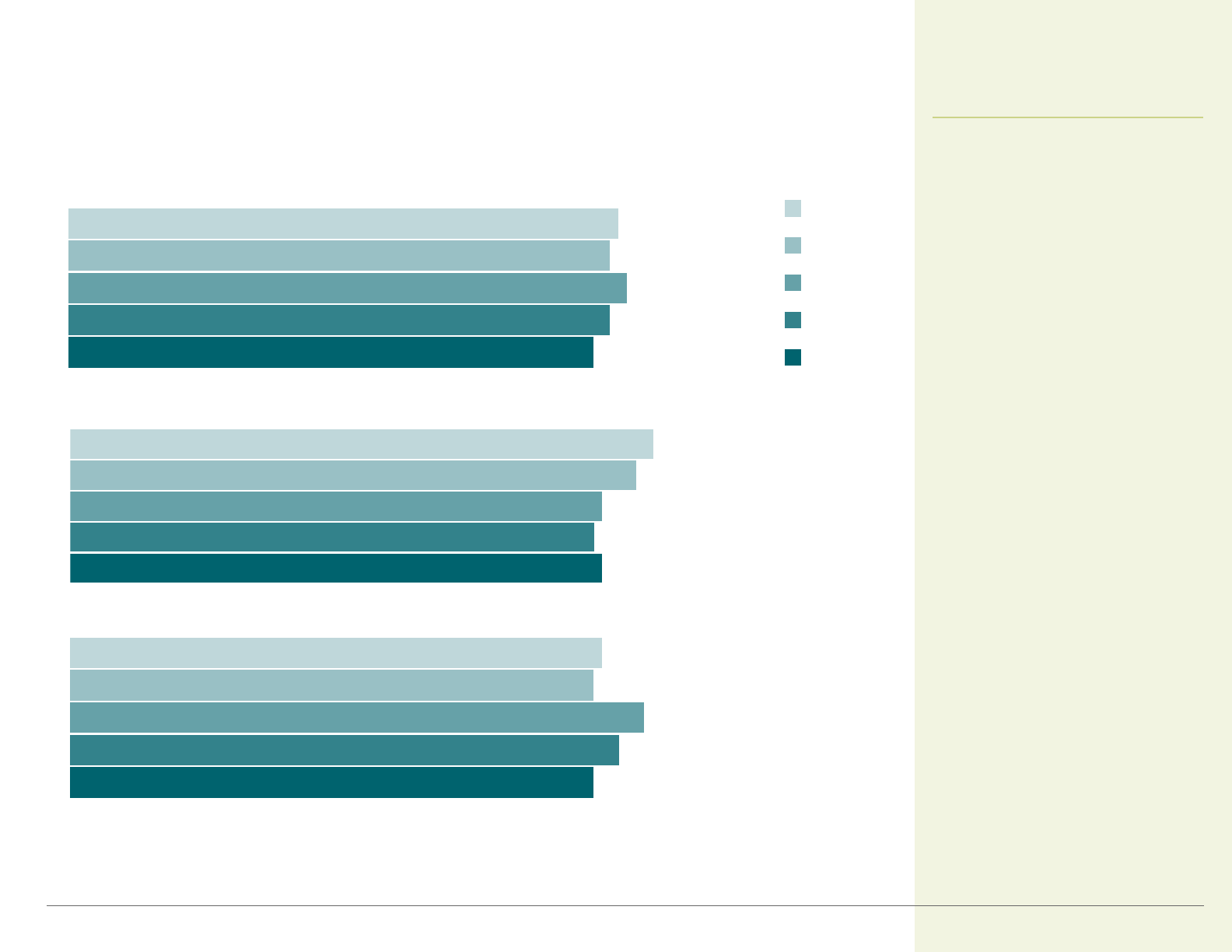

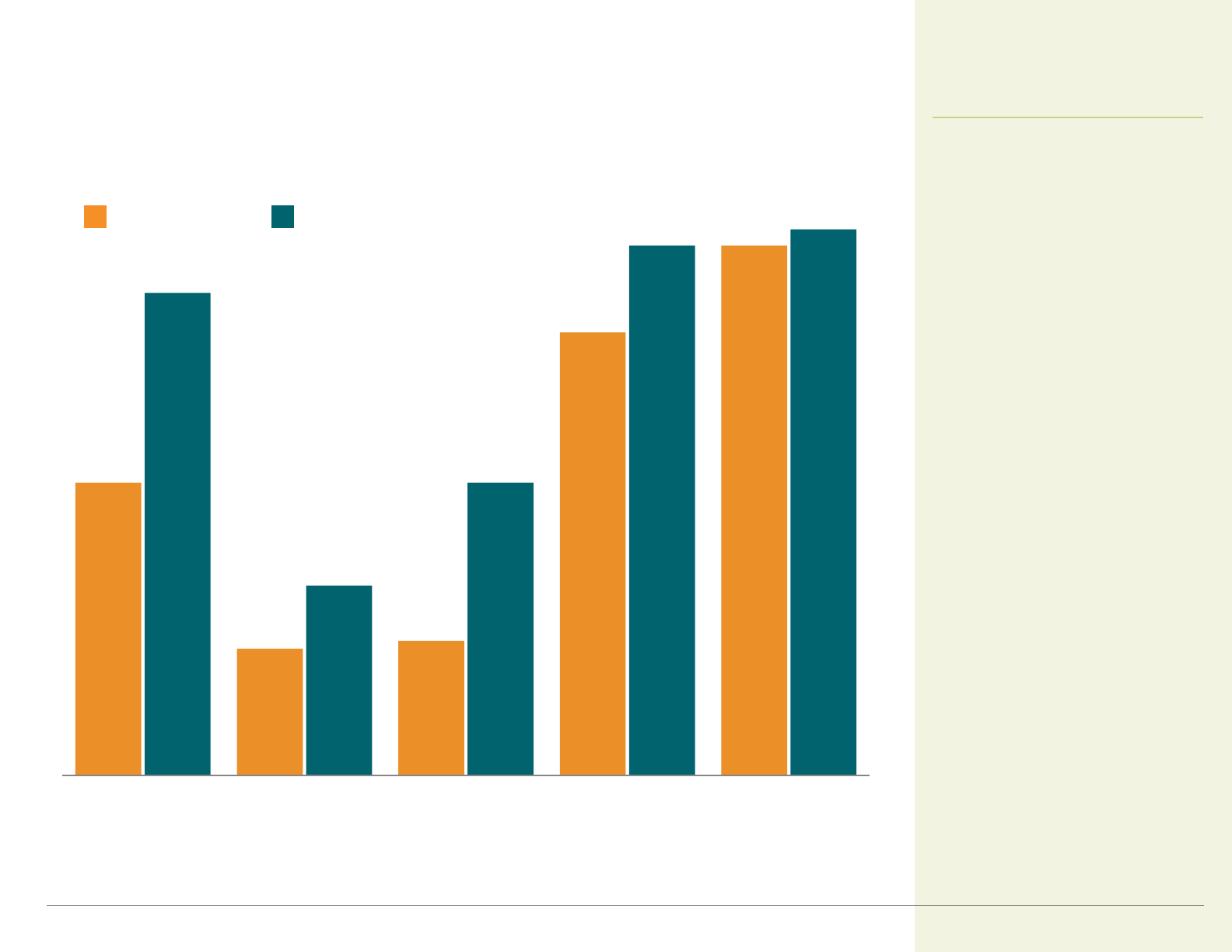

Average Monthly Premiums, by Plan Type

Overall average monthly

premiums for single and

family coverage were

significantly greater in

California than nationally.

Differences in plan design

may account for some of

the differences.

California vs. United States, 2016

California

United States

$1,395

$1,525

$1,584

$1,498

$1,512

$480

$532

$567

$548

$536

$1,485

$1,534

$1,839

$1,559

$1,634

$517

$541

$689

$567

$597

HDHP/SO

POS

PPO

HMO

All Plans

HDHP/SO

POS

PPO

HMO

All Plans

Family Coverage

Single Coverage

*

*

*

*

Cost of Health Insurance

California Employer Health Benefits

$163

$567

$187

$548

$0

$100

$200

$300

$400

$500

$600

*Estimates are statistically different between California and US.

Notes: Annual rate of change for HMO single premiums should not be calculated by comparing dollar values from one year with t he previous year, due to both the survey’s sampling

design and the way in which plan information is collected. Rates of change in family premiums are collected directly as a que stion in the survey (no change data for single premiums

are collected).

Sources: California Employer Health Benefits Survey: 2007-2016, CHCF/NORC; California Employer Health Benefits Survey: 2005-2006, CHCF/HSC; California Employer Health Benefits

Survey: 2004, CHCF/HRET; California Employer Health Benefits Survey : 2000-2003, Kaiser/HRET; Employer Health Benefits Survey: 2000-2016, Kaiser/HRET.

13

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

California

United States

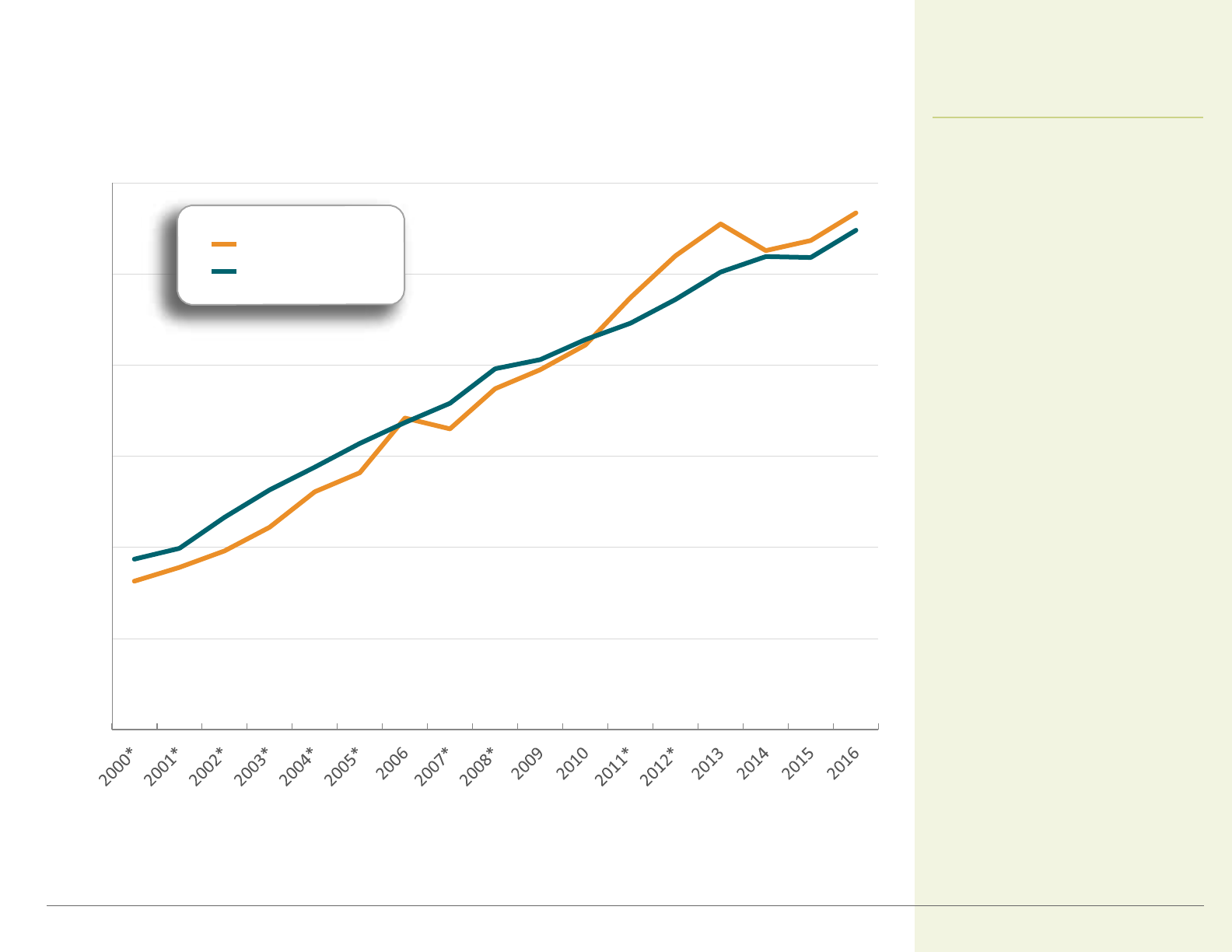

Average Monthly HMO Premiums, Single Coverage

From 2000 to 2010,

California's average monthly

HMO premium for single

coverage stayed below that

of the US. In 2011, however,

it exceeded the national

rate. In 2016, California's

single HMO premium was

similar to the national figure.

California, 2000 to 2016

Cost of Health Insurance

California Employer Health Benefits

*Estimates are statistically different betw een California and US within coverage type.

Note: Segments may not add to totals due to roun di n g.

Sources: California Employer Health Benefits Survey: 2016, CHCF/NORC; Employer Health Benefits Survey: 2016, Kaiser/HRET.

14

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Contribution by:

Worker Employer

Annual Worker and Employer Premium Contributions

California workers

contributed an average of

$1,020 annually for single

coverage and $4,918 for

family coverage in 2016.

Employer contributions to

single and family premiums

were higher in California

than nationally.

$5,277*

$4,918*

$1,129*

$1,020*

$12,865*

$14,693*

$5,306*

$6,141*

US

CA

US

CA

$7,161*

$6,435

$19,612*

$18,142

Family Coverage

Single Coverage

California vs. United States, 2016

Cost of Health Insurance

California Employer Health Benefits

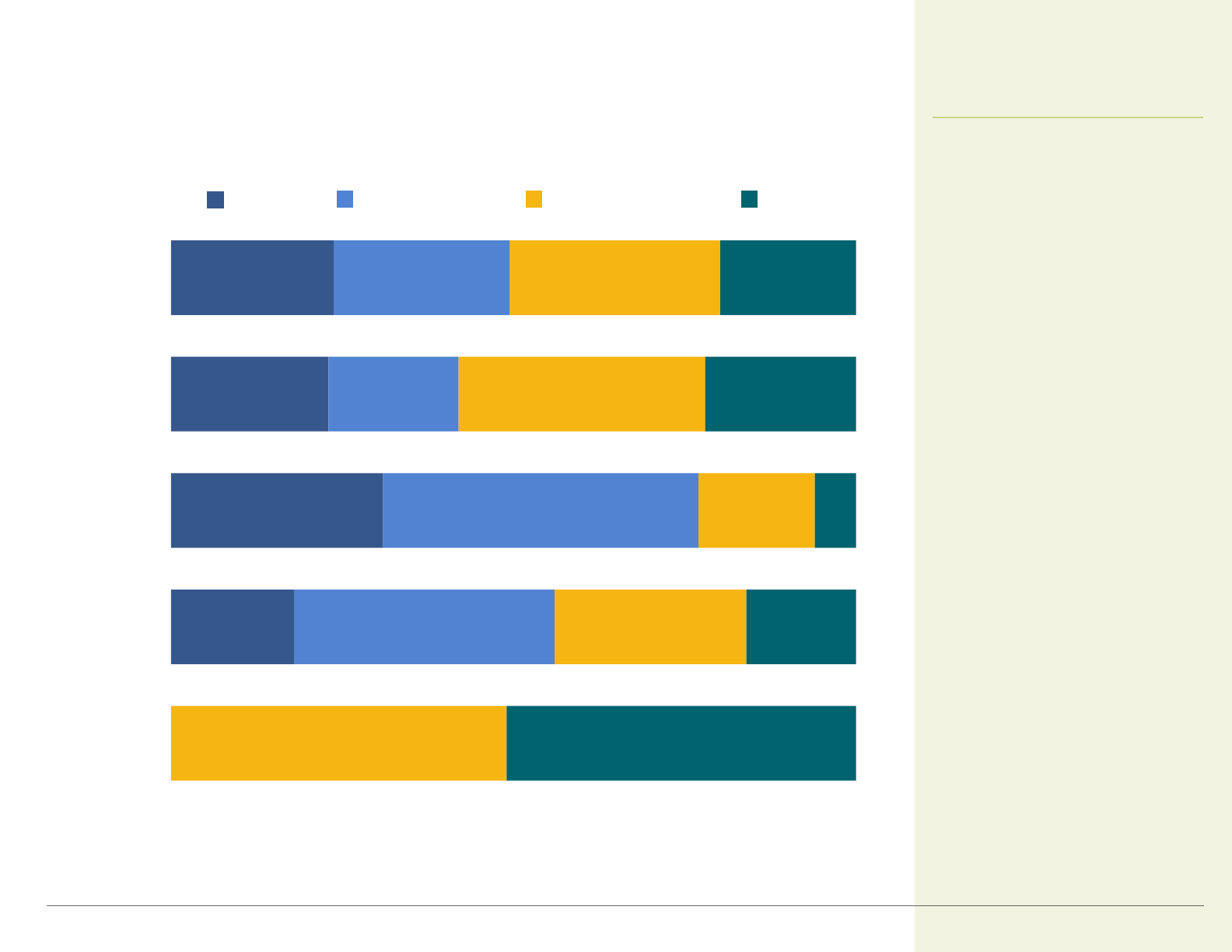

12%

17%

62%

55%

24%

26%

2%

2%

US

CA

Single Coverage

15

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

No Contribution 1%-25% 26%-50% 51%+

Worker Share of Premium

The distribution of the

percentage of the premium

paid by workers was similar

for California and the

nation.

California vs. United States, 2016

3%

6%

45%

50%

37%

31%

15%

14%

US

CA

Family Coverage

Notes: Segments may not add to 100% due to rounding. Tests found no statistically different estimates between California and US.

Sources: California Employer Health Benefits Survey: 2016, CHCF/NORC; Employer Health Benefits Survey: 2016, Kaiser/HRET.

Cost of Health Insurance

California Employer Health Benefits

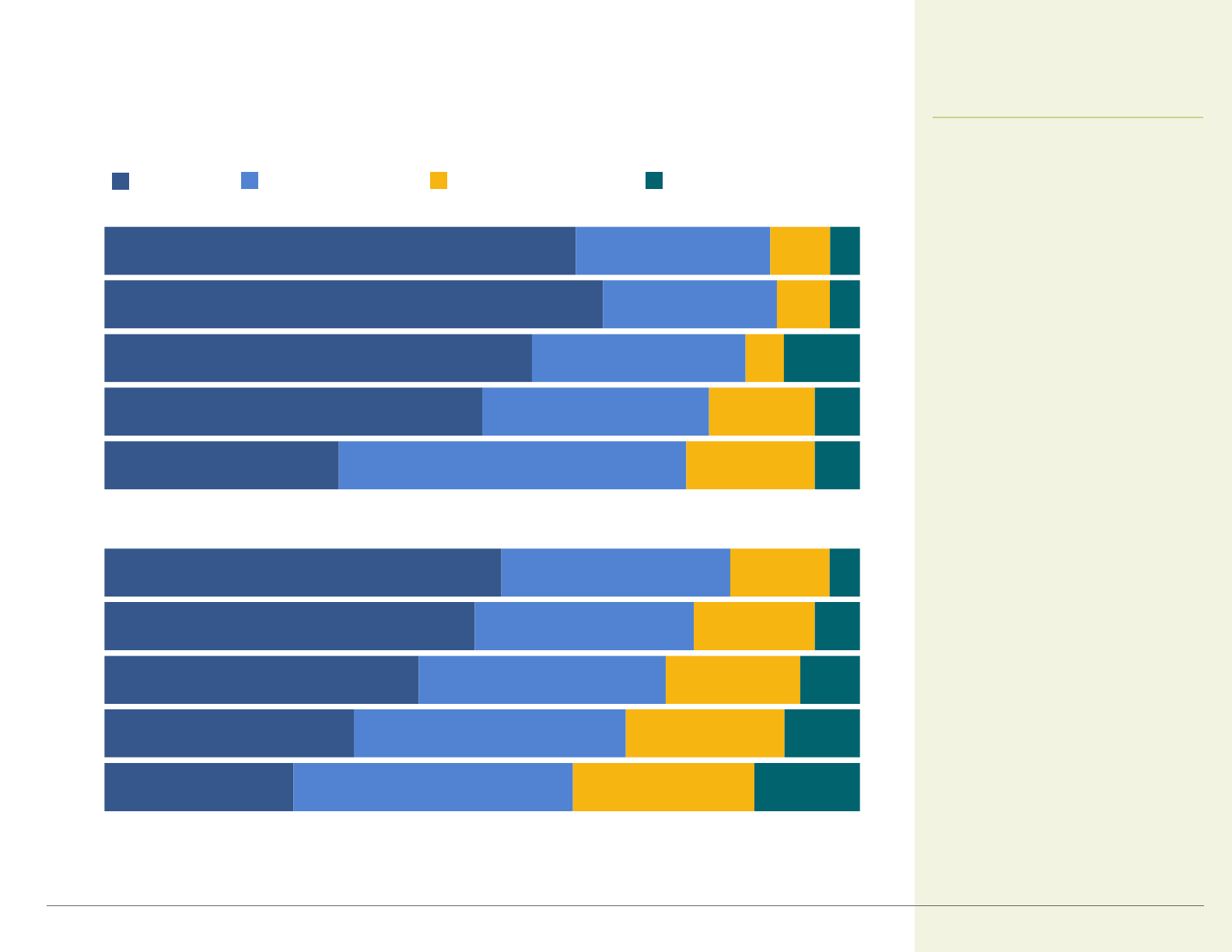

12%

27%

17%

64%

37%

55%

23%

32%

26%

1%

4%

2%

Large

Firms*

Small

Firms*

All Firms

Single Coverage

(3-199 workers)

(200+ workers)

*Difference is statistically different betw een small and large firms within coverage type.

Note: Segments may not add to 100% due to rounding .

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

16

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

No Contribution 1%-25% 26%-50% 51%+

Worker Share of Premium, by Firm Size

Workers’ share of premium

differs significantly by size

of firm. For single coverage,

about one in four workers in

small firms did not have to

contribute to the premium,

compared to one in eight

workers in large firms. For

family coverage, 28% of

workers in small firms pay

more than half of the

premium, compared to only

7% of workers in large

firms.

3%

11%

6%

64%

22%

50%

26%

39%

31%

7%

28%

14%

Large

Firms*

Small

Firms*

All Firms

Family Coverage

(3-199 workers)

(200+ workers)

California, 2016

Cost of Health Insurance

California Employer Health Benefits

*Estimates are significantly different from previous year shown.

Source: California Employer Health Benefits Survey: 2011-2016, CHCF/NORC.

17

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Worker Share of Premium, Single and Family

Coverage

California workers paid an

average of 16% of the total

premium for single coverage

and 26% for family coverage

in 2016. The corresponding

annual premium

contributions were $1,020

and $4,918 for single and

family, respectively (not

shown).

13%

16%

22%

17% 17%

16%

25%

26%

33%

26%

29%

26%

0%

5%

10%

15%

20%

25%

30%

35%

40%

2011 2012 2013 2014 2015 2016

Family

Single

California, 2011 to 2016

*

*

*

*

Cost of Health Insurance

California Employer Health Benefits

$5 $10 $15

•

$20

•

$25

•

$30

Other

Notes: Tests found no statistically different estimates from previous year shown within coverage type. POS means point-of-service plan. Segments m ay not add to 100% due to

roundin g.

Source: California Employer Health Benefits Survey: 2012-2016, CHCF/NORC.

18

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

PER VISIT COPAY

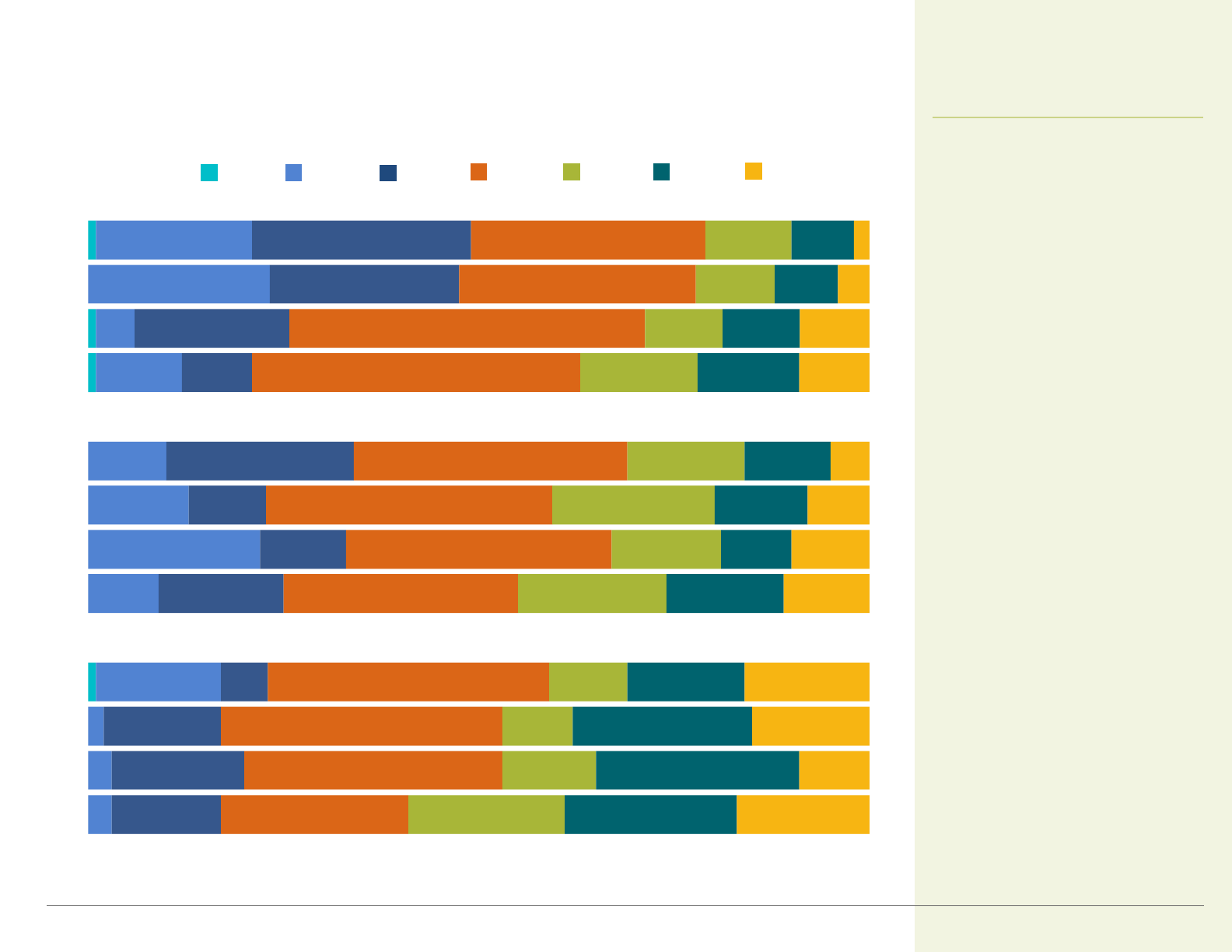

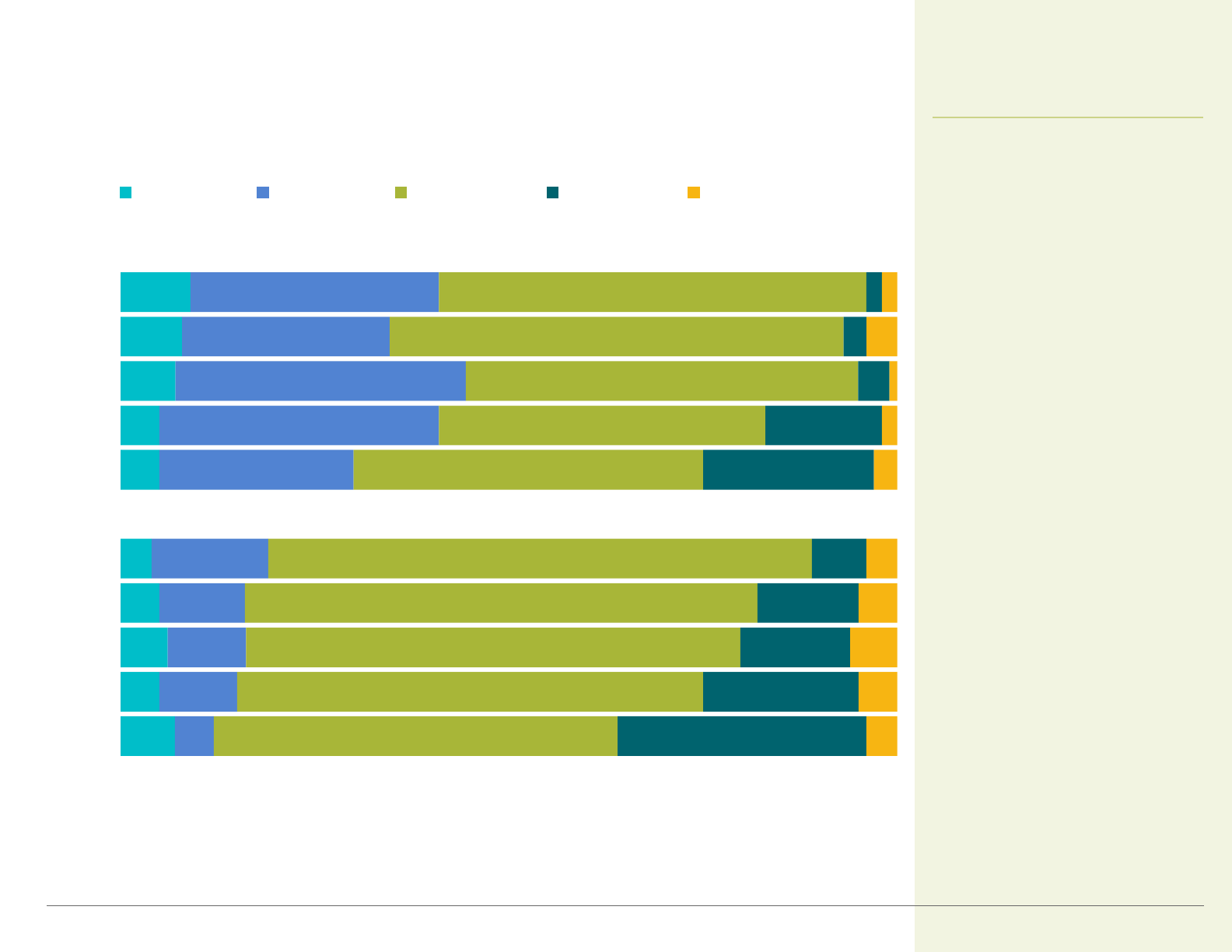

Workers with Office Visit Copayments

The percentage of workers

with a copayment of $10 or

less declined from 18% in

2012 to 9% in 2016.

California, 2012 to 2016

1%

1%

1%

1%

8%

6%

10%

8%

18%

12%

13%

19%

15%

20%

39%

44%

42%

44%

33%

15%

13%

9%

13%

13%

14%

12%

11%

11%

10%

10%

10%

8%

8%

6%

2016

2015

2014

2013

2012

Benefits and Cost Sharing

California Employer Health Benefits

1%

1%

1%

1%

3%

3%

2%

16%

9%

22%

13%

10%

11%

5%

23%

20%

14%

17%

15%

6%

16%

11%

10%

24%

9%

20%

24%

28%

24%

33%

36%

36%

30%

34%

37%

35%

42%

46%

30%

30%

20%

12%

9%

10%

19%

14%

21%

15%

15%

10%

10%

11%

22%

26%

23%

15%

15%

9%

12%

11%

13%

10%

8%

8%

17%

9%

15%

16%

11%

10%

8%

5%

9%

9%

4%

2%

2016

2014

2012

2010

2016

2014

2012

2010

2016

2014

2012

2010

HMO

PPO (in-network)

POS (in network)

$5 $10 $15

•

$20

•

$25

•

$30

Other

Notes: Tests found no statistically different estimates from previous year shown within coverage type. POS means point-of-service plan. Segments m ay not add to 100% due to

roundin g.

Source: California Employer Health Benefits Survey: 2010-2016, CHCF/NORC.

19

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

PER VISIT COPAY

Workers with Office Visit Copayments, by Plan Type

The distribution of

copayments for primary care

office visits has shifted since

2010, with far fewer workers

having copayments of $5 or

$10. The most common

amount in 2016 was $20

across all types of plans.

California, 2010 to 2016, Selected Years

Benefits and Cost Sharing

California Employer Health Benefits

Notes: POS means poi nt-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage. Dollar figures

represent average annual deductibles.

Sources: California Employer Health Benefits Survey: 2016 CHCF/NORC; Employer Health Benefits Survey: 2016, Kaiser/HRET.

20

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

*Percentages are significantly different between California and US.

†Average deductibles are significantly different between California and U.S.

Workers with Annual Deductible, Single Coverage

California workers enrolled

in HMOs and POS plans

were less likely to have a

deductible in 2016 than

those in the nation as a

whole. The prevalence of

deductibles in other types of

plans was comparable.

by Plan Type, California vs. United States, 2016

46%

17%

38%

85%

100%

83%

46%

76%

84%

100%

All Plans HMO*† POS*†

(in-network)

PPO

(in-network)

HDHP/SO

$917

$933

$1,737

$736

$1,028

$2,297 $2,199

$1,180

$1,020

$1,478

California United States

Benefits and Cost Sharing

California Employer Health Benefits

*Estimate is statistically different from previous year show n .

Sources: California Employer Health Benefits Survey: 2007-2016, CHCF/NORC; California Employer Health Benefits Survey: 2006, CHCF/HSC; Kaiser/HRET Survey of Employer-Sponsored

Benefits, 2006-2016.

21

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

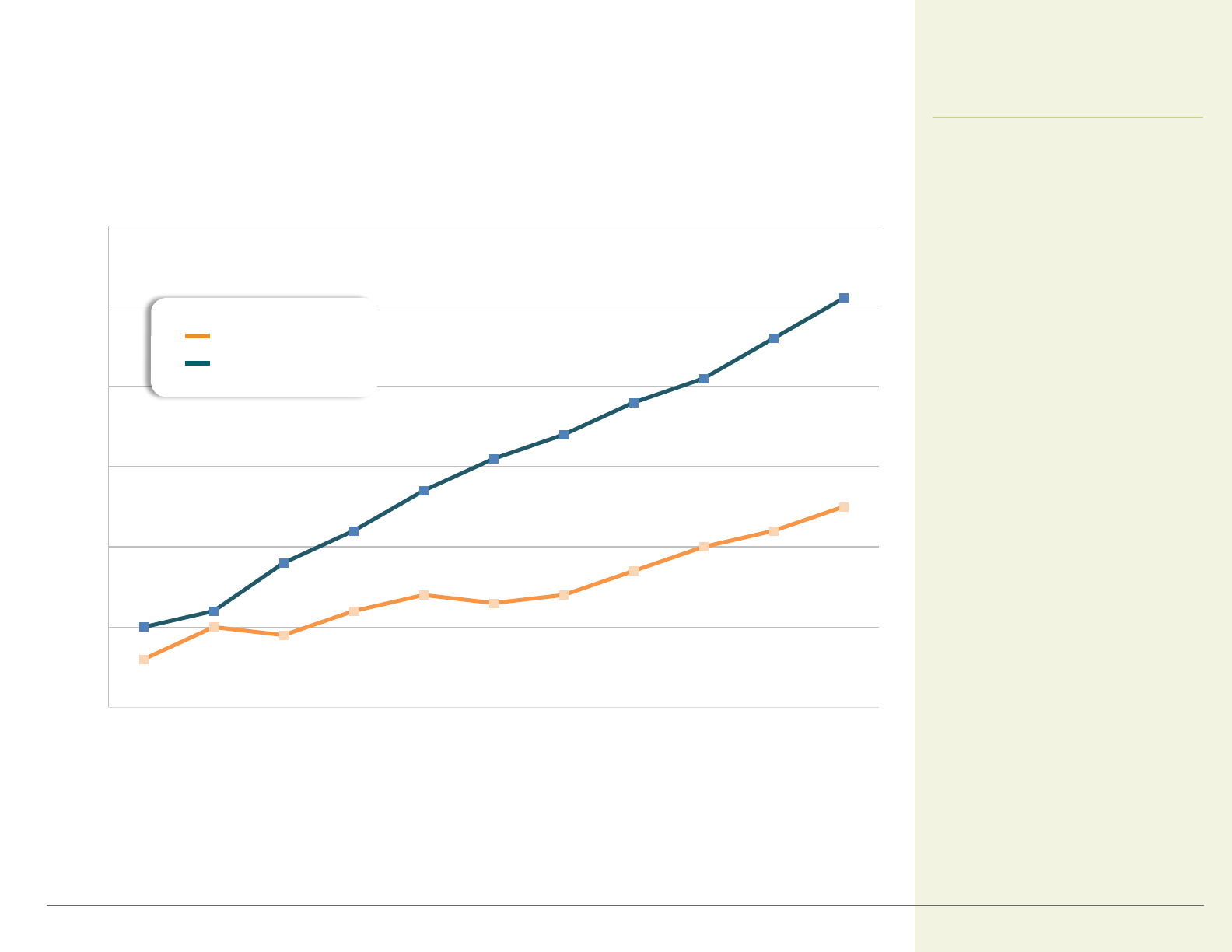

WorkerswithaLargeDeductible ($1,000+),

SingleCoverage

Workers in the United States

were more likely than those

In California to have a

deductible or $1,000 or

more. In 2016, one in two

workers nationally had a

large deductible compared

to one in four in California.

by Firm Size, California vs. United States, 2006 to 2016

6%

10%

9%

12%

14%

13%

14%

17%

20%

22%

25%

10%

12%

18%

22%

27%

31%

34%

38%

41%

46%

51%

0%

10%

20%

30%

40%

50%

60%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

California

United States

*

*

*

*

Benefits and Cost Sharing

California Employer Health Benefits

7%

11%

14%

21%*

27% 27%

26%

32% 32%

41% 41%

5%

10%

5%

6%

5% 5%

8%

9%

14%

11%

17%

6%

10%

9%

12%

14%

13%

14%

17%

20%

22%

25%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

All Firms

Small Firms (3-199 workers)

Large Firms (200+ workers)

*Estimate is statistically different from previous year shown by firm size.

Sources: California Employer Health Benefits Survey: 2007-2016, CHCF/NORC; California Employer Health Benefits Survey: 2006, CHCF/HSC.

22

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

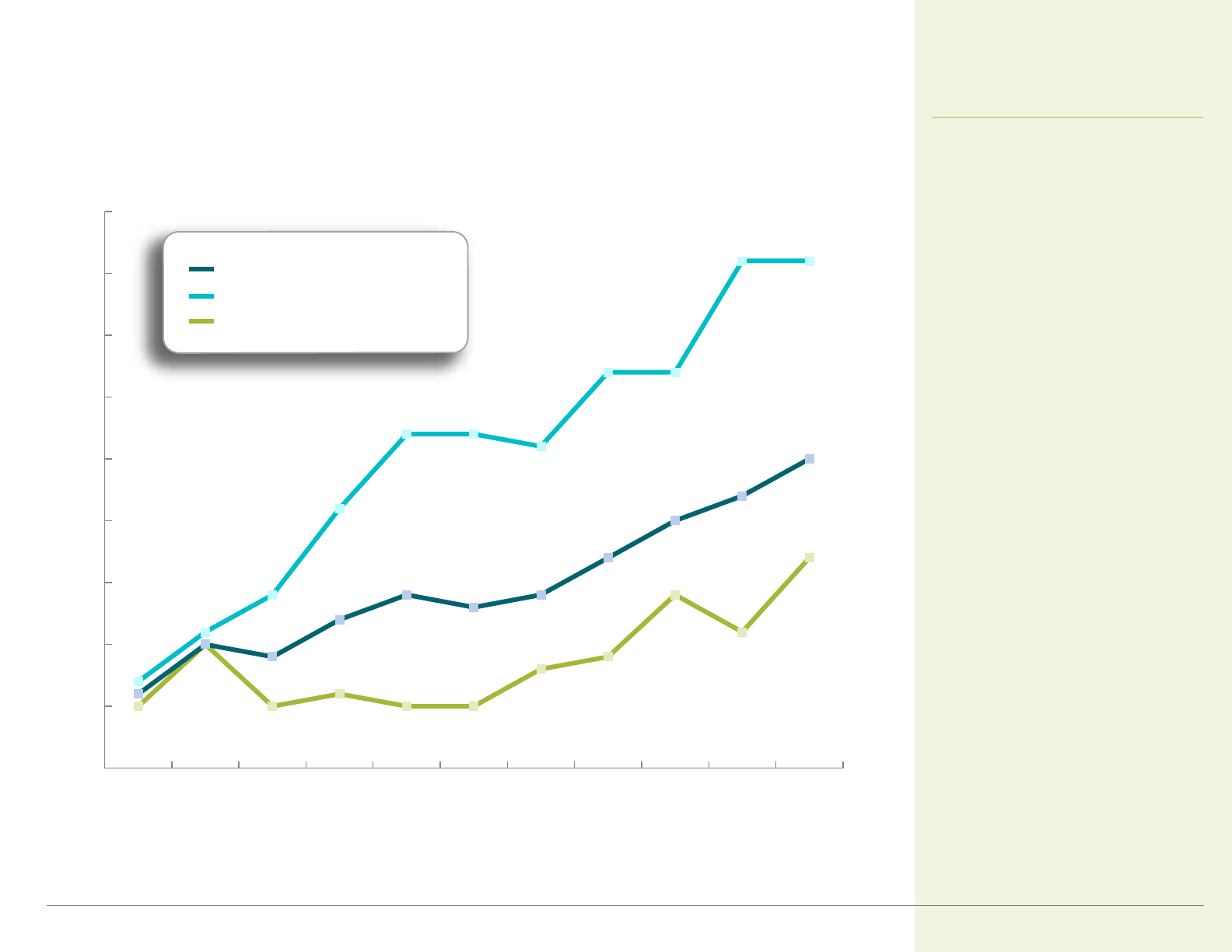

WorkerswithaLargeDeductible ($1,000+),

SingleCoverage

Large-deductible plans were

more common among small

firms. Forty-one percent of

workers in small firms (3-

199 workers) had an annual

deductible of $1,000 or

more for single coverage in

2016, compared to 17% in

large firms. The prevalence

of large-deductible plans in

small firms has increased

substantially since 2010.

by Firm Size, California, 2006 to 2016

Benefits and Cost Sharing

California Employer Health Benefits

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

23

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

<$500 $500-$999 $1,000-$1,999 $2,000+

*Distribution is statistically different from All Plans.

Notes: Data based on w orkers with a deductible. POS means poin t-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at

least $1,000 for single coverage.

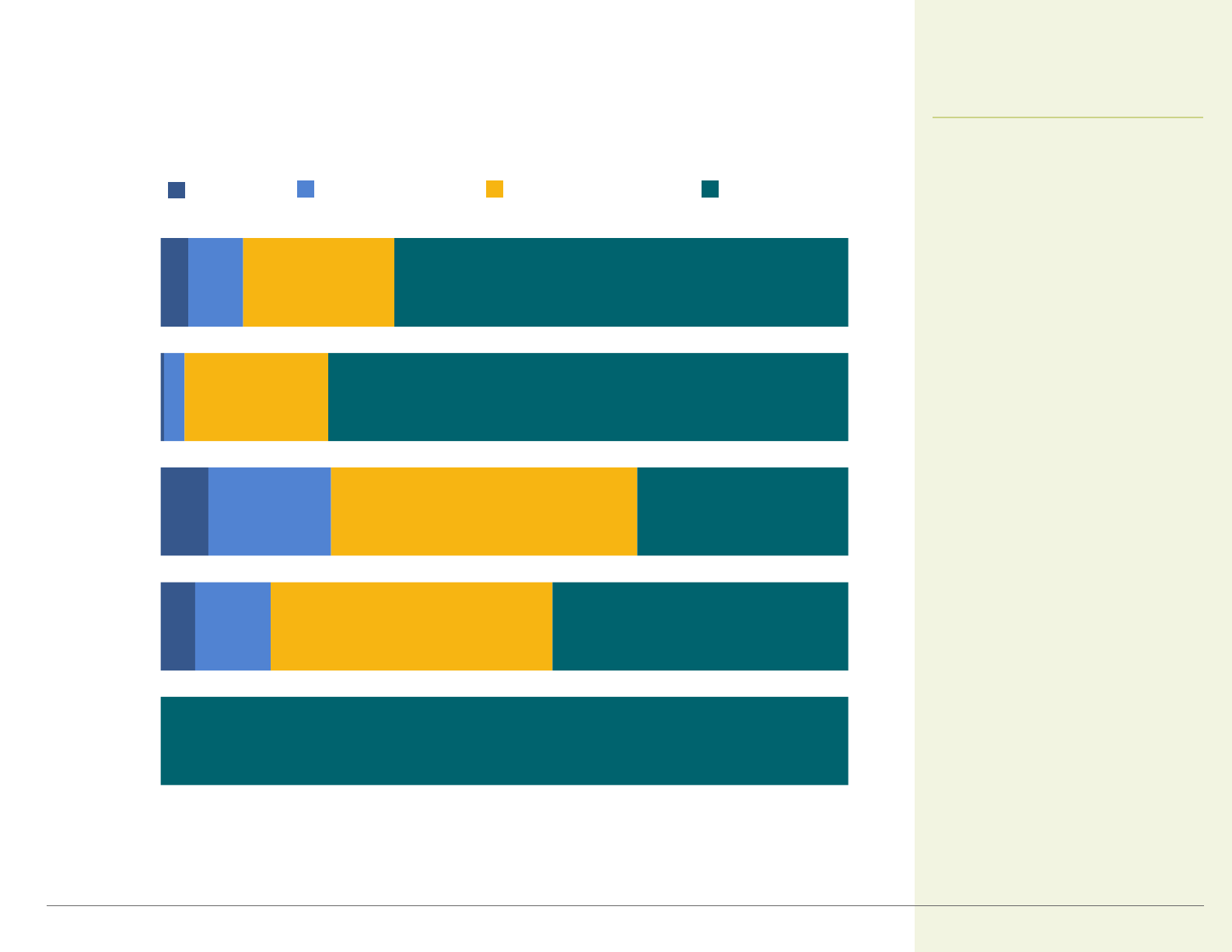

Deductibles for Single Coverage

Among California workers who

faced a deductible for single

coverage, over half (51%) had

a deductible of $1,000 or more,

and 20% had a deductible of

$2,000 or more.

by Plan Type, California, 2016

18%

31%

23%

24%

38%

46%

19%

26%

49%

28%

17%

36%

31%

51%

16%

6%

22%

20%

HDHP/SO*

POS

PPO*

HMO

All Plans

(in-network)

(in-network)

Benefits and Cost Sharing

California Employer Health Benefits

25%

33%

42%

49%

52%

31%

50%

56%

66%

63%

37%

36%

33%

29%

30%

46%

30%

28%

23%

26%

24%

21%

18%

16%

13%

17%

14%

5%

7%

8%

14%

10%

8%

6%

4%

6%

6%

10%

4%

4%

2016

2014

2012

2010

2008

2016

2014

2012

2010

2008

Note: Data based on workers with a deductible. Includes in-netw ork use only.

Sources: California Employer Health Benefits Survey: 2008-2016, CHCF/NORC; author analysis of Employer Health Benefits Survey public use files, 2008-2016, Kaiser/HRET.

24

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

*Distribution is statistically different from previous year shown.

Deductibles for Single PPO Coverage

Since 2008, California workers

have been faced with increasing

deductibles. In 2016, 23% of

California workers in single PPO

coverage plans with a deductible

faced deductibles of $1,000 or

more, compared to 12% in 2008.

Nationally, the percentage of

workers with deductibles of

$1,000 or more increased from

17% in 2008 to 38% in 2016.

<$500 $500-$ 999 $1,000-$1,999 $2,000+

California vs. United States, 2008 to 2016, Selected Years

California

United States

*

*

Benefits and Cost Sharing

California Employer Health Benefits

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

25

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

*Distribution is statistically different from All Plans.

Notes: Data based on w orkers with a deductible. POS means poin t-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least

$2,000 for family coverage. No test was done comparing HDHP/SO with All Plans. Segments m ay not add to 100% due to roundin g.

Deductibles for Family Coverage

Among California workers with

an aggregate family deductible,

66% of workers faced a

deductible of $2,000 or more in

2016.

<$500 $500-$999 $1,000-$1,999 $2,000+

5%

7%

<1%

4%

11%

18%

3%

8%

41%

45%

21%

22%

100%

43%

31%

76%

66%

HDHP/SO

POS

PPO*

HMO

All Plans

(in-network)

(in-network)

by Plan Type, California, 2016

<1%

Benefits and Cost Sharing

California Employer Health Benefits

*Distribution is statistically different from All Plans.

Notes: POS means poi nt-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage. Since HMOs

typically provide very comp rehensive coverage, not having a limit on out-of-pocket expenditures does not expose enrollees to the same financial risk as it could in other plan t ypes.

Segments m ay not add to 100% due to rounding.

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Annual Out-of-Pocket Limits, Single Coverage

26

by Plan Type, California, 2016

3%

2%

2%

6%

1%

26%

11%

16%

2%

28%

6%

36%

23%

1%

12%

15%

8%

8%

9%

14%

10%

9%

10%

81%

38%

38%

29%

37%

8%

2%

5%

3%

HDHP/SO*

POS

PPO*

HMO

All Plans

<$1,000 $1,000-$1,499 $1,500-$1,999 $2,000-$2,499

$2,500-$2,999 $3,000+ No Limits

(in-network)

(in-network)

Benefits and Cost Sharing

California Employer Health Benefits

Out-of-pocket limits, a plan

feature that helps curb costs for

consumers, can vary

substantially. While the large

majority of covered workers

(97%) with single coverage had

an out-of-pocket limit, for 37%

of workers that limit was $3,000

or more, and 3% of workers

had no limit.

*Distribution is statistically different from All Plans.

Notes: POS means point-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least $2,000 for family coverage. Since HMOs

typically provide very comp rehensive coverage, not having a limit on out-of-pocket expenditures does not expose enrollees to the same financial risk as it could in other plan t ypes.

Segments m ay not add to 100% due to rounding.

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Only 21% of covered California

workers with family coverage

had an annual aggregate out-of-

pocket limit of less than $2,000,

while 31% had a limit of $6,000

or more. Four percent of

covered workers had no out-of-

pocket limit. The Affordable

Care Act generally limits the

amount of out-of-pocket

expenses. In 2016 that limit was

$6,850 for an individual plan

and $13,700 for a family plan.

Annual Out-of-Pocket Limits, Family Coverage

27

by Plan Type, California, 2016

11%

15%

26%

17%

21%

6%

1%

7%

9%

8%

2%

31%

12%

32%

24%

1%

9%

12%

8%

7%

9%

9%

7%

7%

6%

71%

26%

34%

22%

31%

<1%

9%

2%

5%

4%

HDHP/SO*

POS

PPO

HMO

All Plans

<$2,000 $2,000-$2,999 $3,000-$3,999 $4,000-$4,999

$5,000-$5,999 $6,000+ No Limit

(in-network)

(in-network)

Benefits and Cost Sharing

California Employer Health Benefits

*Distribution is statistically different from previous year shown.

Notes: Includes in-netw ork use only. Segm ents m ay not add to 100% due to rounding.

Source: California Employer Health Benefits Survey: 2008-2016, CHCF/NORC.

28

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

The proportion of California

workers in PPOs with an out-of-

pocket limit of $3,000 or more

for single coverage increased

from 21% in 2008 to 38% in

2016.

Annual Out-of-Pocket Limits, Single PPO Coverage

California, 2008 to 2016, Selected Years

9%

3%

6%

5%

3%

23%

17%

15%

20%

26%

15%

11%

11%

14%

6%

16%

19%

20%

12%

15%

9%

12%

9%

7%

10%

21%

28%

30%

32%

38%

8%

11%

9%

10%

2%

2008

2010

2012

2014

2016

<$1,000 $1,000-$1,499 $1,500-$1,999 $2,000-$2,499

$2,500-$2,999 $3,000+ No Limit

*

Benefits and Cost Sharing

California Employer Health Benefits

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

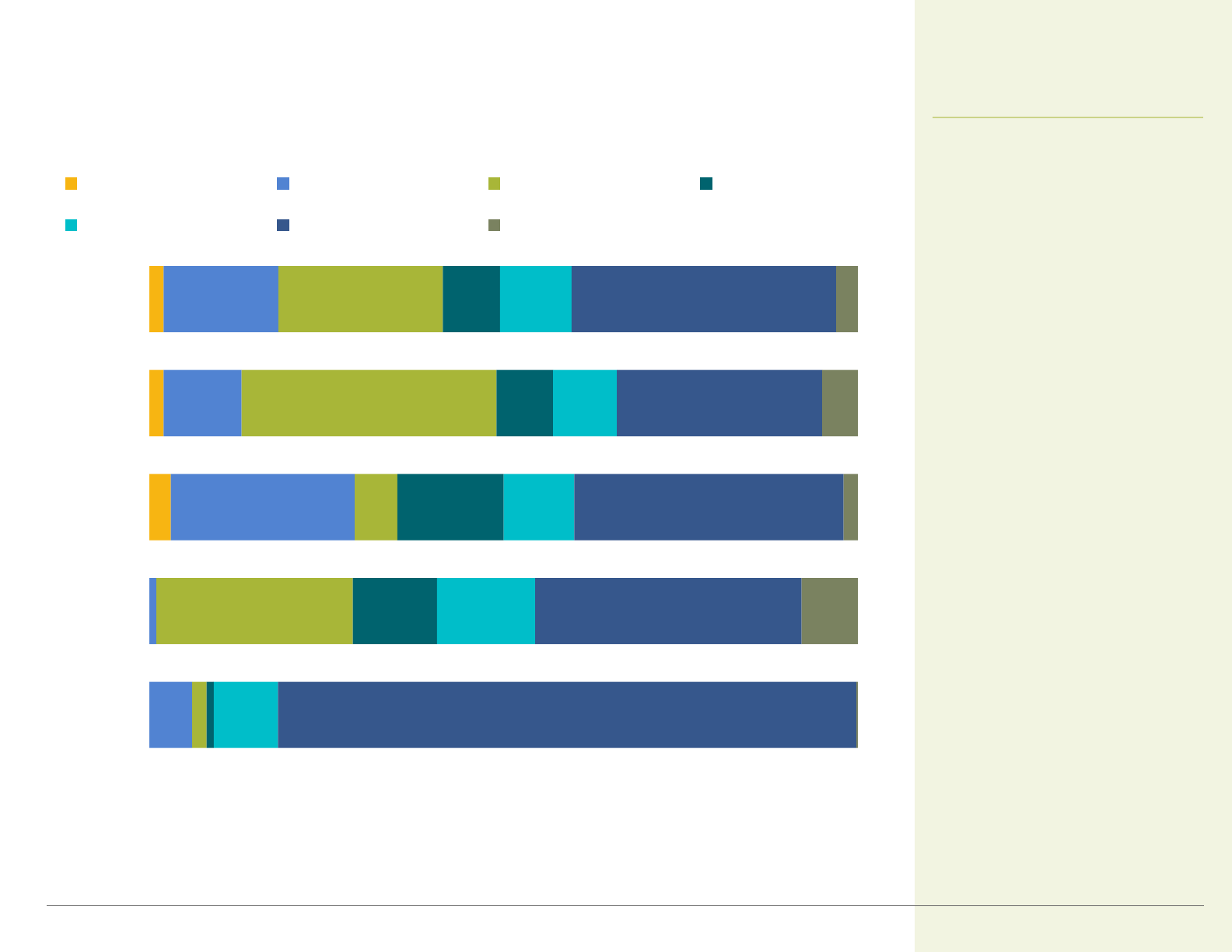

In 2016, 67% of covered

California workers had a three-

or four-tier cost-sharing formula

for prescription drugs, compared

to 84% nationally. The share of

California workers with four tiers

has increased from 2% in 2008

to 22% in 2016. During the same

time, the percentage of workers

with four tiers in the United

States increased from 7% to

32%.

*Distribution is statistically different from previous year shown.

Notes: One tier is the same cost share regardless of drug type. Two tier is one payment for generic drugs and one for brand name. Three tier is one paymen t for generic drugs, another

for preferred drugs, and a third for nonpreferred drugs. Four tier is three-tier cost sharing plus a fourth tier for lifestyle or other specified drugs. Other includes no cost sharing. Preferred

drugs are listed in a plan’s formulary. Nonpreferred drugs are not listed in the formulary. Segments m ay not add to 100% due to rounding .

Sources: California Employer Health Benefits Survey: 2008-2016, CHCF/NORC; author analysis of data from the Survey of Employer-Sponsored Health Benefits public use files: 2008-

2016, Kaiser/HRET.

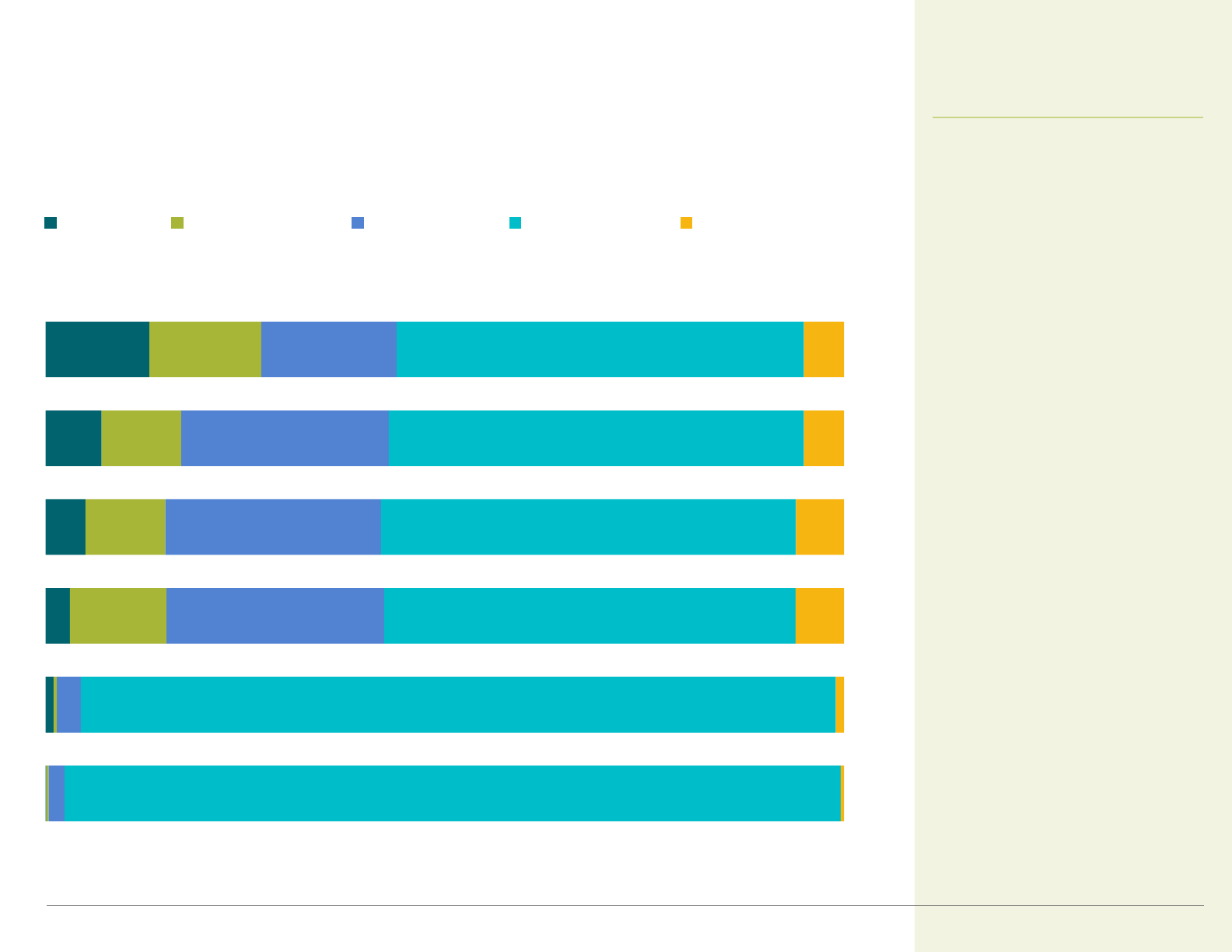

Workers’ Cost Sharing for Prescription Drugs

9%

8%

7%

5%

5%

4%

5%

6%

5%

7%

32%

27%

37%

36%

25%

15%

11%

10%

10%

5%

55%

59%

50%

42%

45%

70%

65%

63%

60%

52%

2%

3%

4%

15%

22%

7%

13%

14%

20%

32%

2%

4%

1%

2%

3%

4%

5%

6%

5%

4%

2008

2010

2012

2014

2016

2008

2010

2012

2014

2016

One Tier Two Tier Three Tier Four Tier Other

California

United States

29

California vs. United States, 2008 to 2016, Selected Years

*

*

Benefits and Cost Sharing

California Employer Health Benefits

*Estimate is statistically different from previous year shown.

Notes: Preferred drugs are listed in a plan’s formulary. Nonpreferred drugs are not listed in the formulary.

Source: California Employer Health Benefits Survey: 2008-2016, CHCF/NORC.

30

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Among firms with four-tier

prescription cost sharing,

average copayments for generic

drugs were less than half what

they were for preferred drugs,

and less than one-fourth what

they were for nonpreferred

drugs. Copayments for all drugs

increased between 2008 and

2016.

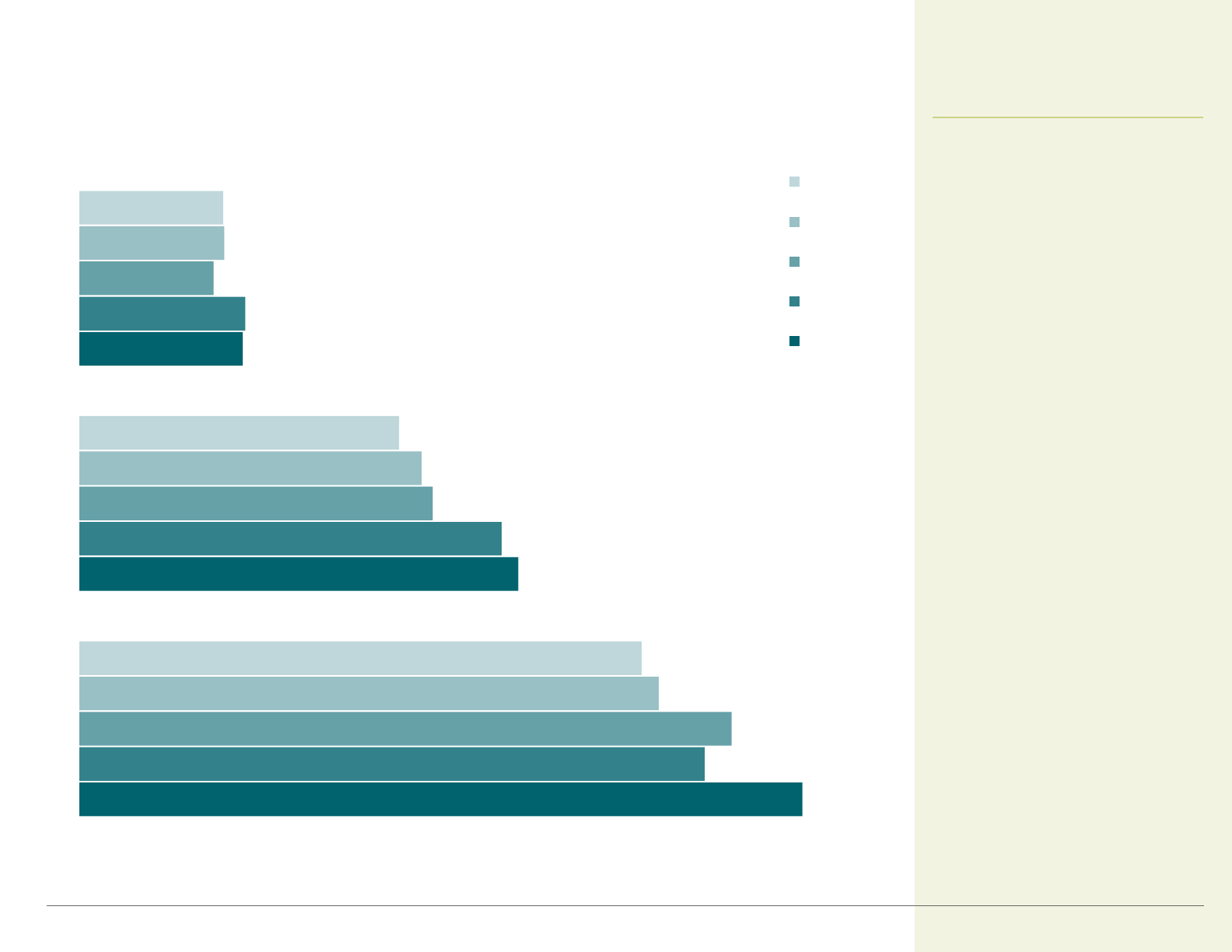

Average Prescription Drug Copayments, by Drug Type

$52.79*

$32.05

$11.93

$45.67

$30.82

$12.11

$47.62*

$25.80

$9.79

$42.31

$24.99*

$10.58

$41.05

$23.34

$10.49

2008

2010

2012

2014

2016

Generic Drugs

Preferred Drugs

Nonpreferred Drugs

California, 2008 to 2016, Selected Years

Benefits and Cost Sharing

California Employer Health Benefits

*Estimates are statistically different betw een California and US.

Notes: POS means poi nt-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage and at

least $2,000 for family coverage.

Sources: California Employer Health Benefits Survey: 2016, CHCF/NORC; Employer Health Benefits Survey: 2016, Kaiser/HRET.

31

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Compared to workers nationally,

California workers were

significantly less likely to have

an HDHP/SO option and

significantly more likely to have

an HMO option. Seventy-seven

percent of covered California

workers had an HMO option,

compared to only 33% of

covered workers nationally.

Plan Options Available to Covered Workers, by Type

California United States

California vs. United States, 2016

<1%

10%

27%

74%

77%

2%

13%

56%

74%

33%

Conventional* POS HDHP/SO* PPO HMO*

Plan Choice and Enrollment

California Employer Health Benefits

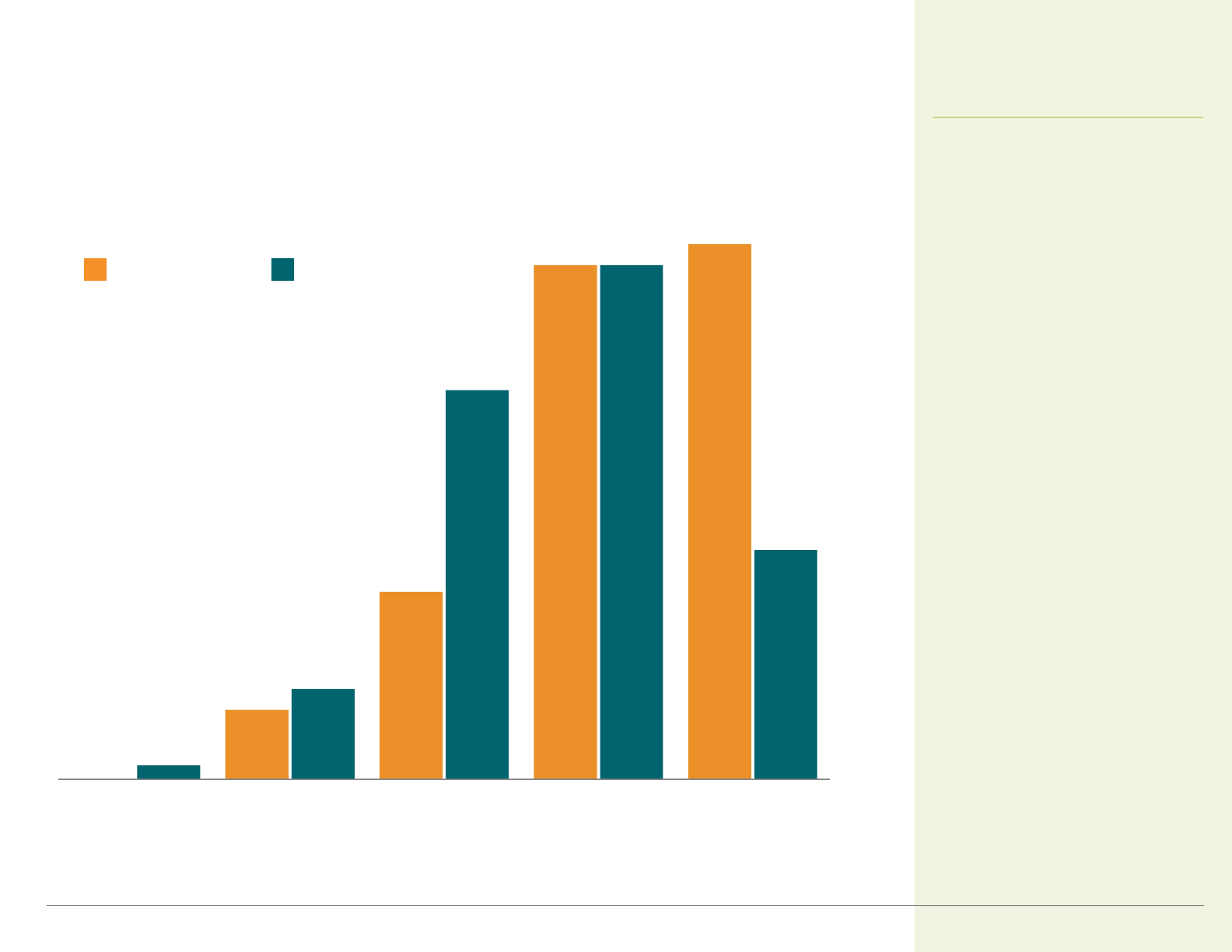

1%

<1%

2%

1%

<1%

<1%

<1%

52%

49%

55%

54%

51%

20%

19%

16%

13%

15%

33%

36%

33%

29%

31%

58%

58%

56%

58%

48%

11%

8%

7%

8%

5%

12%

8%

9%

8%

9%

4%

6%

5%

10%

13%

8%

13%

19%

20%

29%

2008

2010

2012

2014

2016

2008

2010*

2012*

2014

2016

Conventional HMO PPO POS HDHP/SO

*Di str i buti on is stat i sti cal ly differ e n t fr om p revi ous year sh o w n.

Notes: POS means point-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage and at least

$2,000 for family coverage. Segments m ay not add to 100% due to roundi n g. C o n ven ti on al plan enr o l lm en t in Ca l if o r ni a wa s l ess t h a n 1% in 200 8 , 201 2, 2014, and

2016. Conv e nt io na l pl an enrol lm en t in t he US was le s s than 1% i n 2 0 12 - 2 01 6 .

Sources: California Employer Health Benefits Survey: 2008, 2010, 2012, 2014, and 2016, CHCF/NORC; author analysis of data from the Survey of Employer-Sponsored Health

Benefits: 2008-2016, Kaiser/HRET.

32

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

California workers were more

likely to enroll in HMOs.

Nationally, workers were more

likely to enroll in PPO plans.

The percentage of workers

enrolled in high-deductible

health plans tripled from 2008 to

2016, in California and

nationally.

Enrollment of Covered Workers, by Plan Type

California vs. United States, 2008 to 2016, Selected Years

California

United States

Plan Choice and Enrollment

California Employer Health Benefits

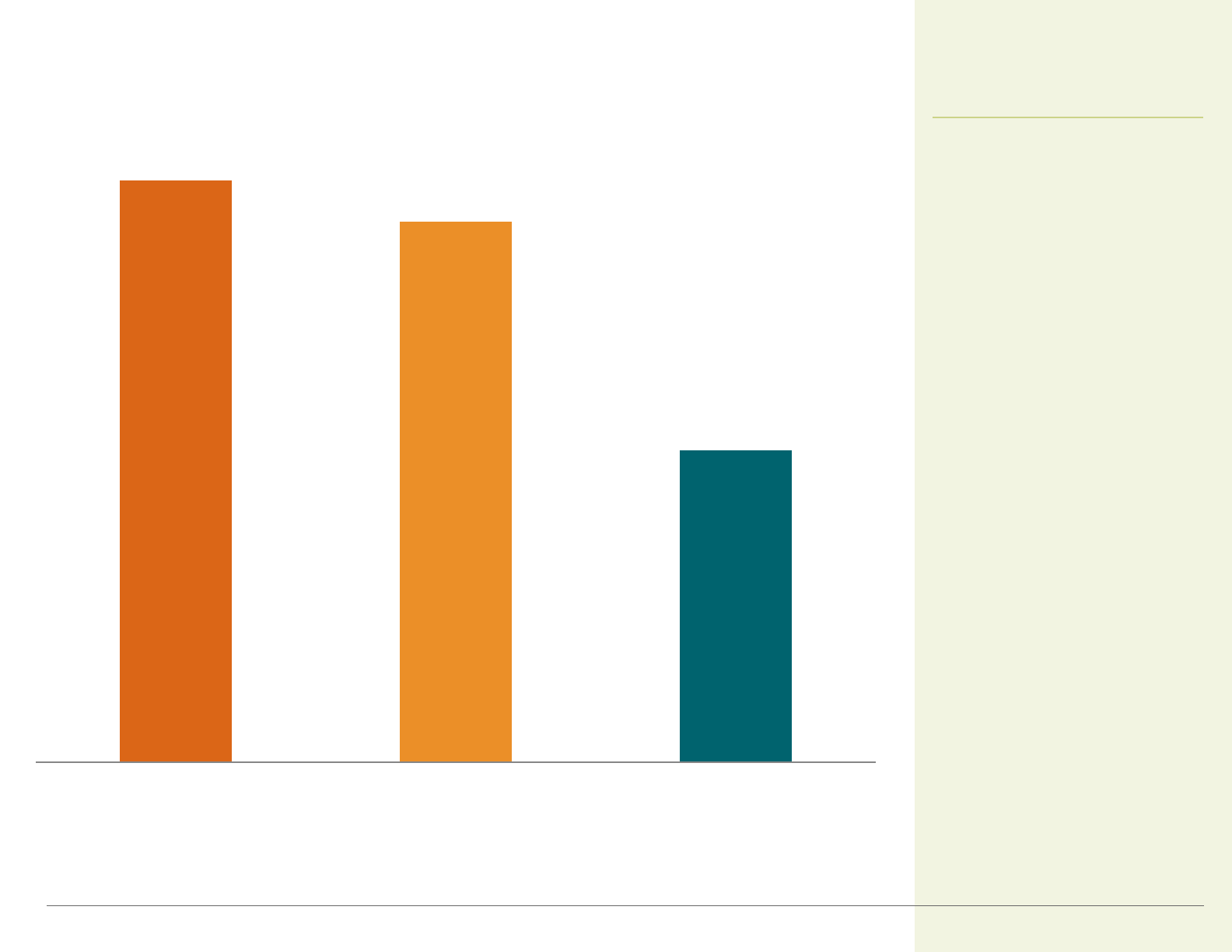

64%

15%

46%

63%

14%

45%

70%

19%

64%

Offer High-Deductible Plan HDHP with HRA HDHP with HSA

All Firms Small Firms (3-199 workers) Large Firms (200+ workers)

33

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Compared to other plan types,

HDHPs expose workers to

higher out-of-pocket costs.

Sixty-four percent of all

California firms offered a high-

deductible health plan (HDHP)

in 2016. Of these firms, 15%

offered an HDHP with a health

reimbursement agreement

(HRA), while 46% offered an

HDHP with a health savings

account (HSA).

*Tests found no significant difference betw een small firms and large firms.

Notes: HDHPs (high-deductible health plans) have a deductible of at least $1,000 for single coverage and at least $2,000 for family coverage. HRAs (health rei m bursement

arrangements) are employer-sponsored accounts that provide financial assistance for out-of-pocket health care expenses, and HSAs (health savings accounts) allow

em ployers or employees (and their families) to contribute to a tax-advantaged account, which can be used to provide financial assistance for IRS-appro ved health care

expenses.

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

Firms Offering a High-Deductible Health Plan,

by Firm Size

California, 2016

Plan Choice and Enrollment

California Employer Health Benefits

34

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Thirty-seven percent of

employees in California were

enrolled in a partly or completely

self-insured plan in 2016,

compared with 61% nationally.

The gap between the state and

national figures is associated

with California’s high HMO

enrollment, since HMOs are

less likely than other plans to be

self-insured.

*Estimates are statistically different betw een California and US.

Notes: Self-insured plans are plans for which an em ployer assumes some or most responsibility for paying health care claims rather than buying coverage from an insurer. POS means

point-of-service plan. HDHP/SO means high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage and at least $2, 000 for family

coverage.

Sources: California Employer Health Benefits Survey, CHCF/NORC: 2016; Employer Health Benefits Survey: 2016, Kaiser/HRET.

Employees in Self-Insured Plans, by Plan Type

California United States

37%

16%

17%

56%

67%

61%

24%

37%

67%

69%

All Plans* POS HMO* HDHP/SO PPO

California vs. United States, 2016

Plan Choice and Enrollment

California Employer Health Benefits

Note: Segments may not add to 100% due to rounding .

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

35

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Twenty-seven percent of

California employers reported

they are very likely or somewhat

likely to increase the amount

that workers pay for premiums

in the next year. Seventeen

percent of employers stated that

they are very likely or somewhat

likely to increase employees’

deductibles, and 15% stated

that they are very likely or

somewhat likely to increase

what employees pay for

prescriptions.

Likelihood of Firms Making Changes in the Next Year

California, 2016

<1%

1%

3%

5%

7%

13%

<1%

<1%

12%

10%

10%

14%

2%

3%

27%

27%

26%

17%

97%

95%

51%

52%

52%

51%

<1%

1%

6%

6%

5%

5%

Very Likely Somewhat Likely Not Too Likely Not At All Likely Don't Know

Increase the Amount Employees Pay for Premiums

Increase the Amount Employees Pay for Deductibles

Increase the Amount Employees Pay for Coinsurance or Copays

Increase the Amount Employees Pay for Prescription Drugs

Restrict Employee Eligibility for Coverage

Drop Coverage Entirely

Employer Views and Practices

California Employer Health Benefits

Note: Segments may not add to 100% due to rounding .

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

36

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Compared to small firms, larger

firms in California were more

likely to report that they are very

likely or somewhat likely to

increase the amount employees

pay for health insurance

premiums in the coming year.

*Estimate is statistically different betw een small and large firms.

Likelihood of Firms Making Selected Changes in the

Next Year

by Firm Size, California, 2016

7%

5%

26%

12%

9%

11%

24%

14%

19%

27%

19%

16%

62%

51%

27%

53%

4%

6%

4%

5%

Large Firm

(200+ workers)

Small Firm

(3-199 workers)

Large Firm*

(200+ workers)

Small Firm*

(3-199 workers)

Very Likely Somewhat Likely Not Too Likely Not At All Likely Don't Know

Increase Amount Worker Pays for Coinsurance or Copayments

Increase Worker Share of Premiums

Employer Views and Practices

California Employer Health Benefits

1%

2%

4%

11%

2%

2%

12%

24%

Reduced hiring of full-

time workers

Reclassified jobs from

full-time to part-time

to reduce eligibility

Reclassified jobs from

part-time to full-time

to increase eligibility*

Extended eligibility to

workers not previously

eligible*

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

37

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

In 2016, employers offering

health insurance were more

likely to take actions that

increased worker eligibility for

health benefits, such as

reclassifying jobs from part-

time to full-time, or extending

coverage to workers not

previously eligible, than to

take actions to reduce

eligibility.

Firms That Made Selected Changes in the Past Year

Small Firms (3-199 workers)

Large Firms (200+ workers)

*Estimate is statistically different betw een small and large firms.

by Firm Size, California, 2016

Employer Views and Practices

California Employer Health Benefits

Notes: Tests found no statistically significant differences for any subgroups. Los Angeles and San Francisco are defined as the m etropolitan statistical area (MSA).

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

38

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

In the past year, 19% of

California firms increased cost

sharing, 12% moved benefit

options to an HRA or HSA, and

4% reduced the scope of

covered benefits.

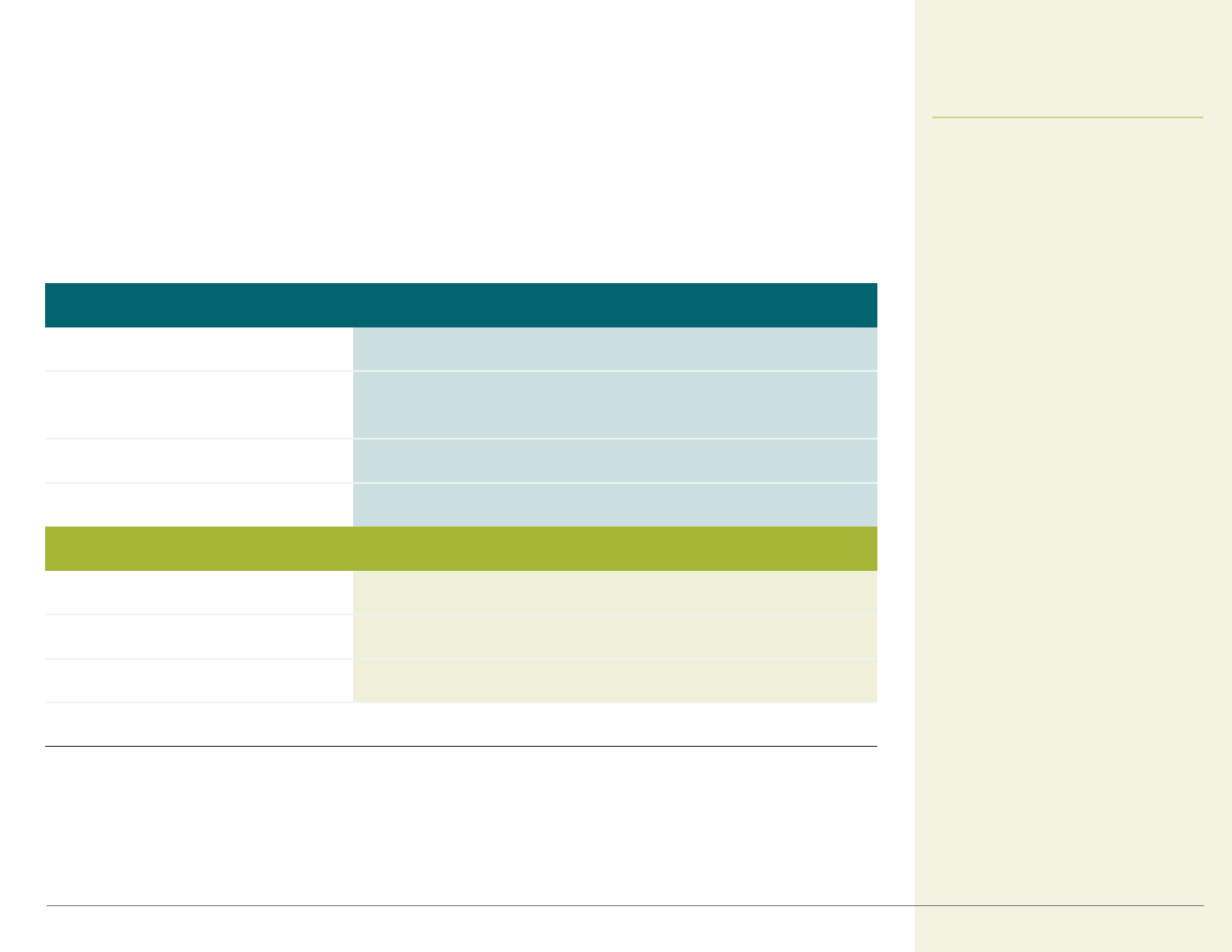

Firms That Made Selected Changes in the Past Year

INCREASED COST

SHARING

MOVED BENEFIT

OPTIONS TO HRA

OR HSA

REDUCED SCOPE

OF COVERED

BENEFITS

INCREASED

INCENTIVES TO

USE LESS COSTLY

PROVIDERS

FIRM SIZE

Small Firms

(3-199 workers)

19% 12% 4% 3%

Large Firms

(200+ workers)

21% 14% 2% 8%

200-999 workers 18% 15% 2% 4%

1,000+ workers 26% 13% <1% 15%

REGION

Los Angeles

18% 15% 2% 5%

San Francisco

17% 2% 9% 1%

Rest of State

21% 24% 1% 4%

All Firms

19% 12% 4% 4%

by Firm Size and Region, California, 2016

Employer Views and Practices

California Employer Health Benefits

39

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Notes: Tests found no significant difference between offering and nonoffering firms. Small firms with fewer than 75 employees. The Small Business Health Options Program (SHOP) includes

federal- or state-sponsored exchanges (Covered California for Small Business in California) in which small employers m ay offer and contri bute to health insurance provided to their

em ployees. So me employers are eligible for tax credits wh e n purchasing coverage on the exchanges.

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

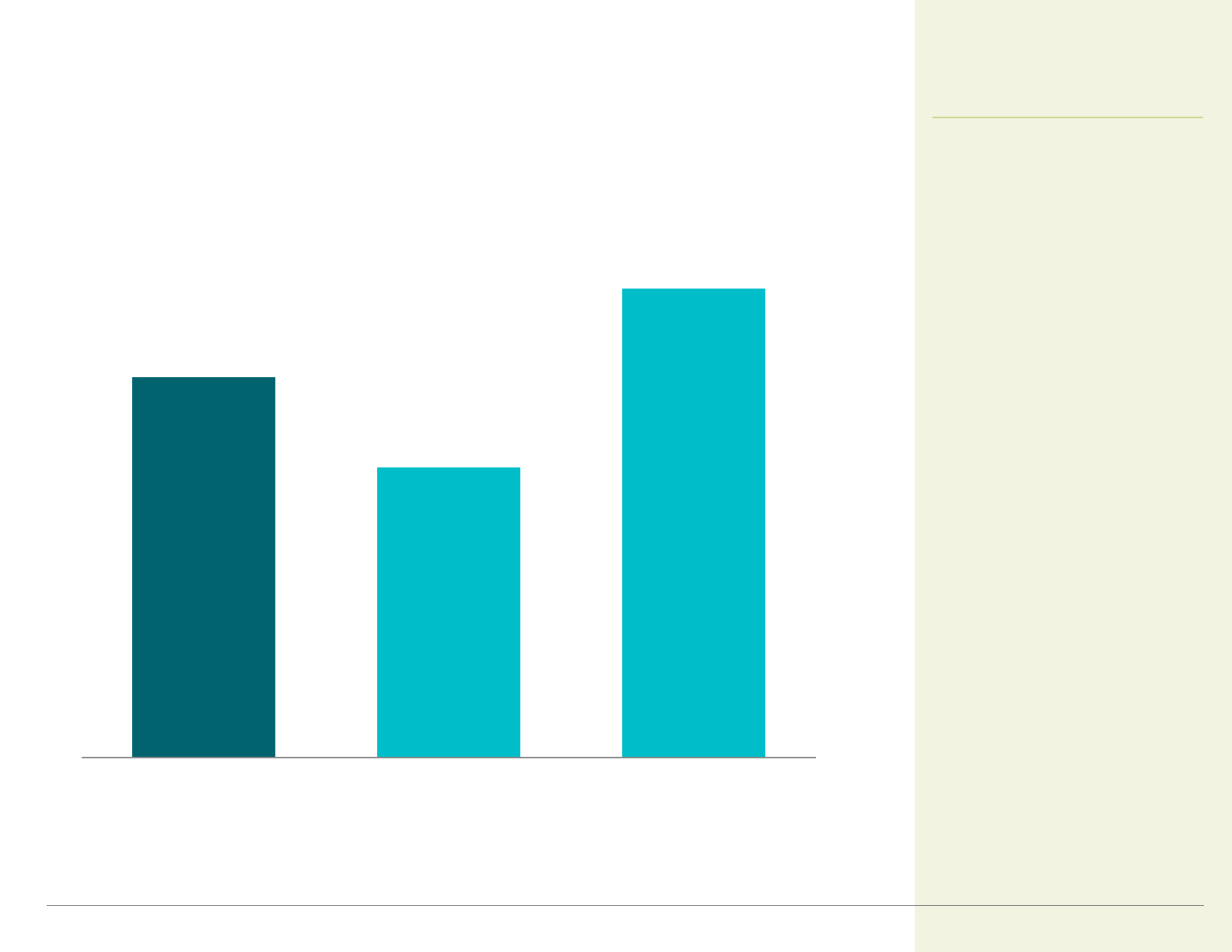

In 2016, 7.5% of small firms that

did not offer health coverage

said they looked for a health

plan on the exchange,

compared to 12% of offering

small firms.

Looked at SHOP Exchange, Selected Small Firms

Offering and Nonoffering, California, 2016

9.8%

7.5%

12.1%

All Nonoffering Firms Offering Firms

Employer Views and Practices

California Employer Health Benefits

26%

59%

54%

42%

Covers Telemedicine

Services

Covers Care Received

at a Retail Clinic*

Small Firms

(3-199 workers)

Large Firms

(200+ workers)

Telemedicine Coverage Includes...

Behavioral Health Visits

Source: California Employer Health Benefits Survey: 2016, CHCF/NORC.

40

© 2 0 1 7 C A LIFOR NI A H E ALTH CARE FO U N D AT ION

Large firms were more likely

than small firms to offer

coverage for telemedicine

services, and to offer

behavioral health

telemedicine visits. Over half

of small offering firms covered

care received at a retail clinic.

Firms Covering Telemedicine and Retail Clinics in

Plan with Largest Enrollment

*Estimate is statistically different betw een small and large firms.

by Firm Size, 2016

53%

34%

Employer Views and Practices

California Employer Health Benefits

Methodology

The California Employer Health Benefits Survey is a joint product of the

California Health Care Foundation (CHCF) and the National Opinion

Research Center (NORC). The survey was designed and analyzed by

researchers at NORC and administered by National Research (NR). The

findings are based on a random sample of 705 interviews with employee

benefit managers in private firms in California. NR conducted interviews

from June to October 2016. As with prior years, the sample of firms was

drawn from the Dun & Bradstreet list of private employers with three or

more workers. The margin of error for responses among all employers is

+/– 3.8%, for responses among employers with 3 to 199 workers it is +/–

5.0%, and among employers with 200 or more workers it is +/– 5.9%.

Some exhibits do not sum to 100% due to rounding effects.

The Kaiser Family Foundation sponsored this survey of California

employers from 2000 to 2003. A similar employer survey was also

conducted in 1999 in California, in conjunction with the Center for Health

and Public Policy Studies at the University of California, Berkeley. The

Health Research and Educational Trust (HRET) collaborated on these

surveys from 1999 to 2004. The Center for Studying Health System Change

collaborated on these surveys from 2005 to 2006.

This survey instrument is similar to a national employer survey conducted

annually by the Kaiser Family Foundation and HRET.

The US results in this study are either from the published reports,

or in a few cases, from author calculations from the survey’s public use

files. A full analysis of the US data set is available on the foundation’s

website at www.kff.org. Both the California and US surveys asked questions

about health maintenance organizations (HMOs), preferred provider

organizations (PPOs), point-of-service (POS) plans, and high-deductible

health plans with a savings option (HDHP/SOs). Conventional (fee-for-

service) plans are generally excluded from the plan type analyses because

they compose such a small share of the California market

Many variables with missing information were identified as needing

complete information within the database. To control for item

nonresponse bias, missing values within these variables were imputed

using a hot-deck approach. Calculation of the weights follows a common

approach. First, the basic weight is determined, followed by a survey

nonresponse adjustment. Next, the weights are trimmed in order to

reduce the influence of weight outliers. Finally, a post-stratification

adjustment is applied.

All statistical tests in this chart pack compare either changes over time, a

plan-specific estimate with an overall estimate, or subcategories versus all

other firms (e.g., firms with 3 to 9 workers vs. all other firms). Tests include

t-tests and chi-square tests, and significance was determined at p < .05

level. Due to the complex nature of the design, standard errors are

calculated in SUDAAN.

An important note about the methodology: Rates of change for total

premiums, for worker or employer contributions to premiums, and other

variables calculated by comparing dollar values in this report to data

reported in past CHCF or KFF publications should be used with caution

due to both the survey’s sampling design and the way in which plan

information is collected. Rates calculated in this fashion not only reflect a

change in the dollar values but also a change in enrollment distribution,

thus creating a variable enrollment estimate. However, rates of change in

premiums are collected directly as a question in the California survey. This

rate of change holds enrollment constant between the current year and

the previous year, thus creating a fixed enrollment estimate. Because the

survey does not collect information on the rate of change in other

variables, additional rates are not reported. The national survey conducted

by Kaiser/HRET, however, stopped collecting directly rates of change in

premiums in its 2008 survey. Therefore, the rate of change in total

premiums in the US provided in this report uses a variable enrollment

estimate.

California Employer Health Benefits

AB O U T T H I S SERI ES

The California Health Care Almanac is an

online clearinghouse for data and analysis

examining the state’s health care system. It

focuses on issues of quality, affordability,

insurance coverage and the uninsured, and

the financial health of the system with the

goal of supporting thoughtful planning and

effective decisionmaking. Learn more at

www.chcf.org/almanac.

AU T H O R S

Heidi Whitmore, Principal Research Scientist

Jon Gabel, Senior Fellow

NORC at the University of Chicago

FOR MORE INFORMAT IO N

California Health Care Foundation

1438 Webster Street, Suite 400

Oakland, CA 94612

510.238.1040

www.chcf.org

41