Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9

Draft Ok to Print

AH XSL/XML

Fileid: … 094c&1095c/2023/a/xml/cycle04/source (Init. & Date) _______

Page 1 of 18 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2023

Instructions for Forms

1094-C and 1095-C

Department of the Treasury

Internal Revenue Service

Section references are to the Internal Revenue Code unless

otherwise noted.

Future Developments

For the latest information about developments related to Form

1094-C, Transmittal of Employer-Provided Health Insurance

Offer and Coverage Information Returns, and Form 1095-C,

Employer-Provided Health Insurance Offer and Coverage, and

the instructions, such as legislation enacted after they were

published, go to

IRS.gov/Form1094C and IRS.gov/Form1095C.

What’s New

The electronic-filing threshold for information returns required to

be filed on or after January 1, 2024, has been decreased to 10 or

more returns. See Electronic Filing, later.

Additional Information

For information related to the Affordable Care Act, visit IRS.gov/

ACA. For the final regulations under section 6056, Information

Reporting by Applicable Large Employers on Health Insurance

Coverage Offered Under Employer-Sponsored Plans, see T.D.

9661, 2014-13 I.R.B. 855, at

IRS.gov/irb/2014-13_IRB/ar09.html.

For the final regulations under section 6055, Information

Reporting of Minimum Essential Coverage, see T.D. 9660,

2014-13 I.R.B. 842, at IRS.gov/irb/2014-13_IRB/ar08.html and

T.D. 9970, 2023-02 I.R.B. 311, at IRS.gov/irb/2023-02_IRB. For

the final regulations under section 4980H, Shared Responsibility

for Employers Regarding Health Coverage, see T.D. 9655,

2014-9 I.R.B. 541, at

IRS.gov/irb/2014-9_IRB/ar05.html. For

answers to frequently asked questions regarding the employer

shared responsibility provisions and related information reporting

requirements, visit IRS.gov.

For information related to filing Forms 1094-C and 1095-C

electronically, visit IRS.gov/AIR. For FAQs specifically related to

completing Forms 1094-C and 1095-C, go to IRS.gov/

Affordable-Care-Act/Employers/Questions-and-Answers-about-

Information-Reporting-by-Employers-on-Form-1094-C-and-

Form-1095-C.

For additional guidance and proposed regulatory changes

relating to section 6055, including the requirement to solicit the

TIN of each covered individual for purposes of the reporting of

health coverage information, see Proposed Regulations section

1.6055-1(h) and Regulations section 301.6724-1.

General Instructions for

Forms 1094-C and 1095-C

See Definitions, later, for key terms used in these instructions.

Purpose of Form

Employers with 50 or more full-time employees (including

full-time equivalent employees) in the previous year use Forms

1094-C and 1095-C to report the information required under

sections 6055 and 6056 about offers of health coverage and

enrollment in health coverage for their employees. Form 1094-C

must be used to report to the IRS summary information for each

Applicable Large Employer (ALE Member) (defined below) and

to transmit Forms 1095-C to the IRS. Form 1095-C is used to

report information about each employee to the IRS and to the

employee. Forms 1094-C and 1095-C are used in determining

whether an ALE Member owes a payment under the employer

shared responsibility provisions under section 4980H. Form

1095-C is also used in determining the eligibility of employees

for the premium tax credit.

ALE Members that offer employer-sponsored, self-insured

coverage also use Form 1095-C to report information to the IRS

and to employees about individuals who have minimum essential

coverage under the employer plan.

Who Must File

An ALE Member must file one or more Forms 1094-C (including

a Form 1094-C designated as the Authoritative Transmittal,

whether or not filing multiple Forms 1094-C), and must file a

Form 1095-C for each employee who was a full-time employee

of the ALE Member for any month of the calendar year.

Generally, the ALE Member is required to furnish a copy of the

Form 1095-C (or a substitute form) to the employee.

An ALE Member is, generally, a single person or entity that is

an Applicable Large Employer, or if applicable, each person or

entity that is a member of an Aggregated ALE Group. An

Applicable Large Employer, generally, is an employer with 50 or

more full-time employees (including full-time equivalent

employees) in the previous year. For purposes of determining if

an employer or group of employers is an Applicable Large

Employer, all ALE Members under common control (an

Aggregated ALE Group) are aggregated together. If the

Aggregated ALE Group, taking into account the employees of all

ALE Members in the group, employed on average 50 or more

full-time employees (including full-time equivalent employees) on

business days during the preceding calendar year, then the

Aggregated ALE Group is an Applicable Large Employer and

each separate employer within the group is an ALE Member.

Each ALE Member is required to file Forms 1094-C and 1095-C

reporting offers of coverage to its full-time employees (even if the

ALE Member has fewer than 50 full-time employees of its own).

For more information on which employers are subject to the

employer shared responsibility provisions of section 4980H, see

Employer in the Definitions section of these instructions. For

more information on determining full-time employees, see

Full-Time Employee in the Definitions section of these

instructions, which includes information on the treatment of new

hires and employees in Limited Non-Assessment Periods.

For purposes of reporting on Forms 1094-C and 1095-C,

an employee in a Limited Non-Assessment Period is not

considered a full-time employee during that period.

Reporting by Employers That

Sponsor Self-Insured Health Plans

An employer that offers health coverage through a self-insured

health plan must report information about each individual

enrolled in such coverage. For an employer that is an ALE

Member, this information must be reported on Form 1095-C, Part

III, for any employee who is enrolled in coverage (and any

spouse or dependent of that employee). See the option to file

TIP

Sep 26, 2023

Cat. No. 63018M

Page 2 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Form 1094-B and Form 1095-B, rather than Form 1094-C and

Form 1095-C, to report coverage of certain non-employees,

below.

ALE Members that offer health coverage through an

employer-sponsored, self-insured health plan must complete

Form 1095-C, Parts I, II, and III, for any employee who enrolls in

the health coverage, whether or not the employee is a full-time

employee for any month of the calendar year.

For full-time employees enrolled in an ALE Member’s

self-insured coverage, including an employee who was a

full-time employee for at least 1 month of the calendar year, the

ALE Member must complete Form 1095-C, Part II, according to

the generally applicable instructions, and should not enter code

1G on line 14 for any month. For an employee enrolled in an ALE

Member’s self-insured coverage who is not a full-time employee

for any month of the calendar year (meaning that for all 12

calendar months the employee was not a full-time employee), for

Form 1095-C, Part II, the ALE Member must enter code 1G on

line 14 in the “All 12 Months” column or in the separate monthly

boxes for all 12 calendar months, and the ALE Member need not

complete Part II, lines 15 and 16.

An individual coverage HRA is a self-insured group

health plan and is therefore an eligible

employer-sponsored plan. An individual is ineligible for a

premium tax credit (PTC) for a month if the individual is covered

by an individual coverage HRA or eligible for an individual

coverage HRA that is affordable.

An employer that offers employer-sponsored, self-insured

health coverage but is not an ALE Member should not file Forms

1094-C and 1095-C, but should instead file Forms 1094-B and

1095-B to report information for employees who enrolled in the

employer-sponsored, self-insured health coverage.

Note. If an ALE Member is offering health coverage to

employees other than under a self-insured plan, such as through

an insured health plan or a multiemployer health plan, the issuer

of the insurance or the sponsor of the plan providing the

coverage is required to furnish the information about their health

coverage to any enrolled employees, and the ALE Member

should not complete Form 1095-C, Part III, for those employees.

Reporting of Enrollment Information

for Non-Employees: Option

To Use Forms 1094-B and 1095-B

ALE Members that offer employer-sponsored, self-insured

health coverage to non-employees who enroll in the coverage

may use Forms 1094-B and 1095-B, rather than Form 1095-C,

Part III, to report coverage for those individuals and other family

members. For this purpose, a non-employee includes, for

example, a non-employee director, an individual who was a

retired employee during the entire year, or a non-employee

COBRA beneficiary, including a former employee who

terminated employment during a previous year.

For information on reporting for non-employees enrolled in an

employer-sponsored, self-insured health plan using Forms

1094-B and 1095-B, see the instructions for those forms.

For ALE Members that choose to use Form 1095-C to report

coverage information for non-employees enrolled in an

employer-sponsored, self-insured health plan, see the specific

instructions for Form 1095-C, Part III—Covered Individuals

(Lines 18–30), later. Form 1095-C may be used only if the

individual identified on line 1 has an SSN.

TIP

Substitute Statements to Recipients

If you are not using the official IRS form to furnish statements to

recipients, see Pub. 5223, General Rules and Specifications for

Affordable Care Act Substitute Forms 1095-A, 1094-B, 1095-B,

1094-C, and 1095-C, which explains the requirements for format

and content of substitute statements to recipients. You may

develop them yourself or buy them from a private printer.

Substitute statements furnished to recipients may be in portrait

format; however, substitute returns filed with the IRS using paper

must be printed in landscape format.

Authoritative Transmittal for ALE

Members Filing Multiple Forms 1094-C

A Form 1094-C must be filed when an ALE Member files one or

more Forms 1095-C. An ALE Member may choose to file

multiple Forms 1094-C, each accompanied by Forms 1095-C for

a portion of its employees, provided that a Form 1095-C is filed

for each employee for whom the ALE Member is required to file.

If an ALE Member files more than one Form 1094-C, one (and

only one) Form 1094-C filed by the ALE Member must be

identified on line 19, Part I, as the Authoritative Transmittal, and,

on the Authoritative Transmittal, the ALE Member must report

certain aggregate data for all full-time employees and all

employees, as applicable, of the ALE Member.

Example 1. Employer A, an ALE Member, files a single Form

1094-C, attaching Forms 1095-C for each of its 100 full-time

employees. This Form 1094-C should be identified as the

Authoritative Transmittal on line 19, and the remainder of the

form completed as indicated in the instructions for

line 19, later.

Example 2. Employer B, an ALE Member, files two Forms

1094-C, one for each of its two operating divisions, Division X

and Division Y. (Division X and Division Y are units of the same

ALE Member, and thus both report under the same employer

identification number (EIN); they are not members of an

Aggregated ALE Group.) Attached to one Form 1094-C are

Forms 1095-C for the 200 full-time employees of Division X, and

attached to the other Form 1094-C are Forms 1095-C for the

1,000 full-time employees of Division Y. One of these Forms

1094-C should be identified as the Authoritative Transmittal on

line 19, and should include aggregate employer-level data for all

1,200 full-time employees of Employer B as well as the total

number of employees of Employer B, as applicable, as required

in Parts II, III, and IV of Form 1094-C. The other Form 1094-C

should not be identified as the Authoritative Transmittal on

line 19, and should report on line 18 only the number of Forms

1095-C that are attached to that Form 1094-C, and should leave

the remaining sections of the form blank, as indicated in the

instructions for

line 19, later.

Note. Each ALE Member must file its own Forms 1094-C and

1095-C under its own separate EIN, even if the ALE Member is

part of an Aggregated ALE Group. No Authoritative Transmittal

should be filed for an Aggregated ALE Group.

Example 3. Assume that Employer A from Example 1 is a

member of the same Aggregated ALE Group as Employer B

from

Example 2. Accordingly, Employer A and Employer B are

separate ALE Members filing under separate EINs. Forms

1094-C should be filed in the same manner indicated in

Examples 1 and 2. Employer A should include only information

about employees of Employer A in its Authoritative Transmittal,

and Employer B should include only information about

employees of Employer B in its Authoritative Transmittal. No

Authoritative Transmittal should be filed for the Aggregated ALE

Group reporting combined data for employees of both Employer

A and Employer B.

Similar rules apply for a Governmental Unit that has

delegated its reporting responsibilities for some of its employees

-2-

Instructions for Forms 1094-C and 1095-C (2023)

Page 3 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

to another Governmental Unit—see Designated Governmental

Entity (DGE) in the Definitions section of these instructions for

more information. In the case of a Governmental Unit that has

delegated its reporting responsibilities for some of its employees,

the Governmental Unit must ensure that among the multiple

Forms 1094-C filed by or on behalf of the Governmental Unit

transmitting Forms 1095-C for the Governmental Unit’s

employees, one of the filed Forms 1094-C is designated as the

Authoritative Transmittal and reports aggregate employer-level

data for the Governmental Unit, as required in Parts II, III, and IV

of Form 1094-C.

Example. County is an Aggregated ALE Group made up of

the ALE Members School District, the Police District, and the

County General Office. The School District designates the state

to report on behalf of the teachers and reports for itself for its

remaining full-time employees. In this case, either the School

District or the state must file an Authoritative Transmittal

reporting aggregate employer-level data for the School District.

One Form 1095-C for Each

Employee of ALE Member

For each full-time employee of an ALE Member, there must be

only one Form 1095-C filed for employment with that ALE

Member. For example, if an ALE Member separately reports for

each of its two divisions, the ALE Member must combine the

offer and coverage information for any employee who worked at

both divisions during the calendar year so that a single Form

1095-C is filed for the calendar year for that employee, which

reports information for all 12 months of the calendar year from

that ALE Member.

In contrast, a full-time employee who works for more than one

ALE Member that is a member of the same Aggregated ALE

Group must receive a separate Form 1095-C from each ALE

Member. For any calendar month in which a full-time employee

works for more than one ALE Member of an Aggregated ALE

Group, only one ALE Member is treated as the employer of that

employee for reporting purposes (generally, the ALE Member for

whom the employee worked the greatest number of hours of

service), and only that ALE Member reports for that employee for

that calendar month. The other ALE Member is not required to

report for that employee for that calendar month, unless the

other ALE Member is otherwise required to file Form 1095-C for

that employee because the individual was a full-time employee

of that ALE Member for a different month of the same calendar

year. In this case, the individual may be treated as not employed

by that ALE Member for that calendar month. If under these

rules, an ALE Member is not required to report for an employee

for any month in the calendar year, the ALE Member is not

required to report for that full-time employee for that calendar

year. For a description of the rules related to determining which

ALE Member in an Aggregated ALE Group is treated as the

employer for a month in this situation, see the definition of

Employee.

Example. Employer A and Employer B are separate ALE

Members that belong to the same Aggregated ALE Group. Both

Employer A and Employer B offer coverage through the AB

health plan, which is an insured plan. In January and February,

Employee has 130 hours of service for Employer A and no hours

of service for Employer B. In March, Employee has 100 hours of

service for Employer A and 30 hours of service for Employer B.

In April through December, Employee has 130 hours of service

for Employer B and no hours of service for Employer A.

Employer A is the employer of Employee for filing purposes for

January, February, and March. Employer A should file Form

1095-C for Employee reporting offers of coverage using the

appropriate code on line 14 for January, February, and March;

should complete lines 15 and 16 per the instructions; and should

include Employee in the count of total employees and full-time

employees reported for those months on Form 1094-C. For the

months April through December, on Form 1095-C, Employer A

should enter code 1H (no offer of coverage) on line 14, leave

line 15 blank, and enter code 2A (not an employee) on line 16

(since Employee is treated as an employee of Employer B and

not as an employee of Employer A in those months), and should

exclude Employee from the count of total employees and

full-time employees reported for those months on Form 1094-C.

When To File

You will meet the requirement to file Forms 1094-C and 1095-C if

the forms are properly addressed and mailed on or before the

due date. If the due date falls on a weekend or legal holiday, then

the due date is the following business day. A business day is any

day that is not a Saturday, Sunday, or legal holiday.

Generally, you must file Forms 1094-C and 1095-C by

February 28 if filing on paper (or March 31 if filing electronically)

of the year following the calendar year to which the return

relates. For calendar year 2023, Forms 1094-C and 1095-C are

required to be filed by February 28, 2024, or April 1, 2024, if filing

electronically.

See Furnishing Forms 1095-C to Employees for information

on when Form 1095-C must be furnished.

Extensions

You can get an automatic 30-day extension of time to file by

completing Form 8809, Application for Extension of Time To File

Information Returns. The form may be submitted on paper, or

through the FIRE System either as a fill-in form or an electronic

file. No signature or explanation is required for the extension.

However, you must file Form 8809 on or before the due date of

the returns in order to get the 30-day extension. Under certain

hardship conditions, you may apply for an additional 30-day

extension. See the Instructions for Form 8809 for more

information.

How to apply. File Form 8809 as soon as you know that a

30-day extension of time to file is needed. See the instructions

for Form 8809. Mail or fax Form 8809 using the address and

phone number listed in the instructions. You can also submit the

extension request online through the FIRE System. You are

encouraged to submit requests using the online fill-in form. See

Pub. 1220 for more information on filing online or electronically.

Where To File

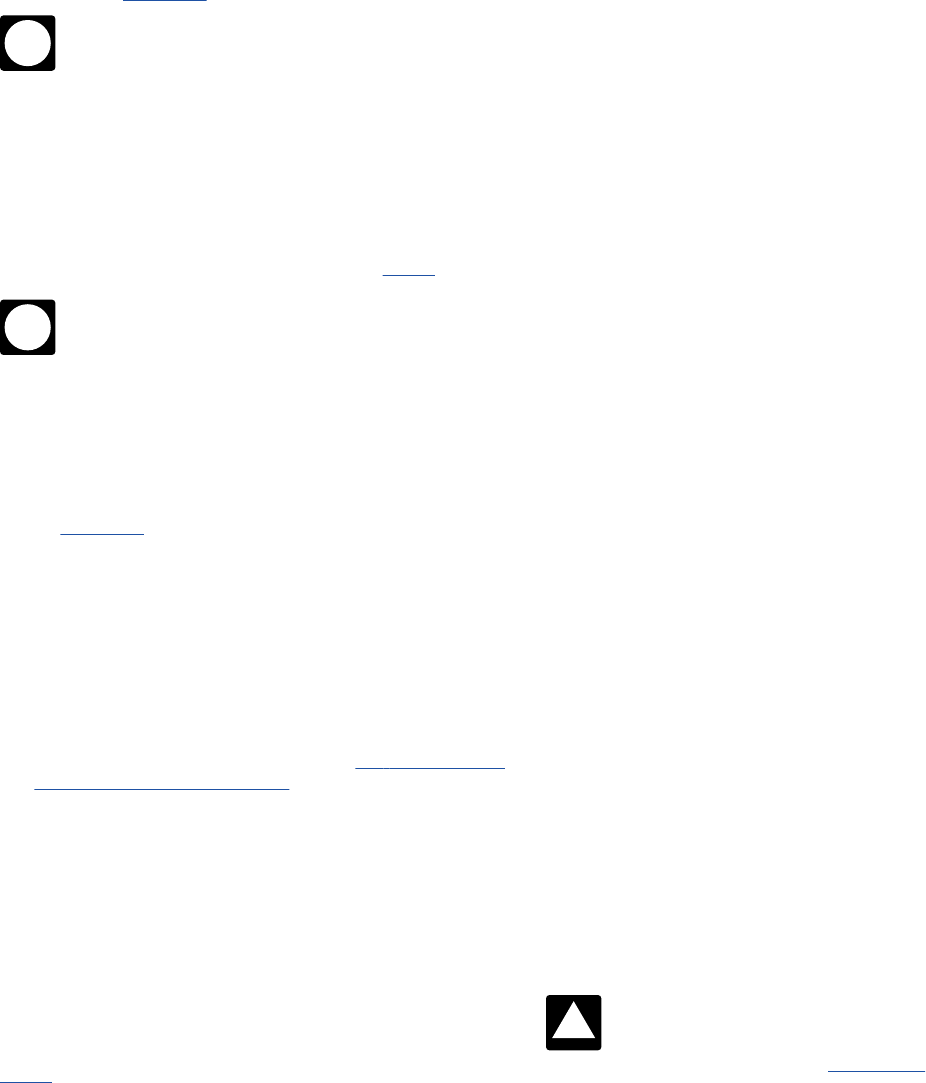

Send all information returns filed on paper to the following:

If your principal business,

office or agency, or legal

residence, in the case of an

individual, is located in:

Use the following address:

▼ ▼

Alabama, Arizona, Arkansas,

Connecticut, Delaware, Florida,

Georgia, Kentucky, Louisiana,

Maine, Massachusetts,

Mississippi, New Hampshire,

New Jersey, New Mexico, New

York, North Carolina, Ohio,

Pennsylvania, Rhode Island,

Texas, Vermont, Virginia,

West Virginia

Department of the Treasury

Internal Revenue Service

Center

Austin, TX 73301

Instructions for Forms 1094-C and 1095-C (2023)

-3-

Page 4 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

If your principal business,

office or agency, or legal

residence, in the case of an

individual, is located in:

Use the following address:

▼ ▼

Alaska, California, Colorado,

District of Columbia, Hawaii,

Idaho, Illinois, Indiana, Iowa,

Kansas, Maryland, Michigan,

Minnesota, Missouri, Montana,

Nebraska, Nevada, North

Dakota, Oklahoma, Oregon,

South Carolina, South Dakota,

Tennessee, Utah, Washington,

Wisconsin, Wyoming

Department of the Treasury

Internal Revenue Service

Center

P.O. Box 219256

Kansas City, MO 64121-9256

If your legal residence or principal place of business or

principal office or agency is outside the United States, file with

the Department of the Treasury, Internal Revenue Service

Center, Austin, TX 73301.

Shipping and mailing. If you are filing on paper, send the

forms to the IRS in a flat mailing (not folded), and do not

paperclip or staple the forms together. If you are sending many

forms, you may send them in conveniently sized packages. On

each package, write your name, number the packages

consecutively, and place Form 1094-C in package number one.

Postal regulations require forms and packages to be sent by

First-Class Mail. Returns filed with the IRS must be printed in

landscape format.

Keeping copies. Generally, keep copies of information returns

you filed with the IRS or have the ability to reconstruct the data

for at least 3 years, from the due date of the returns.

Electronic Filing

If you are required to file 10 or more

information returns during the year, you

must file the forms electronically. The

10-or-more requirement applies in the aggregate to certain

information returns that are original or corrected returns.

Accordingly, a filer may be required to file fewer than 10 Forms

1094-C and 1095-C, but still have an electronic filing obligation

based on other kinds of information returns filed. The electronic

filing requirement does not apply if you request and receive a

hardship waiver. The IRS encourages you to file electronically

even though you are filing fewer than 10 returns.

Waiver. To receive a waiver from the required filing of

information returns electronically, submit Form 8508. You are

encouraged to file Form 8508 at least 45 days before the due

date of the returns, but no later than the due date of the return.

The IRS does not process waiver requests until January 1 of the

calendar year the returns are due. You cannot apply for a waiver

for more than 1 tax year at a time. If you need a waiver for more

than 1 tax year, you must reapply at the appropriate time each

year. If a waiver for original returns is approved, any corrections

for the same types of returns will be covered under the waiver.

However, if you submit original returns electronically but you

want to submit your corrections on paper, a waiver must be

approved for the corrections if you must file 10 or more

corrections. If you receive an approved waiver, do not send a

copy of it to the service center where you file your paper returns.

Keep the waiver for your records only.

If you are required to file electronically but fail to do so, and

you do not have an approved waiver, you may be subject to a

penalty of $310 per return for failure to file electronically unless

you establish reasonable cause. However, you can file up to 10

returns on paper; those returns will not be subject to a penalty for

failure to file electronically. The penalty applies separately to

original returns and corrected returns.

Pub. 5165, Guide for Electronically Filing Affordable Care Act

(ACA) Information Returns for Software Developers and

Transmitters, specifies the communication procedures,

transmission formats, business rules, and validation procedures,

and explains when a return will be accepted, accepted with

errors, or rejected, for returns filed electronically for calendar

year 2023 through the ACA Information Return (AIR) system. To

develop software for use with the AIR system, software

developers, transmitters, and issuers, including ALE Members

filing their own Forms 1094-C and 1095-C, should use the

guidelines provided in Pub. 5165 along with the Extensible

Markup Language (XML) Schemas published on IRS.gov.

Reminder. The formatting directions in these instructions (for

example, the directions to enter the 9-digit EIN, including the

dash on line 2 of Form 1094-C) are for the preparation of paper

returns. When filing forms electronically, the formatting set forth

in the XML Schemas and Business Rules published on IRS.gov

must be followed rather than the formatting directions in these

instructions. For more information regarding electronic filing, see

Pubs. 5164 and 5165.

Substitute Returns Filed With the IRS

If you are filing your returns on paper, see Pub. 5223 for

specifications for private printing of substitute information

returns. You may not request special consideration. Only forms

that conform to the official form and the specifications in Pub.

5223 are acceptable for filing with the IRS. Substitute returns

filed with the IRS must be printed in landscape format.

VOID Box

Do not use this box on Form 1095-C.

Corrected Forms 1094-C and 1095-C

For information about filing corrections electronically, see

section 7.1 of Pub. 5165.

Corrected Returns

A corrected return should be filed as soon as possible after an

error is discovered. File the corrected returns as follows.

Form 1094-C. If correcting information on the Authoritative

Transmittal (identified on Part I, line 19, as the Authoritative

Transmittal, one (and only one) of which must be filed for each

ALE Member reporting aggregate employer-level data for all

full-time employees and employees of the ALE Member), file a

standalone, fully completed Form 1094-C, including the correct

information, and enter an “X” in the “CORRECTED” checkbox.

Do not file a return correcting information on a Form 1094-C that

is not the Authoritative Transmittal.

Do not file any other documents (for example, Form

1095-C) with the corrected Authoritative Transmittal.

Form 1095-C. If correcting information on a Form 1095-C that

was previously filed with the IRS, file a fully completed Form

1095-C, including the correct information and enter an “X” in the

“CORRECTED” checkbox. File a Form 1094-C (

do not mark the

“CORRECTED” checkbox on Form 1094-C) with corrected

Form(s) 1095-C. Furnish the employee a copy of the corrected

Form 1095-C, unless the ALE Member was, and continues to be,

eligible for and used the alternative method of furnishing under

the Qualifying Offer Method for that employee for that year’s

furnishing. For more information, see Alternative method of

TIP

CAUTION

!

-4-

Instructions for Forms 1094-C and 1095-C (2023)

Page 5 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

furnishing Form 1095-C to employees under the Qualifying Offer

Method.

Forms 1095-C filed with incorrect dollar amounts on line 15,

Employee Required Contribution, may fall under a safe harbor

for certain de minimis errors. The safe harbor generally applies if

no single amount in error differs from the correct amount by more

than $100. If the safe harbor applies, you will not have to correct

Form 1095-C to avoid penalties. However, if the recipient elects

for the safe harbor not to apply, you may have to issue a

corrected Form 1095-C to avoid penalties. For more information,

see Notice 2017-9, 2017-4 I.R.B. 542, at

IRS.gov/irb/2017-04

IRB/ar11.html.

Note. Enter an “X” in the “CORRECTED” checkbox only when

correcting a Form 1095-C previously filed with the IRS. If you are

correcting a Form 1095-C that was previously furnished to a

recipient, but not filed with the IRS, write, type, or print

“CORRECTED” on the new Form 1095-C furnished to the

recipient.

Correcting information affecting statement furnished to

employee using an Alternative Furnishing Method under

the Qualifying Offer Method. If an ALE Member eligible to use

the Qualifying Offer Method had furnished the employee an

alternative statement, the ALE Member must furnish the

employee a corrected statement if it filed a corrected Form

1095-C correcting the ALE Member’s name, EIN, address, or

contact name and telephone number. If the ALE Member is no

longer eligible to use an alternative furnishing method for the

employee for whom it filed a corrected Form 1095-C, it must

furnish a Form 1095-C to the employee and advise the employee

that Form 1095-C replaces the statement it had previously

furnished.

If you fail to file correct information returns or fail to

furnish a correct recipient statement, you may be subject

to a penalty. However, you are not required to file

corrected returns for missing or incorrect TINs if you meet the

reasonable cause criteria. For additional information, see Pub.

1586, Reasonable Cause Regulations and Requirements for

Missing and Incorrect Name/TINs on Information Returns.

See the charts for examples of errors and step-by-step

instructions for filing corrected returns.

CAUTION

!

TIP

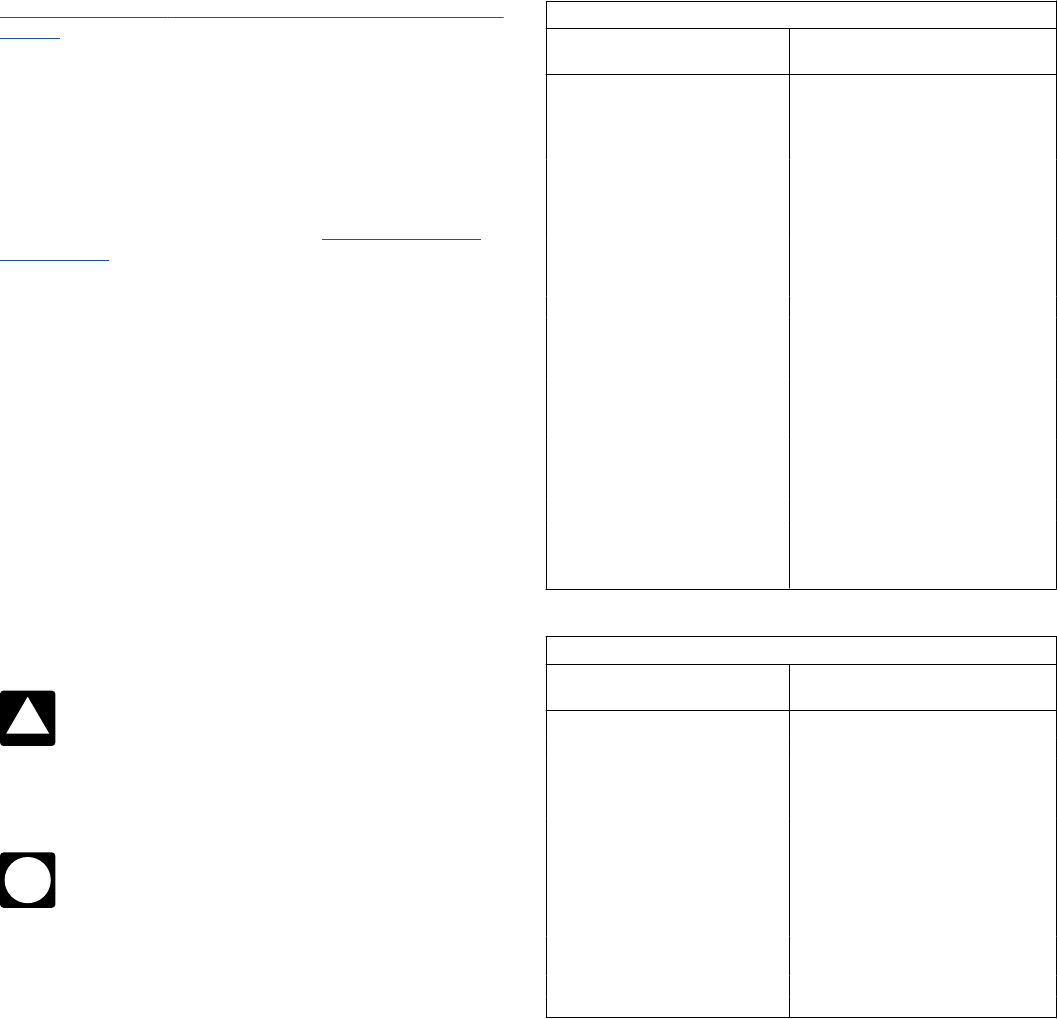

Original Authoritative Transmittal Form 1094-C

IF any of the following are

incorrect ...

THEN ...

ALE Member or Designated

Government Entity (Name and/or

EIN)

1. Prepare a new Authoritative

Transmittal, Form 1094-C.

2. Enter an “X” in the “CORRECTED”

checkbox at the top of the form.

Total number of Forms 1095-C filed

by and/or on behalf of ALE Member

3. Submit the standalone corrected

Form 1094-C with the correct

information present.

Aggregated ALE Group Membership

Certifications of Eligibility

Minimum Essential Coverage Offer

Indicator

Section 4980H Full-Time Employee

Count for ALE Member

Aggregated Group Indicator

Other ALE Members of Aggregated

ALE Group (Name and/or EIN)

Original Form 1095-C Submitted to IRS and Furnished to Employee

IF any of the following are

incorrect ...

THEN ...

Name, SSN, ALE Member EIN 1. Prepare a new Form 1095-C.

Offer of Coverage (line 14) 2. Enter an “X” in the “CORRECTED”

checkbox at the top of the form.

Employee Required Contribution 3. Submit corrected Forms 1095-C with

a non-authoritative Form 1094-C

transmittal to the IRS.

Section 4980H Safe Harbor and

Other Relief Codes (line 16)

4. Furnish a corrected Form 1095-C to

the employee.

Covered Individuals Information

Instructions for Forms 1094-C and 1095-C (2023)

-5-

Page 6 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

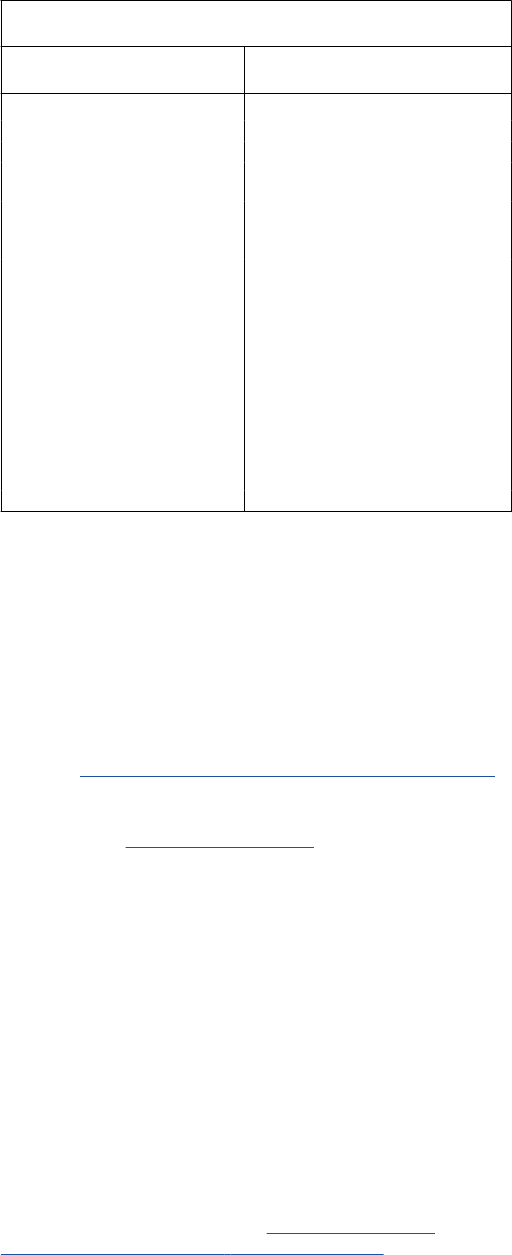

Original Alternative Furnishing Method Under the Qualifying Offer

Method Statement Furnished to Employee

IF any of the following are

incorrect ...

THEN ...

Name, SSN, ALE Member EIN • Submission to the IRS:

1. Prepare a new Form 1095-C.

Offer of Coverage 2. Enter an “X” in the “CORRECTED”

checkbox at the top of the form.

3. Submit corrected Form 1095-Cs

with a non-authoritative Form 1094-C

transmittal to the IRS.

• Furnish to employee:

If, after the correction, the ALE Member

is still eligible to use the alternative

furnishing method under the Qualifying

Offer Method, furnish the employee

either a Form 1095-C or corrected

statement.

If the ALE Member is no longer eligible

to use the alternative furnishing method

with respect to the employee, furnish a

Form 1095-C to the employee.

Furnishing Forms 1095-C to Employees

You will meet the requirement to furnish Form 1095-C to an

employee if the form is properly addressed and mailed on or

before the due date. If the due date falls on a weekend or legal

holiday, then the due date is the following business day. A

business day is any day that is not a Saturday, Sunday, or legal

holiday.

An ALE member must furnish a Form 1095-C to each of its

full-time employees by March 1, 2024, for the 2023 calendar

year. See

Extensions of time to furnish statements to recipients,

below.

For more information on alternative furnishing methods for

employers, see

Qualifying Offer Method, later.

Filers of Form 1095-C may truncate the social security

number (SSN) of an individual (the employee or any family

member of the employee receiving coverage) on Form 1095-C

statements furnished to employees by showing only the last four

digits of the SSN and replacing the first five digits with asterisks

(*) or Xs. Truncation is not allowed on forms filed with the IRS. In

addition, an ALE Member's EIN may not be truncated on the

statements furnished to employees or the forms filed with the

IRS.

Except as provided below, statements must be furnished on

paper by mail (or hand delivered), unless the recipient

affirmatively consents to receive the statement in an electronic

format. If mailed, the statement must be sent to the employee's

last known permanent address, or if no permanent address is

known, to the employee's temporary address. For more

information on furnishing statements to non-full-time employees

and non-employees who are enrolled in employer-sponsored

self-insured health coverage, see

Alternative manner of

furnishing statements to non-full-time employees, later.

Consent to furnish statement electronically. An ALE

Member is required to obtain affirmative consent to furnish a

statement electronically. This requirement ensures that

statements are furnished electronically only to individuals who

are able to access them. The consent must relate specifically to

receiving the Form 1095-C electronically. An individual may

consent on paper or electronically, such as by email. If consent is

on paper, the individual must confirm the consent electronically.

A statement may be furnished electronically by email or by

informing the individual how to access the statement on the ALE

Member’s website. Statements reporting coverage and offers of

coverage under an expatriate health plan, however, may be

furnished electronically unless the recipient explicitly refuses to

consent to receive the statement in an electronic format. Specific

information on consents to furnish statements electronically can

be found in Regulations section 301.6056-2.

Extensions of time to furnish statements to recipients. The

due date for furnishing Form 1095-C is automatically extended

from January 31, 2024, to March 1, 2024. Thus, no additional

extensions will be granted.

Information reporting penalties. All employers subject to the

employer shared responsibility provisions and other employers

that sponsor self-insured group health plans that fail to comply

with the applicable information reporting requirements may be

subject to the general reporting penalty provisions for failure to

file correct information returns and failure to furnish correct

payee statements. For returns required to be made and

statements required to be furnished for 2023 tax year returns, the

following apply.

•

The penalty for failure to file a correct information return is

$310 for each return for which the failure occurs, with the total

penalty for a calendar year not to exceed $3,783,000.

•

The penalty for failure to provide a correct payee statement is

$310 for each statement for which the failure occurs, with the

total penalty for a calendar year not to exceed $3,783,000.

•

Special rules apply that increase the per-statement and total

penalties if there is intentional disregard of the requirement to file

the returns and furnish the required statements.

Penalties may be waived if the failure was due to reasonable

cause and not willful neglect. See section 6724 and Regulations

section 301.6724-1 and Regulations section 1.6055-1(h) (which

relate to Form 1095-C, Part III). For additional information, see

Pub. 1586.

Alternative manner of furnishing statements to

non-full-time employees. If you are an ALE member that offers

employer-sponsored, self-insured health coverage and meets

the requirements of Regulations section 1.6055-1(g), you may

use the alternative manner of furnishing statements to

non-full-time employees and non-employees who are enrolled in

the self-insured health coverage. To use the alternative manner

of furnishing statements, the following conditions must be met.

•

The employer must provide clear and conspicuous notice, in a

location on its website that is reasonably accessible to all

individuals, stating that individuals may receive a copy of their

statement upon request. The notice must include an email

address, a physical address to which a request for a statement

may be sent, and a telephone number that individuals may use

to contact the employer with any questions. A notice posted on

an employer’s website must be written in plain, non-technical

terms and with letters of a font size large enough, including any

visual clues or graphical figures, to call to a viewer’s attention

that the information pertains to tax statements reporting that

individuals had health coverage. For example, an employer’s

website provides a clear and conspicuous notice if it (1) includes

a statement on the main page, or a link on the main page,

reading “Tax Information,” to a secondary page that includes a

statement, in capital letters, “IMPORTANT HEALTH COVERAGE

TAX DOCUMENTS”; (2) explains how non-full-time employees

and non-employees who are enrolled in the plan may request a

copy of Form 1095-C; and (3) includes the employer’s email

address, mailing address, and telephone number.

•

The employer must post the notice on its website by March 1,

2024, and retain the notice in the same location on its website

through October 15, 2024.

•

The employer must furnish the statement to a requesting

individual within 30 days of the date the request is received. To

-6-

Instructions for Forms 1094-C and 1095-C (2023)

Page 7 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

satisfy this requirement, the employer may furnish the statement

electronically if the recipient affirmatively consents.

Specific Instructions for Form 1094-C

Part I—Applicable Large Employer Member

(ALE Member)

Line 1. Enter employer's name. The employer is the ALE

Member.

Line 2. Enter the ALE Member’s EIN. Do not enter an SSN.

Enter the 9-digit EIN, including the dash.

If you are filing Form 1094-C, a valid EIN is required at

the time the form is filed. If a valid EIN is not provided,

Form 1094-C will not be processed. If you do not have

an EIN, you may apply for one online. Go to

IRS.gov/EIN. You

may also apply by faxing or mailing Form SS-4, Application for

Employer Identification Number, to the IRS. See the Instructions

for Form SS-4 and Pub. 1635, Employer Identification Number.

Lines 3–6. Enter the ALE Member’s complete address

(including room or suite no., if applicable). This address should

match the ALE Member’s address used on Form 1095-C.

Lines 7 and 8. Enter the name and telephone number of the

person to contact who is responsible for answering any

questions from the IRS regarding the filing of, or information

reported on, Form 1094-C or 1095-C. This may be different than

the contact information on line 10 of Form 1095-C.

Note. If you are a Designated Governmental Entity (DGE) filing

on behalf of an ALE Member, complete lines 9–16. If you are not

a DGE filing on behalf of an ALE Member, do not complete lines

9–16. Instead, skip to line 18. See

Designated Governmental

Entity (DGE) in the Definitions section of these instructions.

Line 9. If a DGE is filing on behalf of the ALE Member, enter the

name of the DGE.

Line 10. Enter the DGE’s EIN (including the dash). Do not enter

an SSN.

If you are a DGE that is filing Form 1094-C, a valid EIN is

required at the time the return is filed. If a valid EIN is not

provided, the return will not be processed. If the DGE

does not have an EIN when filing Form 1094-C, it can get an EIN

by applying online at

IRS.gov/EIN or by faxing or mailing a

completed Form SS-4. See the Instructions for Form SS-4 and

Pub. 1635.

Lines 11–14. Enter the DGE’s complete address (including

room or suite no.).

Lines 15 and 16. Enter the name and telephone number of the

person to contact who is responsible for answering any

questions from the IRS regarding the filing of, or information

reported on, Form 1094-C.

Line 17. Reserved for future use.

Line 18. Enter the total number of Forms 1095-C submitted with

this Form 1094-C transmittal.

Line 19. If this Form 1094-C transmittal is the Authoritative

Transmittal that reports aggregate employer-level data for the

ALE Member, check the box on line 19 and complete Parts II, III,

and IV, to the extent applicable. Otherwise, complete the

signature portion of Form 1094-C and leave the remainder of

Parts II, III, and IV blank.

There must be only one Authoritative Transmittal filed for each

ALE Member. If this is the only Form 1094-C being filed for the

ALE Member, this Form 1094-C must report aggregate

CAUTION

!

CAUTION

!

employer-level data for the ALE Member and be identified on

line 19 as the Authoritative Transmittal. If multiple Forms 1094-C

are being filed for an ALE Member so that Forms 1095-C for all

full-time employees of the ALE Member are not attached to a

single Form 1094-C transmittal (because Forms 1095-C for

some full-time employees of the ALE Member are being

transmitted separately), one (and only one) of the Forms 1094-C

must report aggregate employer-level data for the ALE Member

and be identified on line 19 as the Authoritative Transmittal. For

more information, see

Authoritative Transmittal for ALE Members

Filing Multiple Forms 1094-C, earlier.

Part II—ALE Member Information

Reminder. Lines 20–22 should be completed only on the

Authoritative Transmittal for the ALE Member. For more

information, see Authoritative Transmittal for ALE Members Filing

Multiple Forms 1094-C, earlier.

Line 20. Enter the total number of Forms 1095-C that will be

filed by, and/or on behalf of, the ALE Member. This includes all

Forms 1095-C that are filed with this transmittal, including those

filed for individuals who enrolled in the employer-sponsored,

self-insured plan, if any, and for any Forms 1095-C filed with a

separate transmittal filed by, or on behalf of, the ALE Member.

Line 21. If during any month of the calendar year the ALE

Member was a member of an Aggregated ALE Group, check

“Yes.” If you check “Yes,” also complete the “Aggregated Group

Indicator” in Part III, column (d), and then complete Part IV to list

the other members of the Aggregated ALE Group. If, for all 12

months of the calendar year, the employer was not a member of

an Aggregated ALE Group, check “No,” and do not complete

Part III, column (d), or Part IV.

Line 22. If the ALE Member meets the eligibility requirements

and is using one of the Offer Methods, it must check the

applicable box. See the descriptions of Qualifying Offer Method

and 98% Offer Method, later.

A. Qualifying Offer Method. Check this box if the ALE

Member is eligible to use, and is using, the Qualifying Offer

Method to report the information on Form 1095-C for one or

more full-time employees. Under the Qualifying Offer Method,

there is an alternative method of completing Form 1095-C and

an alternative method for furnishing Form 1095-C to certain

employees. If the ALE Member is using either of these

alternative rules, check this box. To be eligible to use the

Qualifying Offer Method, the ALE Member must certify that it

made a Qualifying Offer to one or more of its full-time employees

for all months during the year in which the employee was a

full-time employee for whom an employer shared responsibility

payment could apply. Additional requirements described below

must be met to be eligible to use the alternative method for

furnishing Form 1095-C to employees under the Qualifying Offer

Method.

Alternative method of completing Form 1095-C under

the Qualifying Offer Method. If the ALE Member reports using

this method, it must not complete Form 1095-C, Part II, line 15,

for any month for which a Qualifying Offer is made. Instead, it

must enter the Qualifying Offer code 1A on Form 1095-C,

line 14, for any month for which the employee received a

Qualifying Offer (or in the “ All 12 Months” box if the employee

received a Qualifying Offer for all 12 months), and must leave

line 15 blank for any month for which code 1A is entered on

line 14. The ALE Member may, but is not required to, enter an

applicable code on line 16 for any month for which code 1A is

entered on line 14; a Qualifying Offer is, by definition, treated as

an offer that falls within an affordability safe harbor even if no

code is entered on line 16.

An ALE Member is not required to use the Qualifying Offer

Method even if it is eligible, and instead may enter on line 14 the

Instructions for Forms 1094-C and 1095-C (2023)

-7-

Page 8 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

applicable offer code and then enter on line 15 the Employee

Required Contribution.

If the ALE Member is eligible to use the Qualifying Offer

Method, it may report on Form 1095-C by entering the

Qualifying Offer code 1A on Form 1095-C, line 14, for

any month for which it made a Qualifying Offer to an employee,

even if the employee did not receive a Qualifying Offer for all 12

calendar months. However, if an employee receives a Qualifying

Offer for less than all 12 months, the ALE Member must furnish a

copy of Form 1095-C to the employee (rather than using the

alternative method of furnishing Form 1095-C described later).

Example. Employee’s employment with Employer begins on

January 1. Employee is in a health coverage waiting period (and

an employer shared responsibility payment could not apply with

respect to Employee, because Employee is in a Limited

Non-Assessment Period) until April 1 and is a full-time employee

for the remainder of the calendar year. Employer makes a

Qualifying Offer to Employee for coverage beginning on April 1

and for the remainder of the calendar year. Employer is eligible

to use the Qualifying Offer method because it has made a

Qualifying Offer to at least one full-time employee for all months

in which both (1) the employee was a full-time employee, and (2)

an employer shared responsibility payment could apply with

respect to the employee. Employer may use the alternative

method of completing Form 1095-C under the Qualifying Offer

Method for this Employee. However, Employer may not use the

alternative method of furnishing Form 1095-C to Employee under

the Qualifying Offer Method because Employee did not receive a

Qualifying Offer for all 12 months of the calendar year.

Alternative method of furnishing Form 1095-C to

employees under the Qualifying Offer Method. An ALE

Member that is eligible to use the Qualifying Offer Method may

use the alternative method of furnishing Form 1095-C only for a

full-time employee who (1) received a Qualifying Offer for all 12

months of the calendar year, and (2) did not enroll in

employer-sponsored, self-insured coverage. For such an

employee, an ALE Member meets its obligation to furnish a Form

1095-C to the employee if it furnishes the employee a statement

containing the following information.

•

Employer/ALE Member name, address, and EIN.

•

Contact name and telephone number at which the employee

may receive information about the offer of coverage and the

information on the Form 1095-C filed with the IRS for that

employee.

•

Notification that, for all 12 months of the calendar year, the

employee and his or her spouse and dependents, if any,

received a Qualifying Offer and therefore the employee is not

eligible for a premium tax credit.

•

Information directing the employee to see Pub. 974, Premium

Tax Credit (PTC), for more information on eligibility for the

premium tax credit.

An ALE Member is not required to use the alternative method

of furnishing for an employee even if the alternative method

would be allowed. Instead, the ALE Member may furnish a copy

of Form 1095-C as filed with the IRS (with or without the

statement described earlier).

As stated earlier, an ALE Member may not use the alternative

furnishing method for a full-time employee who enrolled in

self-insured coverage. Rather, the ALE Member must furnish

Form 1095-C, including the information reporting enrollment in

the coverage on Form 1095-C, Part III.

B. Reserved for future use.

C. Reserved for future use.

D. 98% Offer Method. Check this box if the employer is

eligible for, and is using, the 98% Offer Method. To be eligible to

use the 98% Offer Method, an employer must certify that, taking

into account all months during which the individuals were

employees of the ALE Member and were not in a Limited

TIP

Non-Assessment Period, the ALE Member offered affordable

health coverage providing minimum value to at least 98% of its

employees for whom it is filing a Form 1095-C employee

statement, and offered minimum essential coverage to those

employees’ dependents. The ALE Member is not required to

identify which of the employees for whom it is filing were full-time

employees, but the ALE Member is still required, under the

general reporting rules, to file Forms 1095-C on behalf of all its

full-time employees who were full-time employees for one or

more months of the calendar year. To ensure compliance with

the general reporting rules, an ALE Member should confirm for

any employee for whom it fails to file a Form 1095-C that the

employee was not a full-time employee for any month of the

calendar year. For this purpose, the health coverage is affordable

if the ALE Member meets one of the section 4980H affordability

safe harbors.

Example. Employer has 325 employees. Of those 325

employees, Employer identifies 25 employees as not possibly

being full-time employees because they are scheduled to work

10 hours per week and are not eligible for additional hours. Of

the remaining 300 employees, 295 are offered affordable

minimum value coverage for all periods during which they are

employed other than any applicable waiting period (which

qualifies as a Limited Non-Assessment Period). Employer files a

Form 1095-C for each of the 300 employees (excluding the 25

employees that it identified as not possibly being full-time

employees). Employer may use the 98% Offer Method because

it makes an affordable offer of coverage that provides minimum

value to at least 98% of the employees for whom Employer files

a Form 1095-C. Using this method, Employer does not identify

whether each of the 300 employees is a full-time employee.

However, Employer must still file a Form 1095-C for all of its

full-time employees. Employer chooses to file a Form 1095-C on

behalf of all 300 employees, including the five employees to

whom it did not offer coverage, because if one or more of those

employees was, in fact, a full-time employee for one or more

months of the calendar year, Employer would be required to

have filed a Form 1095-C on behalf of those employees.

Note. If an ALE Member uses the 98% offer method, it is not

required to complete the “Section 4980H Full-Time Employee

Count for ALE Member” in Part III, column (b).

Part III—ALE Member Information—Monthly

(Lines 23–35)

Column (a)—Minimum Essential Coverage Offer Indicator.

•

If the ALE Member offered minimum essential coverage,

including an individual coverage HRA, to at least 95% of its

full-time employees and their dependents for the entire calendar

year, enter “X” in the “Yes” checkbox on line 23 for “All 12

Months” or for each of the 12 calendar months.

•

If the ALE Member offered minimum essential coverage,

including an individual coverage HRA, to at least 95% of its

full-time employees and their dependents only for certain

calendar months, enter “X” in the “Yes” checkbox for each

applicable month.

•

For the months, if any, for which the ALE Member did not offer

minimum essential coverage, including an individual coverage

HRA, to at least 95% of its full-time employees and their

dependents, enter “X” in the “No” checkbox for each applicable

month.

•

If the ALE Member did not offer minimum essential coverage,

including an individual coverage HRA, to at least 95% of its

full-time employees and their dependents for any of the 12

months, enter “X” in the “No” checkbox for “All 12 Months” or for

each of the 12 calendar months.

Note. For purposes of column (a), an employee in a Limited

Non-Assessment Period is not counted in determining whether

-8-

Instructions for Forms 1094-C and 1095-C (2023)

Page 9 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

minimum essential coverage was offered to at least 95% of an

ALE Member’s full-time employees and their dependents. For a

description of the differences between the definition of the term

“Limited Non-Assessment Period” used with respect to section

4980H(a) and the definition used with respect to section

4980H(b), relating to whether the ALE Member offers minimum

value coverage at the end of the Limited Non-Assessment

Period, see the

Definitions section.

An employee who is treated as having been offered

health coverage, including an individual coverage HRA,

for purposes of section 4980H (even though not actually

offered) is treated as offered minimum essential coverage for this

purpose. For example, for the months for which the ALE Member

is eligible for multiemployer arrangement interim guidance (if the

ALE Member is contributing on behalf of an employee whether

or not the employee is eligible for coverage under the

multiemployer plan) with respect to an employee, that employee

should be treated as having been offered minimum essential

coverage for purposes of column (a). For different rules for

purposes of reporting offers of coverage on Form 1095-C, see

the specific instructions for Form 1095-C, Part II,

line 14.

For purposes of column (a), if the ALE Member offered

minimum essential coverage to all but five of its full-time

employees and their dependents, and five is greater

than 5% of the number of full-time employees of the ALE

Member, the ALE Member may report in column (a) as if it

offered health coverage to at least 95% of its full-time employees

and their dependents (even if it offered health coverage to less

than 95% of its full-time employees and their dependents, for

example, to 75 of its 80 full-time employees and their

dependents).

See Definitions, later, for more information on an offer of

health coverage.

Column (b)—Section 4980H Full-Time Employee Count for

ALE Member. Enter the number of full-time employees for each

month, but do not count any employee in a Limited

Non-Assessment Period. If the number of full-time employees

(excluding employees in a Limited Non-Assessment Period) for a

month is zero, enter -0-. An employee should be counted as a

full-time employee for a month if the employee satisfied the

definition of “full-time employee” under the monthly

measurement method or the look-back measurement method

(as applicable) on any day of the month. See

Full-time employee

and Limited Non-Assessment Period in the Definitions section.

Be sure to use the section 4980H definition and not any other

definition of the term “full-time employee” that you may use for

other purposes.

Example. Employer uses the look-back measurement

method to determine the full-time status of its employees.

Employee, who is not in a Limited Non-Assessment Period,

averaged over 130 hours of service per month during the

measurement period that corresponds with the stability period

starting January 1, 2023, and ending December 31, 2023.

Employee terminates employment with Employer on February

15, 2023. Employer must include Employee in the number of

full-time employees reported in column (b) for January and

February. See the description of code 2B in the instructions for

line 16 of Form 1095-C, later, for rules for reporting an offer of

coverage in an employee’s final month of employment.

Note. If the ALE Member certified that it was eligible for the 98%

Offer Method by selecting box D, on line 22, it is not required to

complete column (b).

Column (c)—Total Employee Count for ALE Member. Enter

the total number of all of the ALE Member’s employees,

including full-time employees and non-full-time employees, and

TIP

TIP

employees in a Limited Non-Assessment Period, for each

calendar month. An ALE Member must choose to use one of the

following days of the month to determine the number of

employees per month and must use that day for all months of the

year: (1) the first day of each month, (2) the last day of each

month, (3) the 12th day of each month, (4) the first day of the first

payroll period that starts during each month, or (5) the last day of

the first payroll period that starts during each month (provided

that for each month that last day falls within the calendar month

in which the payroll period starts). If the total number of

employees was the same for every month of the entire calendar

year, enter that number in line 23, column (c), “All 12 Months,” or

in the boxes for each month of the calendar year. If the number

of employees for any month is zero, enter -0-.

Column (d)—Aggregated Group Indicator. An ALE Member

must complete this column if it checked “Yes” on line 21,

indicating that, during any month of the calendar year, it was a

member of an Aggregated ALE Group. If the ALE Member was a

member of an Aggregated ALE Group during each month of the

calendar year, enter “X” in the “All 12 Months” box or in the boxes

for each of the 12 calendar months. If the ALE Member was not

a member of an Aggregated ALE Group for all 12 months but

was a member of an Aggregated ALE Group for one or more

month(s), enter “X” in each month for which it was a member of

an Aggregated ALE Group. If an ALE Member enters “X” in one

or more months in this column, it must also complete Part IV.

Part IV—Other ALE Members of

Aggregated ALE Group (Lines 36–65)

An ALE Member must complete this section if it checks “Yes” on

line 21. If the ALE Member was a member of an Aggregated ALE

Group (with other ALE Members) for any month of the calendar

year, enter the name(s) and EIN(s) of up to 30 of the other

Aggregated ALE Group members (not including the reporting

ALE Member). If there are more than 30 members of the

Aggregated ALE Group (not including the reporting ALE

Member), enter the 30 with the highest monthly average number

of full-time employees (using the number reported in Part III,

column (b), if a number was required to be reported) for the year

or for the number of months during which the ALE Member was

a member of the Aggregated ALE Group. If any member of the

Aggregated ALE Group uses the 98% Offer Method and thus is

not required to identify which employees are full-time employees,

all ALE Members of the Aggregated ALE Group should use the

monthly average number of total employees rather than the

monthly average number of full-time employees for this purpose.

Regardless of the number of members in the Aggregated ALE

Group, list only the 30 members in descending order, listing first

the member with the highest average monthly number of full-time

employees (or highest average number of total employees, if any

member of the Aggregated ALE Group uses the 98% Offer

Method), but do not include the reporting ALE Member. The

reporting ALE Member must also complete Part III, column (d),

to indicate which months it was part of an Aggregated ALE

Group.

If you are filing Form 1094-C, a valid EIN is required at

the time it is filed. If a valid EIN is not provided, Form

1094-C will not be processed. If you do not have an EIN,

you may apply for one online. Go to IRS.gov/EIN. You may also

apply by faxing or mailing Form SS-4 to the IRS. See the

Instructions for Form SS-4 and Pub. 1635.

CAUTION

!

Instructions for Forms 1094-C and 1095-C (2023)

-9-

Page 10 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Specific Instructions for Form 1095-C

Part I—Employee

Line 1. Enter the name of the employee (first name, middle

initial, last name).

Line 2. Enter the 9-digit SSN of the employee (including the

dashes).

Lines 3–6. Enter the employee’s complete address, including

apartment no., if applicable. A country code is not required for

U.S. addresses.

Part I—Applicable Large Employer Member

(Employer)

Line 7. Enter the name of the ALE Member.

Line 8. Enter the ALE Member’s EIN. Do not enter an SSN.

Enter the 9-digit EIN, including the dash. The ALE Member’s

name and EIN should match the name and EIN of the ALE

Member reported on lines 1 and 2 of Form 1094-C.

If you are filing Form 1095-C, a valid EIN is required at

the time it is filed. If a valid EIN is not provided, Form

1095-C will not be processed. If you do not have an EIN,

you may apply for one online. Go to

IRS.gov/EIN. You may also

apply by faxing or mailing Form SS-4 to the IRS. See the

Instructions for Form SS-4 and Pub. 1635.

Lines 9 and 11–13. Enter the ALE Member’s complete address

(including room or suite no., if applicable). This address should

match the address reported on lines 3–6 of the Form 1094-C.

Line 10. Enter the telephone number of the person to contact

whom the recipient may call about the information reported on

the form. This may be different than the contact information

entered on line 8 of Form 1094-C.

Part II—Employee Offer of Coverage

Age. If the employee was offered an individual coverage HRA,

enter the employee’s age on January 1, 2023. Note that for

non-calendar year plans or for employees who become eligible

during the plan year, this age may not be the Applicable age

used to determine Employee Required Contribution.

Plan Start Month. This box is required for the 2023 Form

1095-C and the ALE Member may not leave it blank. To

complete the box, enter the 2-digit number (01 through 12)

indicating the calendar month during which the plan year begins

of the health plan in which the employee is offered coverage (or

would be offered coverage if the employee were eligible to

participate in the plan). If more than one plan year could apply

(for instance, if the ALE Member changes the plan year during

the year), enter the earliest applicable month. If there is no health

plan under which coverage is offered to the employee, enter “00.”

Line 14. For each calendar month, enter the applicable code

from Code Series 1. If the same code applies for all 12 calendar

months, you may enter the applicable code in the “All 12 Months”

box and not complete the individual calendar month boxes, or

you may enter the code in each of the boxes for the 12 calendar

months. If an employee was not offered coverage for a month,

enter code 1H. Do not leave line 14 blank for any month

(including months when the individual was not an employee of

the ALE Member). An ALE Member offers health coverage for a

month only if it offers health coverage that would provide

coverage for every day of that calendar month. Thus, if coverage

terminates before the last day of the month (because, for

instance, the employee terminates employment with the ALE

Member, or otherwise loses eligibility for coverage under the

CAUTION

!

plan), the employee does not actually have an offer of coverage

for that month (and code 1H should therefore be entered on

line 14). See line 16, code 2B, later, for how the ALE Member

may complete line 16 in the event that coverage terminates

before the last day of the month.

A code must be entered for each calendar month, January

through December, even if the employee was not a full-time

employee for one or more of the calendar months. Enter the

code identifying the type of health coverage actually offered by

the ALE Member (or on behalf of the ALE Member) to the

employee, if any. If the employee was not actually offered

coverage, enter code 1H (no offer of coverage) on line 14.

For reporting offers of coverage for 2023, an ALE Member

relying on the multiemployer arrangement interim guidance

should enter code 1H on line 14 for any month for which the ALE

Member enters code 2E on line 16 (indicating that the ALE

Member was required to contribute to a multiemployer plan on

behalf of the employee for that month and therefore is eligible for

multiemployer interim rule relief). For a description of the

multiemployer arrangement interim guidance, see

Offer of health

coverage in the Definitions section. For reporting for 2023, code

1H may be entered without regard to whether the employee was

eligible to enroll, or enrolled in, coverage under the

multiemployer plan. For reporting for 2024 and future years, ALE

Members relying on the multiemployer arrangement interim

guidance may be required to report offers of coverage made

through a multiemployer plan in a different manner.

Indicator Codes for Employee Offer of Coverage

(Form 1095-C, Line 14)

Code Series 1—Offer of Coverage. The Code Series 1

indicator codes specify the type of coverage, if any, offered to an

employee, the employee’s spouse, and the employee’s

dependents. The term

Dependent has the specific meaning set

forth in the Definitions section of these instructions. In addition,

for this purpose, an offer of coverage is treated as made to an

employee’s dependents only if the offer of coverage is made to

an unlimited number of dependents regardless of the actual

number of dependents, if any, an employee has during any

particular calendar month.

If the type of coverage, if any, offered to an employee was the

same for all 12 months in the calendar year, enter the Code

Series 1 indicator code corresponding to the type of coverage

offered either in the “All 12 Months” box or in each of the 12

boxes for the calendar months.

Conditional offer of spousal coverage. Codes 1J and 1K

address conditional offers of spousal coverage (also referred to

as “coverage offered conditionally”). A conditional offer is an

offer of coverage that is subject to one or more reasonable,

objective conditions (for example, an offer to cover an

employee’s spouse only if the spouse is not eligible for coverage

under Medicare or a group health plan sponsored by another

employer). Using codes 1J and 1K, an ALE Member may report

a conditional offer to a spouse as an offer of coverage,

regardless of whether the spouse meets the reasonable,

objective condition. A conditional offer may impact a spouse's

eligibility for the premium tax credit under section 36B only if all

conditions to the offer are satisfied (that is, the spouse was

actually offered the coverage and eligible for it) and the

Exchange makes a determination about the affordability of the

offer. To help employees (and spouses) who have received a

conditional offer determine their eligibility for the premium tax

credit, the ALE Member should be prepared to provide, upon

request, a list of any and all conditions applicable to the spousal

offer of coverage. As is noted in the definition of

Dependent in

the Definitions section, a spouse is not a dependent for

purposes of section 4980H.

-10-

Instructions for Forms 1094-C and 1095-C (2023)

Page 11 of 18 Fileid: … 094c&1095c/2023/a/xml/cycle04/source 9:16 - 26-Sep-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

An ALE Member may not report a conditional offer of

coverage to an employee’s dependents as an offer to the

dependents, unless the ALE Member knows that the

dependents met the condition to be eligible for the ALE

Member’s coverage. Further, an offer of coverage is treated as

made to an employee’s dependents only if the offer of coverage

is made to an unlimited number of dependents regardless of the

actual number of dependents, if any, an employee has during

any particular calendar month.

COBRA continuation coverage. An offer of COBRA

continuation coverage is reported differently depending on

whether or not the offer is made due to an employee’s

termination of employment.

An offer of COBRA continuation coverage that is made to a

former employee (or to a former employee’s spouse or

dependents) due to termination of employment should not be

reported as an offer of coverage on line 14. In this situation, code

1H (No offer of coverage) must be entered on line 14 for any

month for which the offer of COBRA continuation coverage

applies, and code 2A (Employee not employed during the

month) must be entered on line 16 (see the instructions for

line 16), without regard to whether the employee or spouse or

dependents enrolled in the COBRA coverage. However, for the

month in which the employee terminates employment with the

ALE Member, see the instructions for line 16, code 2B.

An offer of COBRA continuation coverage that is made to an

employee who remains employed by the ALE Member (or to that

employee’s spouse and dependents) should be reported on

line 14 as an offer of coverage, but only for any individual who

receives an offer of COBRA continuation coverage (or an offer of

similar coverage that is made at the same time as the offer of

COBRA continuation coverage is made to enrolled individuals).

Generally, an offer of COBRA continuation coverage is required

to be made only to individuals who were enrolled in coverage

and would lose eligibility for coverage due to the COBRA

qualifying event, but an ALE Member may choose to extend a

similar offer of coverage to a spouse or dependent even if the

offer is not required by COBRA.

Example. During the applicable open enrollment period for

its health plan, Employer makes an offer of minimum essential

coverage providing minimum value to Employee and to

Employee’s spouse and dependents. Employee elects to enroll

in employee-only coverage starting January 1. On June 1,

Employee experiences a reduction in hours that results in loss of

eligibility for coverage under the plan. As of June 1, Employer

terminates Employee’s existing coverage and makes an offer of

COBRA continuation coverage to Employee, but does not make

an offer to Employee’s spouse and dependents. Employer

should enter code 1E (Minimum essential coverage providing

minimum value offered to employee and at least minimum

essential coverage offered to dependent(s) and spouse) on

line 14 for months January–May, and should enter code 1B

(Minimum essential coverage providing minimum value offered

to employee only) on line 14 for months June–December.

Note. Notwithstanding the preceding instructions for completing

line 14 of Form 1095-C, for purposes of section 4980H, an ALE

Member is treated as having made an offer to the employee’s